NFT Royalties for Musicians: How Artists Earn Passive Income from Secondary Sales

NFT Royalty Earnings Calculator

Calculate Your Earnings

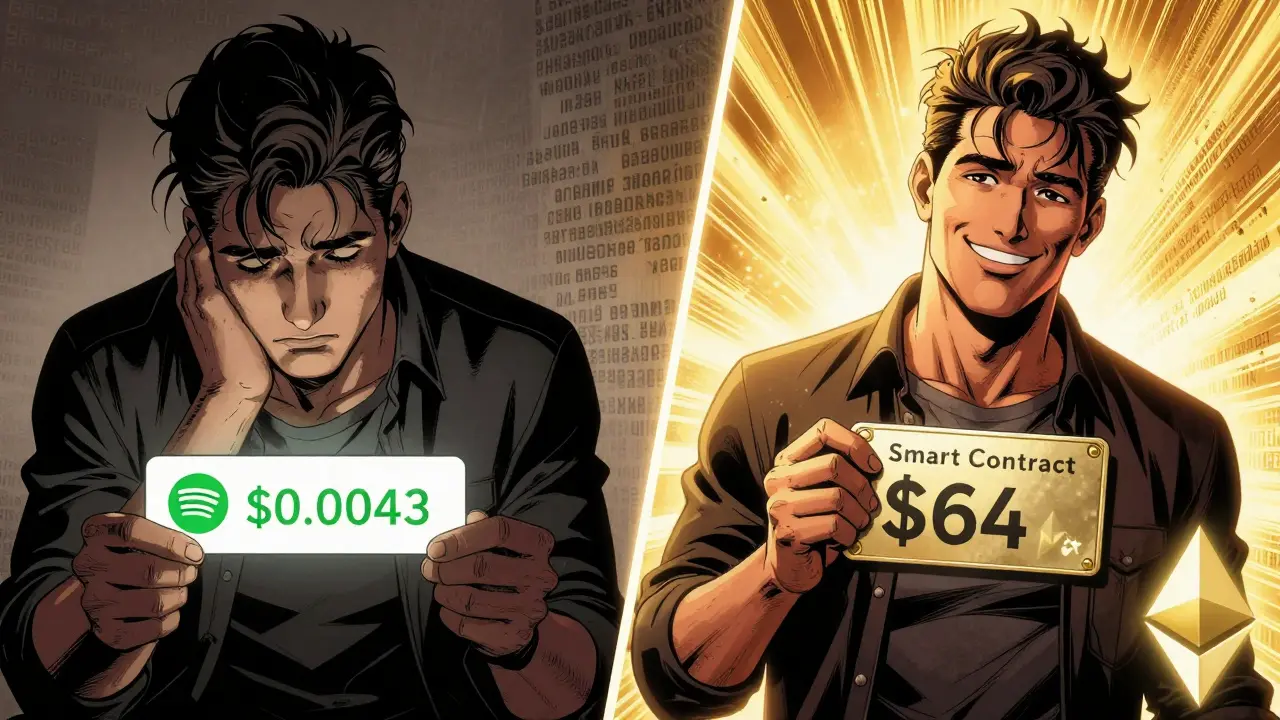

For decades, musicians have been stuck in a broken system. You spend months writing, recording, and promoting an album. Then, when it drops on Spotify or Apple Music, you make about $0.0043 per stream. That’s less than half a cent. And once your album is sold in a physical store or digital download, you rarely see another dime. That’s where NFT royalties change everything.

What Are NFT Royalties for Musicians?

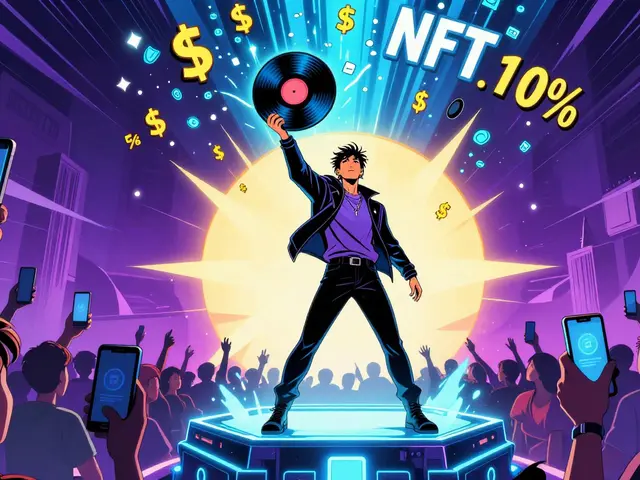

NFT royalties let musicians earn money every time their music is resold-like a secondhand vinyl record, but on the blockchain. When you mint a song or album as an NFT, you set a royalty percentage-usually between 5% and 10%-in a smart contract. Every time someone resells that NFT, that percentage automatically goes back to you. No middlemen. No delays. No hidden fees.This isn’t just a nice idea. It’s a direct fix to the biggest problem in music: artists lose control-and income-after the first sale. With streaming, you’re paid per play. With NFTs, you’re paid every time your work gains value. When Kings of Leon released their album as an NFT in 2021, they made $2 million in primary sales. But the real win? Ongoing royalties from resales. Some fans bought early for $50 and later sold for $500. The band got 10% of each of those sales. That’s hundreds of thousands in passive income, long after the album dropped.

