BL3P Crypto Exchange Review 2025 - Fees, Security, and Features

BL3P Trading Fee Calculator

Calculate Your Trading Costs

This calculator shows the exact fees for trading on BL3P compared to Binance.

Enter your trade amount to see the fee calculation

Looking for a European‑focused platform that lets you move euros straight from a Dutch bank into Bitcoin and altcoins? This BL3P crypto exchange review breaks down what the exchange offers, how it protects your funds, and whether it still makes sense in 2025.

Key Takeaways

- BL3P is the only Dutch‑registered exchange with direct EUR bank integration, meaning faster deposits and withdrawals.

- Security relies on industry‑standard 2FA, mandatory withdrawal confirmations, and API‑key restrictions, but the platform doesn’t publish detailed cold‑storage ratios.

- Trading fees start at 0.25% for makers and 0.35% for takers; higher volume discounts are modest compared with global rivals.

- Customer support is email‑centric with a 24‑hour response SLA; live chat is unavailable.

- Best for traders who prioritize Dutch regulatory oversight and want to keep most activity in euros.

What Is BL3P?

BL3P is a cryptocurrency exchange operated by Bitonic B.V., a Netherlands‑based bitcoin company founded in 2012. BL3P launched as one of Europe’s earliest exchanges and remains the only platform physically based in the Netherlands that maintains direct Dutch bank accounts for EUR transactions. This regulatory footing gives it a unique edge for Euro‑zone users who want to avoid intermediary payment processors.

Core Features and Market Position

The exchange serves all European countries but focuses on the Eurozone. Users can deposit and withdraw euros via SEPA, which typically clears within one business day. BL3P supports Bitcoin, Ethereum, Litecoin, XRP, and a handful of major altcoins. The platform’s UI is minimalist, offering a classic order‑book view, limit/market orders, and basic charting tools. It does not currently provide advanced features such as futures, margin trading, or a native mobile app-something larger rivals like Binance and Coinbase do.

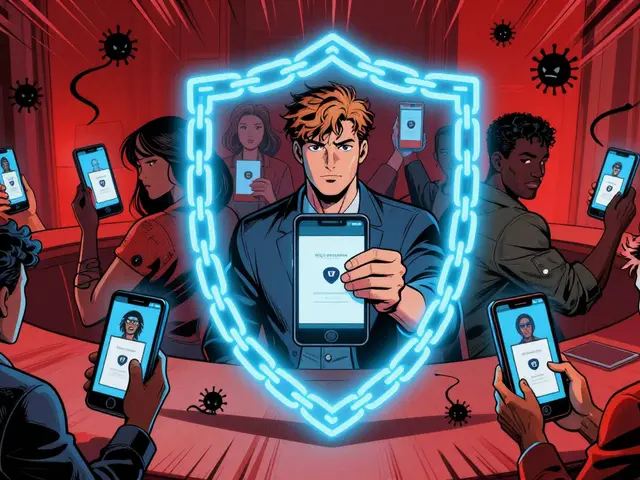

Security Architecture

Security is a top priority for BL3P. The exchange 2FA (two‑factor authentication) is strongly recommended for every account, drastically reducing unauthorized access. A mandatory “extra confirmation” step is required for each withdrawal, adding a second verification layer before funds leave the platform.

For API users, BL3P advises locking API access to a single IP address and supports multiple API keys with granular permission settings. This helps separate trading functions from fund‑management operations, limiting the impact of a compromised key.

While BL3P does not publish its exact cold‑storage ratio, it follows industry best practices: most assets are kept offline, and the remaining hot‑wallet balances are protected by multi‑signature controls and regular security audits. Users are also urged to keep their operating system, browsers, and antivirus software up‑to‑date, and to avoid storing passwords unencrypted on their machines.

Fees and Trading Costs

BL3P’s fee schedule is straightforward. Maker fees start at 0.25% and taker fees at 0.35%. Volume discounts apply after 1BTC worth of monthly trades, dropping the maker fee to 0.20% and the taker fee to 0.30%. Deposit fees are free for SEPA transfers, while withdrawals incur a flat €0.10 fee plus the network fee for the specific cryptocurrency.

