Thick vs Thin Order Books: What It Means for Crypto Trading

What Is an Order Book Anyway?

An order book is the real-time list of buy and sell orders for a cryptocurrency, sorted by price. It shows exactly how much of a coin people want to buy at each price, and how much others are willing to sell. Think of it like a live auction where bids and offers are stacked up - higher bids on the left, lower asks on the right. The closer the highest bid and lowest ask are, the tighter the spread. But what really matters isn’t just the spread - it’s how much volume sits behind those prices. That’s where thick and thin order books come in.

Thick Order Books: The Quiet Powerhouses

A thick order book has deep liquidity. That means there’s a huge pile of buy and sell orders stacked up at many price levels - not just at the top, but ten, twenty, even fifty cents away from the current price. For example, on BTC/USD on Binance during U.S. trading hours, you might see over $5 million in buy orders and the same in sell orders within just 1% of the current price. This kind of depth makes the market feel calm. Even if someone tries to move the price with a $1 million trade, the impact is tiny - maybe 0.1% at most.

These markets have tight spreads, often under 0.05%. You don’t get ripped off when you buy or sell because the gap between what buyers are offering and what sellers want is razor-thin. Execution is fast, too. Market orders fill almost instantly without jumping to worse prices. That’s why institutions like Fidelity and Coinbase’s institutional arm do over 90% of their crypto trading in just the top 10 pairs - they need this kind of depth to move large amounts without blowing up their own trades.

But here’s the catch: thick books are boring for some traders. Because prices don’t swing wildly, there’s less room for quick, high-risk scalping. If you’re looking for 5% intraday moves, thick markets won’t give you that. They’re built for stability, not excitement.

Thin Order Books: High Risk, High Reward

Thin order books are the opposite. They’re shallow. You might see only $50,000 in total volume within 1% of the price - sometimes less. For a low-cap coin like SHIB or a lesser-known altcoin on a smaller exchange, that’s normal. The spread? It can be 2% or even 5%. That means if you want to buy SHIB at $0.000010, the next seller might be asking $0.0000105 - a 5% jump just to fill your order.

When you trade in a thin market, your order doesn’t just fill - it drags the price. A $100,000 buy order might push the price up 3-5% because there’s barely any sellers nearby. The same goes for selling: you’ll get crushed by the lack of buyers. That’s why 67% of active traders surveyed by CryptoSlate in 2024 said they lost money at least once because of thin liquidity.

But here’s the twist: some traders *want* thin markets. Experienced traders who know how to read order flow use these conditions to their advantage. During low-volume hours - say, 3 AM UTC - a well-timed order can trigger a panic sell-off or a short squeeze. The volatility is dangerous, but the profit potential is real. Just don’t mistake this for a strategy you can repeat daily. It’s more like poker with loaded dice.

