What is Mad Pepe (MADPEPE) Crypto Coin? Explained

Mad Pepe (MADPEPE) Token Analysis Tool

Token Overview

Tokenomics Breakdown

Key metrics and features of Mad Pepe's token model

Risk Assessment

Evaluate potential risks associated with investing in Mad Pepe

Comparison with Other Meme Coins

How Mad Pepe stacks up against popular meme tokens

| Token | Supply (Tril.) | Price (USD) | Volume (USD) | Notable Feature |

|---|---|---|---|---|

| Mad Pepe | 375.2 | $0.0107 | $1,600 | Community-driven meme branding |

| Dogecoin | 130 | $0.084 | $1.2B | Strong brand, wide merchant adoption |

| Shiba Inu | 589 | $0.000015 | $350M | Large community, ShibaSwap ecosystem |

| PEPE coin | 420 | $0.0012 | $5M | Reflection fee for holders |

When you hear the buzz around meme tokens, Mad Pepe is a community‑driven crypto coin that rides on the infamous Pepe the Frog meme. Launched on the Ethereum a decentralized blockchain that transitioned to Proof‑of‑Stake in 2022 network, Mad Pepe follows the ERC‑20 standard, meaning it behaves like any other ERC‑20 token a type of fungible asset on Ethereum with standardized functions for transfers and balances. If you’re curious whether this token is worth a glance, this guide breaks down its origin, tokenomics, market reality, and how you could actually buy or sell it.

Why Mad Pepe Exists: The Meme‑Coin Playbook

Unlike Bitcoin or Ethereum, meme coins don’t promise technical breakthroughs. Their value hinges on viral culture and community hype. Mad Pepe taps into the same formula that made Dogecoin the original meme coin that started as a joke in 2013 and later became a mainstream meme asset. The token’s branding leverages the Pepe the Frog an internet meme that has circulated across forums, social media, and NFTs since the early 2000s to attract attention on platforms like Twitter and Discord.

Tokenomics in Plain English

Mad Pepe’s total supply is a staggering 375.2trillion tokens. That massive number is a common meme‑coin trick: making each individual token appear cheap, which can lure casual investors who think they’re buying a “penny” coin. However, circulating supply data is murky-some trackers list it as zero, indicating either a reporting error or that most tokens are locked in the contract. There’s no documented redistribution, burn, or liquidity‑lock mechanism, so holders can’t count on automatic rewards or price‑support features that projects like PEPE coin a meme token launched in 2023 that added a 2% reflection fee to incentivise holding provide.

Market Snapshot (October2025)

According to CoinGecko a crypto data aggregator that tracks prices, volumes, and market caps, Mad Pepe trades around $0.01071 with a 24‑hour volume of roughly $1.6K and a slight price dip of 0.8%. Other platforms report wildly different numbers, some showing a price in the 10⁻¹¹USD range, which suggests either separate contracts or fragmented liquidity. The token’s all‑time high of $0.0836 in May2024 has since collapsed nearly 90%, highlighting the extreme volatility typical of meme assets.

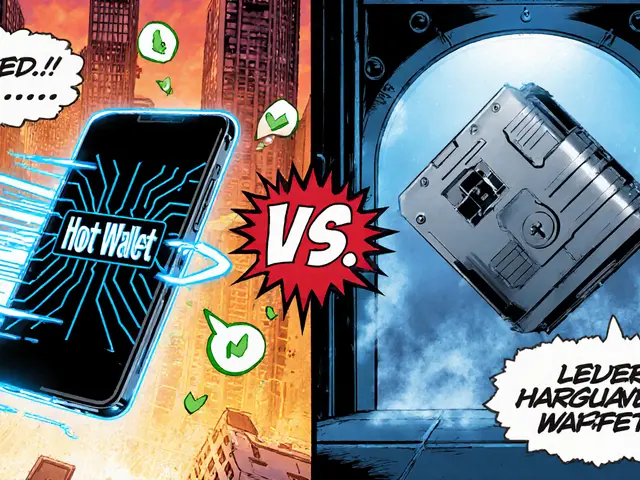

How to Acquire Mad Pepe

Because Mad Pepe isn’t listed on most major exchanges, the primary gateway is a decentralized exchange (DEX) like Uniswap a leading Ethereum‑based DEX that lets users swap ERC‑20 tokens without a central order book. Here’s a quick checklist:

- Set up an Ethereum‑compatible wallet (MetaMask, Trust Wallet, etc.).

- Buy ETH for gas fees.