Compared with global exchanges:

| Exchange | Maker Fee | Taker Fee | Deposit (EUR) | Withdrawal (EUR) |

|---|---|---|---|---|

| BL3P | 0.25% | 0.35% | Free (SEPA) | €0.10 + network fee |

| Binance | 0.10% | 0.10% | Free (SEPA) | ~€0.15 + network fee |

| Coinbase | 0.00% (maker) | 0.50% (taker) | Free (SEPA) | €0.15 + network fee |

User Experience & Support

The web interface is clean but lacks mobile‑app convenience. Account verification follows a standard KYC flow: identity document upload, proof of address, and a selfie check. Once verified, users can trade immediately.

Support is primarily email‑based. BL3P promises a response within 24hours for standard inquiries and offers a priority channel for verified users who need urgent assistance. No live chat or phone support is available, which may be a drawback for traders who value instant help.

Pros & Cons

- Pros

- Direct SEPA integration-fast, cheap euro deposits/withdrawals.

- Regulated under Dutch law, offering clear jurisdiction.

- Solid basic security (2FA, withdrawal confirmations, API IP locking).

- Simple fee structure with no hidden charges.

- Cons

- Limited crypto selection compared with global rivals.

- No mobile app, no advanced trading tools (margin, futures).

- Customer support only via email; no live chat.

- Transparency on cold‑storage percentages is lacking.

Who Should Use BL3P?

If you’re based in Europe, primarily trade in euros, and value a Dutch‑regulated environment, BL3P is a solid choice. It suits:

- Beginner to intermediate traders who need a straightforward interface.

- Investors who want to keep most of their funds in a bank‑linked euro account.

- Security‑conscious users who appreciate mandatory withdrawal confirmations.

Conversely, power traders looking for futures, high‑frequency API access, or a robust mobile experience might gravitate toward platforms like Binance or Coinbase.

Future Outlook

Since the 2018 temporary account‑restriction episode, BL3P has not announced major product launches, but it continues to support SegWit and maintains regular security patching. The upcoming EU MiCA regulation will likely push the exchange to enhance its compliance reporting and possibly expand its asset list. If BL3P can roll out a mobile app and more advanced order types, it could retain its niche market against the ever‑growing competition.

Quick Checklist Before Signing Up

- Confirm you have a Dutch or EU bank account that supports SEPA.

- Prepare a valid government ID and proof‑of‑address for KYC.

- Enable 2FA on the account and set up a strong, unique password.

- Decide whether you need API access; if so, plan a static IP or use a VPN with a fixed exit node.

- Allocate only the amount you’re comfortable losing for active trading; store long‑term holdings in a hardware wallet.

Frequently Asked Questions

Is BL3P safe for storing large amounts of crypto?

BL3P follows industry‑standard security measures-2FA, withdrawal confirmations, and cold‑storage for the majority of assets. However, it does not disclose the exact cold‑storage ratio, so most experts recommend keeping only what you need for active trading on the exchange and storing the bulk of your holdings in a hardware wallet.

How fast are EUR deposits and withdrawals?

SEPA deposits usually appear in the BL3P account within one business day. Withdrawals are processed the same way, typically arriving in the user’s bank account within one to two business days, depending on the bank’s processing times.

Does BL3P offer a mobile app?

No, BL3P currently provides only a web‑based interface. Users access the platform via desktop browsers or mobile browsers in responsive mode.

What are the verification requirements?

You must submit a government‑issued ID, a proof‑of‑address document (utility bill or bank statement), and a selfie for facial verification. Once approved, you can trade without further restrictions.

How does BL3P compare to Binance on fees?

Binance’s maker and taker fees sit at 0.10% for both, which is lower than BL3P’s 0.25%/0.35% structure. However, BL3P’s fee advantage is its zero‑cost SEPA deposits and the direct euro‑bank link, which can offset the higher trading fee for Euro‑based users.

When you stare at the fee structure of BL3P, it feels like gazing into a modern-day Sisyphean hill, where every trade pushes you closer to the summit of profit yet the friction of tiny percentages drags you back.

The maker fee of 0.25% whispers promises of efficiency, like a quiet monk offering a spoonful of enlightenment in a noisy bazaar.