How to Spot the Difference

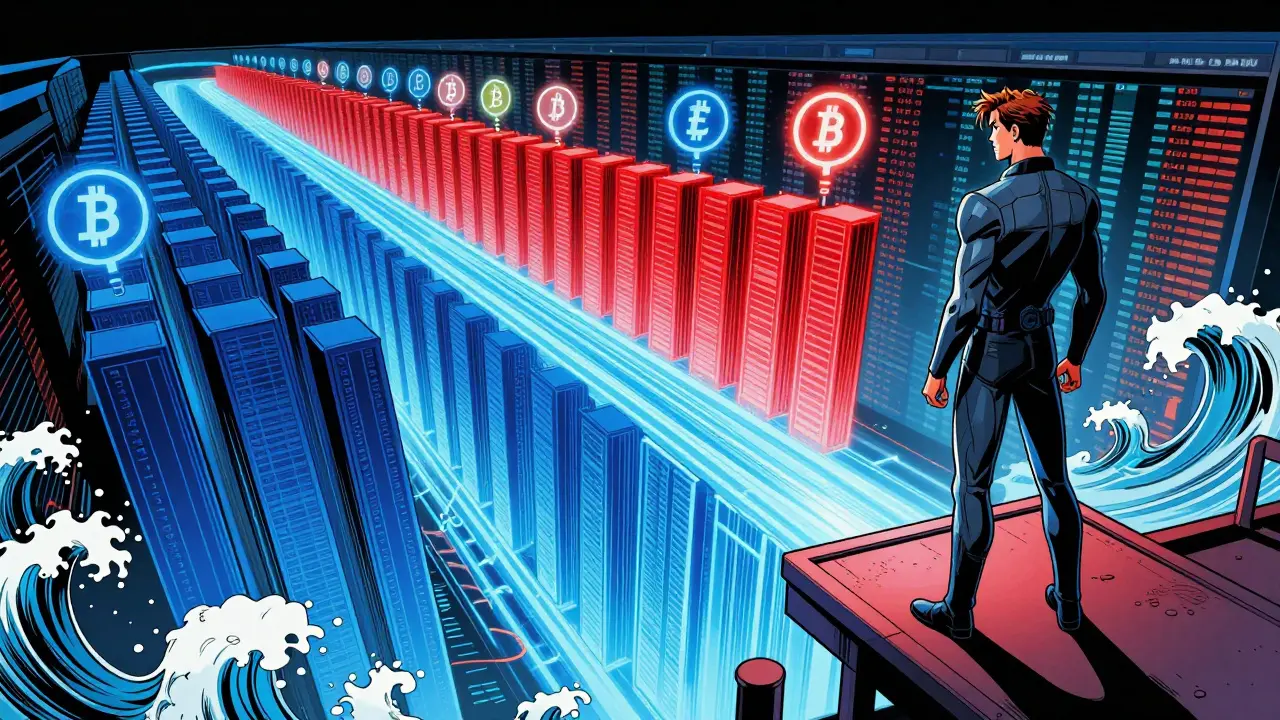

You don’t need fancy tools to tell thick from thin. Most exchanges show a depth chart - a graph with blue bars for buy orders and red for sell orders. In a thick book, those bars stretch far out from the center, like a wide river. In a thin book, they’re just a couple of sticks near the middle.

Here’s a quick checklist:

- Check the bid-ask spread. Under 0.1%? Thick. Over 1%? Thin.

- Look at the volume at ±1% from the current price. Over $1 million? Thick. Under $200,000? Thin.

- Watch how the price reacts when you place a small market order. If it jumps 0.5% or more, the book is thin.

- Check the time of day. Crypto liquidity drops 40% during Asian hours. What looked thick at noon EST might be thin at 3 AM UTC.

Why It Matters for Your Trades

If you’re buying or selling small amounts - $100 or $500 - order book depth might not feel important. But if you’re trading $5,000 or more, it becomes critical. A $10,000 market order in a thin market could cost you 2-3% in slippage. That’s $200-$300 gone before you even think about profit.

Professional traders use three tricks to avoid this:

- Use limit orders instead of market orders. You set the price you’re willing to pay - no surprises.

- Break big orders into smaller chunks. Instead of dumping $500,000 all at once, spread it over 30 minutes. This cuts slippage by up to 60%.

- Trade during peak hours. For crypto, that’s 8 AM to 12 PM EST, when U.S. and European traders are active. Liquidity spikes, spreads shrink, and your trades execute cleanly.

The Hidden Danger: Fake Depth

Not all thick order books are what they seem. High-frequency trading firms sometimes place large orders just to look like they’re supporting the market - then pull them the second someone tries to trade against them. This is called “spoofing.” It creates the illusion of depth while hiding the fact that real liquidity is thin.

That’s why some experts warn that a tight spread doesn’t always mean a healthy market. You can have a 0.02% spread with only $50,000 behind it - and that’s a trap. When volatility hits, those fake orders vanish, and the price collapses. The SEC flagged this issue in its 2023 report: thin markets had 300% more extreme price swings than thick ones.

How do you spot fake depth? Look at the order book over time. If the top few levels change every second - orders appearing and disappearing like magic - that’s a red flag. Real liquidity stays put.

What’s Changing in 2026

Exchanges are starting to respond. Binance now shows a “liquidity score” for every trading pair. Coinbase charges lower fees for market-makers who add depth to thin markets. And by mid-2025, the SEC plans to require minimum liquidity thresholds for all major exchanges.

Looking ahead, liquidity will keep concentrating. Gartner predicts that by 2026, the top 20 crypto pairs will hold 85% of all order book depth - up from 78% today. That means even more pressure on smaller coins to either grow their liquidity or get left behind.

Bottom Line: Depth Is Safety

Thick order books don’t make you rich overnight. But they keep you from losing everything. Thin books might offer big moves, but they’re like driving a sports car on ice - thrilling until you crash.

If you’re new to trading, stick to thick markets. BTC, ETH, SOL, XRP - these have the depth to handle your trades without eating your profits. If you’re experienced and want to play in thin markets, do it with small size, tight stops, and a clear exit plan. Never assume a price is real just because it’s on the screen. Always check the depth behind it.

The market doesn’t care how smart you are. It only cares how deep the water is beneath you.

What does a thick order book mean for trading?

A thick order book means there’s a large volume of buy and sell orders stacked at multiple price levels, which leads to tight spreads, low price impact, and fast execution. This makes it safer and cheaper to trade larger amounts, especially for institutional traders. For example, a $1 million trade in BTC/USD with a thick order book might only move the price by 0.1%, while the same trade in a thin market could shift it by 5%.

Can a thin order book ever be good for traders?