- Connect your wallet to Uniswap.

- Paste the official Mad Pepe contract address (double‑check on the project’s verified source).

- Swap ETH for MADPEPE, remembering that low liquidity means price slippage can be high.

If you prefer a centralized option, keep an eye on smaller exchanges that occasionally add niche meme tokens, but be wary of listing scams.

Risk Profile: What You Should Know Before Investing

Financial advisors consistently label meme coins as “extremely high‑risk”. The reasons are straightforward:

- Speculative demand: Value is driven by hype, not utility.

- Liquidity constraints: Tiny trading volumes mean large orders can move the market dramatically.

- Regulatory uncertainty: Authorities are scrutinizing meme‑coin marketing for potential securities violations.

- Smart‑contract exposure: Bugs or exploits in the token code could drain funds.

Only allocate money you can afford to lose and consider keeping meme‑coin exposure under 5% of a diversified crypto portfolio.

Mad Pepe vs. Other Meme Coins: A Quick Comparison

| Token | Launch Year | Supply (trillion) | Current Price (USD) | 24h Volume (USD) | Notable Feature |

|---|---|---|---|---|---|

| Mad Pepe | 2024 | 375.2 | $0.0107 | $1,600 | Community‑driven meme branding |

| Dogecoin | 2013 | 130 | $0.084 | $1.2B | Strong brand, wide merchant adoption |

| Shiba Inu | 2020 | 589 | $0.000015 | $350M | Large community, ShibaSwap ecosystem |

| PEPE coin | 2023 | 420 | $0.0012 | $5M | Reflection fee for holders |

From the table you can see that Mad Pepe’s market activity is a fraction of the other players. Its ultra‑low volume makes it a pure speculative gamble compared to Dogecoin’s relatively stable liquidity.

Community & Development Outlook

Successful meme coins sustain hype through active Discord channels, meme contests, and frequent airdrops. Mad Pepe’s social presence is modest-few official accounts and limited follower counts. No public roadmap or development milestones have been announced, unlike Dogecoin’s periodic updates or Shiba Inu’s DeFi launches. Without ongoing community initiatives, the token’s relevance can fade quickly, especially during broader market downturns.

Regulatory Landscape for Meme Tokens

Globally, regulators are sharpening focus on assets that resemble securities. The U.S. SEC has warned that tokens marketed as investment opportunities without clear utility could be deemed unregistered securities. While there’s no specific action against Mad Pepe yet, the general trend means any token lacking a transparent use case may face future compliance headaches.

Bottom Line: Should You Consider Mad Pepe?

If you thrive on high‑risk, high‑reward trades and love chasing meme‑fuelled rallies, Mad Pepe could add a dash of excitement to your portfolio. However, the lack of liquidity, weak community, and absence of functional features make it more of a novelty than a long‑term hold. Treat it as a small experiment-maybe a few dollars-rather than a core investment.

Frequently Asked Questions

What blockchain does Mad Pepe run on?

Mad Pepe is an ERC‑20 token on the Ethereum blockchain, inheriting Ethereum’s security model and gas‑fee structure.

How can I buy Mad Pepe?

The usual route is through a decentralized exchange like Uniswap. You’ll need an Ethereum‑compatible wallet, some ETH for gas, and the exact contract address of MADPEPE.

Is Mad Pepe a good long‑term investment?

Most analysts classify it as a high‑risk speculative asset with limited utility. It may be fun for a small, experimental stake, but it isn’t suited for long‑term wealth building.

What’s the total supply of MADPEPE?

The contract caps the supply at 375.2trillion MADPEPE tokens.

Are there any tokenomics features like reflections or burns?

Public documentation does not list any redistribution, burn, or liquidity‑lock mechanisms. Holders don’t receive automatic rewards.