Meanwhile the taker fee at 0.35% is the louder sibling, shouting that speed has its price, a reality that mirrors the hustle of the crypto world. 🌪️

In the grand tapestry of exchanges, BL3P tries to carve its niche, but its European‑centric vibe sometimes feels like a closed club, leaving the global wanderer wondering if he belongs.

Security, the holy grail, is guarded by cold‑wallet storage and two‑factor authentication, but the mind conjures images of unseen eyes lurking behind the code… 🍂

The fee calculator widget embedded in the article is a neat tool, yet it reminds me of those ancient abacuses-useful but archaic in the age of AI.

If you compare BL3P to the behemoth Binance, the fee delta is modest, but the trade‑off is a more regulated environment, which might appeal to the risk‑averse.

Think of it as choosing a sturdy sedan over a flashy sports car; the ride may be less exhilarating, but the safety belt is thicker.

For day‑traders, the maker‑taker split can be leveraged by placing limit orders, effectively reducing the cost to near‑zero in high‑volume tiers-if you can predict market moves with the precision of a chess grandmaster, which, let’s be honest, most of us can’t.

On the other hand, the liquidity depth is something to watch.

Smaller order books can cause slippage, turning a seemingly cheap trade into a costly surprise.

The platform’s API is decent, but the documentation feels like a labyrinth with missing signposts, making automation a chore for developers. 🛠️

All in all, BL3P presents itself as a disciplined, maybe even austere, alternative in a world full of flash and hype.

It’s a place where the quiet Nerd may feel at home, provided they’re willing to accept the slower pace and the slightly higher cost for the sake of compliance. 🌐

So, before you jump in, weigh the peace of mind against the marginal fees, and decide which path aligns with your crypto philosophy.

If you're looking for a platform that respects your time and keeps fees transparent, BL3P might just be the buddy you need. The maker‑taker split is simple enough for newcomers, and the security layers give you peace of mind. Plus, the European regulation can be a comforting safety net when the market gets chaotic. Dive in, set your limits, and watch your trades flow with confidence. Remember, consistency beats occasional bursts of excitement any day!

The UI feels like a rainbow after a storm, bright and inviting, making the whole trading experience feel like a creative canvas. You can tweak the fee calculator with a few clicks, and the results pop up like fireworks, instantly showing you where your pennies drift. The token list isn’t massive, but it’s curated, like a boutique gallery of the most promising digital art. Security measures are stitched together with care, giving a warm, fuzzy feeling that your assets are guarded by digital guardians. Overall, BL3P paints a pleasant picture for anyone tired of the gritty, gray exchanges.

BL3P stores most funds offline in cold wallets and uses 2FA for logins. This reduces the attack surface considerably. Withdrawal limits are tiered, so you can plan your moves without surprise holds. The platform also supports SEPA transfers, which is handy for Euro users. Overall the security approach is solid without overcomplicating the UI.

Honestly, BL3P’s fee architecture, while ostensibly competitive, is riddled with opaque tier thresholds, convoluted maker‑taker dichotomies, and a lamentable paucity of volume rebates, which, frankly, betrays a myopic adherence to legacy banking paradigms;

One must question whether such regressive structures, replete with antiquated compliance shackles, truly serve the hyper‑dynamic exigencies of contemporary crypto arbitrage, or merely perpetuate an illusion of security;

Furthermore, the platform’s API, albeit functional, suffers from esoteric nomenclature, redundant endpoints, and sluggish latency, thereby impeding seamless integration for seasoned developers.

While the fee layout can feel dense, it’s worth noting that BL3P’s regulatory compliance does provide an extra layer of protection for users, which could offset some of the perceived complexity. If you focus on the long‑term stability, the higher‑tier rebates become accessible as you increase your volume, making the structure less harsh over time.

BL3P could be a front for covert data harvesting under the guise of compliance.

i dunno, the fees seem kinda high for what you get, and the UI looks like it was stuck in 2015.

Whoa, that's harsh! 😱 But hey, the security suite is top‑notch, and the fee calculator actually helps you see where every cent goes – it’s like a secret weapon for savvy traders! 🚀

All things considered, BL3P offers a balanced mix of security and cost; it may not be the flashiest, but it’s a solid choice for steady traders.