Yes - but only for experienced traders who understand the risks. Thin order books create high volatility, which can lead to large price swings in a short time. Skilled traders can exploit this by placing strategic limit orders during low-liquidity periods, aiming to catch sudden spikes or drops. However, the risk of slippage and unexpected price jumps is very high, and most retail traders lose money trying to trade thin markets without a solid plan.

How do I check order book depth on my exchange?

Most major exchanges like Binance, Coinbase, and Kraken show a depth chart or market depth panel next to the trading interface. It’s usually a graph with blue bars (buy orders) on the left and red bars (sell orders) on the right. The width and height of the bars show how much volume exists at each price level. Look for how far the bars extend from the current price - if they stretch beyond 1-2%, the book is thick. If they’re just a few pixels wide, it’s thin.

Why do some exchanges have thicker order books than others?

Exchanges with higher trading volume and more institutional participation naturally have thicker order books. Binance and Coinbase lead because they attract the most traders and market-makers. Smaller exchanges lack the user base and liquidity providers to sustain deep books. Also, liquidity is concentrated in top pairs like BTC/USD and ETH/USD - even on the same exchange, a lesser-known altcoin pair will have a much thinner book.

Is it better to use market orders or limit orders in thin markets?

Always use limit orders in thin markets. Market orders can trigger massive slippage because they fill at whatever price is available, and in shallow books, those prices can be far worse than expected. A limit order lets you control the maximum price you pay or minimum price you accept. Even if your order takes longer to fill, you avoid getting ripped off by the lack of buyers or sellers.

What time of day has the best order book depth for crypto?

The best liquidity for crypto trading typically occurs during U.S. market hours: 8 AM to 12 PM Eastern Time. That’s when U.S. and European traders are both active, and institutional volume peaks. Liquidity drops significantly during Asian hours (especially 2 AM to 6 AM UTC), and even major pairs like BTC/USD can temporarily behave like thin markets. Avoid placing large trades during these low-volume windows.

thick books are for cowards. if you cant handle a 5% swing you dont belong in crypto. i made 20k in 20 mins on a thin book shib trade. you call that boring? i call it freedom.

bro this is so true 😍 i used to trade thin books all the time and lost my rent money 😭 then i switched to btc/eth and now i sleep at night 🛌💸 thanks for the reminder!

just want to add that fake depth is way more common than people think. i once watched a 10M bid on sol disappear the second i placed a 500k limit order. it was like watching a magician pull a rabbit out of a hat... then the hat caught fire. always check order flow over time, not just the snapshot.

you people are overcomplicating this. if you're using market orders on anything below top 10 coins you're an idiot. period. limit orders. chunk your trades. trade during us hours. done. stop wasting time reading essays and just trade smart.

THICK BOOKS = SAFETY 🚨 THIN BOOKS = ADVENTURE 🎢 don't let fear stop you from chasing the big moves! if you're not sweating, you're not winning! 💪🔥

i keep thinking about how the order book is just a collective hallucination of trust. every bid and ask is someone’s hope, fear, or greed made visible. when the book thickens, it’s not just liquidity-it’s shared belief. when it thins, we’re all just guessing in the dark. and yet we still trade. why? because we’re wired to believe the next price will be better. even when the data screams otherwise.

thick books are a scam the exchanges make you think depth means safety but its just a mirror. the real action is in the hidden orders and the bots pulling the strings. you think you're safe? you're just the bait

OMG I JUST LOST MY ENTIRE PORTFOLIO ON A THIN BOOK OMG I WAS SO STUPID I THOUGHT SHIB WAS GOING TO MOON I DIDNT EVEN CHECK THE DEPTH I JUST SAW A GREEN CANDLE AND I WENT ALL IN 😭😭😭

i used to be the guy who chased thin markets until i realized i was just feeding the machine. now i trade btc like i’m tucking my kid in at night-gentle, patient, no drama. it’s not sexy but it keeps the lights on.

the notion that thick order books are 'boring' reveals a fundamental misunderstanding of risk. boredom in trading is not a flaw-it's the absence of unnecessary exposure. the market does not reward impatience; it rewards precision. those who mistake volatility for opportunity are not traders-they are gamblers with spreadsheets.

stick to btc and eth. seriously. you’ll thank yourself later.

so you're telling me the entire crypto industry is just a giant liquidity game of musical chairs and i'm the one still standing when the music stops?

I JUST REALIZED I'VE BEEN TRADING ON A THIN BOOK FOR 6 MONTHS AND I DIDN'T EVEN NOTICE 😭 I THOUGHT THE PRICE WAS JUST VOLATILE BUT IT WAS JUST NO ONE ELSE THERE TO BUY OR SELL I'M SO EMBARRASSED I'M GOING TO QUIT CRYPTO FOREVER