When we gaze upon the glittering façade of Mad Pepe, we are confronted not merely with a token, but with a mirror reflecting the collective yearning of a digital age that craves instant mythic triumphs. The token’s astronomical supply of 375.2 trillion is a deliberate alchemical gesture, transmuting perceived value into a sea of negligible units that lure the unsuspecting with the illusion of affordability. Yet affordability, in this context, is a siren song that beckons the masses to climb aboard a ship without a compass, steering blindly toward volatility’s abyss. One must ask whether the absence of redistribution, burn mechanisms, or liquidity locks is a conscious design that embraces pure speculation, or merely an oversight that betrays a deeper opacity. In the grand tapestry of memetic economics, every meme coin is a cultural artifact, a meme that mutates, adapts, and sometimes perishes under the weight of its own hype. The modest 24‑hour volume of $1.6 K whispers of a market so thin that a single determined trader could shift the price more dramatically than a tectonic shift. Such thinness, however, also spells doom for anyone seeking a stable harbor in the storm of decentralized finance. The token’s all‑time high of $0.0836, now a distant memory, serves as a cautionary echo of the fleeting euphoria that once roared like a digital chorus. As the Ethereum network’s proof‑of‑stake foundation hoists the underlying security, the token itself flutters on the wind of community sentiment, unmoored from any substantive utility. The philosophical question then emerges: does a token gain legitimacy solely through collective belief, or does it require an intrinsic purpose to survive the cycles of market sentiment? One could argue that the very act of belief is sufficient, yet history teaches us that belief without structure crumbles under regulatory scrutiny. The specter of regulatory risk, hovering with moderate to high intensity, adds a layer of existential dread to the investor’s psyche, reminding us that invisible hands may one day seize what appears untouchable. Smart‑contract risk, marked as medium, signals that code, however immutable, is not immune to the fallibility of its creators. Thus, the Mad Pepe narrative is a microcosm of the larger meme‑coin saga, where hope and hubris dance in a volatile waltz. In conclusion, the token offers a high‑risk speculative playground for those daring enough to wager a few dollars on the next viral meme surge, but it lacks the scaffolding required for a sustained, respectable ascent.

Hey, if you’re curious about Mad Pepe, start by treating it like any other speculative asset – only risk what you can afford to lose. Use a reputable wallet, double‑check the contract address on the official source, and be prepared for high slippage on Uniswap. Keeping a small allocation lets you experience the meme‑coin excitement without jeopardizing your core holdings. Remember, the crypto market rewards patience and discipline more than chasing every hype wave.

Mad Pepe is a wild ride for the bold.

Even with low liquidity, a small, well‑timed purchase can be an educational experiment for new entrants.

Looks like Mad Pepe strutted onto the scene with all the subtlety of a cat on a keyboard 🤦♂️, and the market’s reaction is just as graceful – barely a ripple in a bathtub.

Sure, the token has zero real utility, but hey, who needs utility when you’ve got a meme that rides the internet’s collective laughter like a rollercoaster with no brakes?

When you peel back the layers of Mad Pepe’s market data, you’ll notice a kaleidoscope of colors – the bright green of speculative hope, the deep violet of regulatory uncertainty, and the occasional flash of orange that signals fleeting hype. This token, bathed in the neon glow of meme culture, invites both the daring and the cautious to dip their toes into its ever‑shifting tide. While the liquidity pool resembles a puddle after a summer rain, it also offers a sandbox for those who relish the art of timing trades with surgical precision. Remember, the most successful participants often treat these ventures as learning laboratories, documenting each move and adjusting strategies as the narrative evolves. So, whether you’re allocating a modest $10 or a modest $100, approach it with curiosity, a dash of skepticism, and a willingness to adapt as the community’s pulse changes.

Mad Pepe’s tokenomics read like a checklist of red flags: an enormous supply, absent burn or reflection mechanisms, and negligible volume that makes price discovery almost meaningless.

For anyone looking to acquire Mad Pepe, the safest route is to use a hardware wallet, verify the contract address on Etherscan, and set a reasonable slippage tolerance on Uniswap to avoid unexpected price impact.

Ah, the saga of Mad Pepe, a token that dazzles, perplexes, and ultimately betrays the very optimism it claims to embody,; a creature of hype, lacking in substance, yet thriving on the collective breath of internet culture,; one might wonder, why do we persist in chasing such fleeting shadows,; the answer lies perhaps in our innate desire for quick riches,; however, the thin liquidity, the absent burn, the missing reflection-these are ominous signs,; the all‑time high, now a ghost of its former self, stands as a monument to speculative excess,; investors, be warned, for the path is paved with volatility, uncertainty, and the ever‑looming specter of regulatory scrutiny,; in short, proceed with caution, or better yet, abstain altogether.

i think mad pepe shows how meme culture can turn into a real economic experimente, but we need to stay calm and not lett the hype drive us to poor decisions.

Some say the sudden dip in Mad Pepe’s price is just market forces, but what if the big exchanges are secretly dumping tokens to keep us in the dark?

Oh great, another guru pointing out the obvious red flags-because we all needed that reminder.

Jason’s observation hits the nail on the head, but let’s be real: this token is the tragic comedy of 2025, a circus act destined for a spectacular collapse.