How NFT Royalties Actually Work

It all happens through smart contracts on blockchains like Ethereum, Solana, or Polygon. When you mint your music as an NFT, you program the royalty percentage into the code. If someone buys your NFT for $200 and later sells it for $800, the smart contract automatically sends 8% of $800 ($64) to your wallet. The whole process takes 15 to 30 seconds on Ethereum during normal traffic.Platforms like Catalog, Royal, and OneOf specialize in music NFTs. They handle the technical side so you don’t have to. You upload your track, set your royalty rate, and mint. The platform connects your digital wallet, handles the blockchain transaction, and tracks every resale. You can even offer perks-like exclusive access to live shows, unreleased demos, or voice notes from the studio-to make your NFTs more valuable.

But here’s the catch: not all marketplaces enforce royalties. OpenSea and LooksRare, two of the biggest NFT marketplaces, don’t always honor the royalty percentages you set. Some buyers know this and move their purchases to these platforms to avoid paying you. That’s why musicians are switching to platforms that guarantee enforcement. Foundation, for example, blocks sales if royalties aren’t paid. Royal and Catalog have built-in systems that make it impossible to bypass.

Real Earnings: What Musicians Are Making

Some artists are turning NFT royalties into their main income. RAC, a producer and musician, released a single as an NFT for $1,000. Within months, it was resold 17 times. He earned $17,000 in royalties-17 times his initial sale. That’s not a fluke. On Reddit, a musician named SynthWaveSam said his $50 NFT album generated $1,200 in royalties over six months-more than he made from Spotify in the same period.But it’s not all success stories. Electronic artist BeatsByJen set an 8% royalty on her NFTs. Then she noticed 60% of resales happened on platforms that ignored royalties. She lost thousands in potential income. That’s the risk: if buyers use the wrong marketplace, you get nothing. That’s why choosing the right platform matters more than the music itself.

Why NFT Royalties Beat Streaming

Streaming pays pennies. NFTs pay percentages. Let’s break it down:- Spotify: $0.0043 per stream. To make $1,000, you need 232,558 streams.

- NFT royalty (at 8%): One resale at $1,250 = $100 to you. Ten resales = $1,000.

With streaming, you need millions of plays. With NFTs, you need a few fans willing to pay more. That’s the power of community. Your biggest supporters become your investors. They buy your NFT because they believe in you. When your music grows in value, they profit-and so do you.

And it’s not just about money. NFTs create direct relationships. Fans don’t just listen-they own a piece of your work. They feel connected. They share your drops. They promote your releases. That’s the real value beyond royalties.

The Big Problem: Royalty Enforcement

The biggest threat to NFT royalties isn’t technology. It’s marketplaces. Some platforms, like LooksRare, stopped enforcing royalties in 2023 to boost trading volume. Why? Because buyers don’t like paying extra. But creators? They’re furious. Tyler Hobbs, an artist who makes generative art NFTs, started blacklisting marketplaces that ignore royalties. Musicians are doing the same.Platforms are starting to respond. LooksRare now shares 25% of its protocol fees with creators. Royal and Catalog built royalty enforcement into their core. The Music NFT Alliance proposed a 5% minimum royalty standard in early 2023. But until every marketplace follows the same rules, artists are still at risk.

Right now, the safest move is to use music-specific platforms. They’re designed for artists. They care about royalties. General NFT sites? Not so much.

How to Get Started (Without Being a Tech Expert)

You don’t need to code. You don’t need to understand blockchain. Here’s how to start:- Choose a platform: Royal, Catalog, or OneOf are the best for musicians. They handle everything.

- Prepare your music: Export your track as a high-quality WAV or MP3. Add artwork. Write a short story about the song.

- Set your royalty: 5% to 10% is standard. Higher than 10% might scare buyers.

- Mint your NFT: Connect your wallet (MetaMask or Phantom). Pay the gas fee (usually $2-$15).

- List it: Set a price. Promote it to your fans.

Most platforms offer free onboarding calls and step-by-step guides. Royal’s artist guide is 120 pages long. Catalog walks you through every step in video tutorials. You’ll need about 20-30 hours to learn the basics. But once you do, it’s repeatable for every release.

What’s Next for NFT Royalties in Music

The future is hybrid. Projects like Blocktones are connecting NFT royalties to traditional publishing systems. That means you can earn from both Spotify and NFT resales at the same time. Universal Music Group and Warner Music are now building their own NFT divisions. That’s a huge signal: this isn’t a fad. It’s infrastructure being built.Dynamic royalties are coming too. Catalog lets you set royalties that decrease over time. For example: 10% for the first 10 resales, then 5% after that. That encourages early buying and keeps trading alive.

And then there’s DAOs. Artist 3LAU let fans vote on how royalty money is used-funding tours, buying studio gear, or even donating to music education. Fans aren’t just buyers anymore. They’re stakeholders.

By 2026, Bernstein analysts predict NFT royalties will make up 10-15% of an artist’s total income. That’s not replacing streaming. It’s adding a new layer. A layer where you’re rewarded every time your music grows in value.

Final Thought: It’s About Ownership

NFT royalties aren’t just about money. They’re about power. For the first time, musicians can own their work-and profit from its future. No label taking 80%. No streaming platform deciding your worth. You set the price. You set the royalty. You decide who gets to own your art.It’s not perfect. There are still glitches. Some marketplaces cheat. Gas fees can be high. But the trend is clear: artists are taking back control. And the ones who adapt? They’re not just surviving. They’re thriving.

It’s wild to think about how much power we’ve given to platforms that don’t care about the people who make the art. NFT royalties feel like the first real shift in a century of artists being exploited. Not because it’s perfect, but because it’s *mine* again. I don’t need a label to tell me my work has value-I can set that myself. And when someone resells my song for ten times what they paid? That’s not just money. That’s validation.

It’s not about getting rich overnight. It’s about building a system where your fans become your partners. That’s the real revolution.

Yeah right, like America’s gonna let some blockchain magic fix the music industry. You think these NFTs aren’t just for rich crypto bros to flex on Twitter? The whole thing’s a scam wrapped in ‘artist empowerment’ glitter. Meanwhile, real musicians are still playing dive bars for beer money while some guy in Miami buys a JPEG of a bassline and calls himself a patron. Get real.

I just launched my first NFT album last week and honestly? It changed everything. I set a 7% royalty, sold 12 copies at $80 each, and already had 4 resales. That’s $224 in passive income-more than I made from Spotify in 6 months. My fans are excited because they feel like they’re part of the journey. I sent them a voice note after the first resale and they lost it. This isn’t just money-it’s connection.

You don’t need to be a tech wizard. Just start small. Trust me, your fans are waiting.

I don’t know much about crypto, but I get the feeling. It’s like when you paint a picture and someone hangs it on their wall. You don’t get paid every time they show it to a friend… but what if you did? That’s what this feels like. A quiet kind of justice.

It’s not about making millions. It’s about being seen. Even if it’s just one person who buys your song because they truly love it-and then sells it later because they believe in you. That’s beautiful.

As a Black woman in music, I’ve spent years watching white producers get credited for my ideas. NFTs don’t fix systemic racism, but they do let me cut out the middlemen who never cared about my culture. I minted my album with a 10% royalty and included a free sample pack for fans who bought it. Now, 17-year-olds in Lagos are making beats with my sounds and tagging me. That’s power.

Don’t let anyone tell you this is just for rich white guys. The blockchain doesn’t care about your skin color. It only cares if you show up.

And yes, I use Royal. Because I won’t let some greedy exchange steal my future.

Of course the government’s gonna shut this down soon. You really think the Fed’s gonna let artists bypass the banking system? This is just Phase 1 of the Great Music Erasure. They’re letting us think we’re free so they can track every transaction and tax us into oblivion. And don’t get me started on how NFTs are used to implant microchips through your headphones. 😏

Also, I heard the guy who made that Kings of Leon NFT? He’s a CIA plant. Just saying.

So let me get this straight... you're telling me that instead of getting paid a fraction of a cent per stream, I'm supposed to be excited about getting paid 8% of some guy's resale profit on a JPEG of my song? And this is progress? Cool. I'll just keep my day job selling insurance. At least I know the company won't ghost me after I'm done.

Also, gas fees? More like gaslighting fees.

I’ve been reading all these comments and I just want to say-this is hard. For everyone. The artists trying to figure out the tech, the fans trying to understand why they should pay $50 for a file, the platforms trying to stay fair. But the fact that we’re even having this conversation? That’s huge.

You don’t have to do it all at once. Just start with one song. One fan. One resale. That’s enough. You’re not alone in this.

How quaint. A blockchain-based royalty system for musicians? How… 2021. The real elite don’t even use NFTs anymore. They’re moving into tokenized ownership of physical assets-vinyl pressings with embedded RFID, signed by the artist, tracked via private blockchain. This? This is for amateurs who think a WAV file equals art.

Oh wow, another ‘artist empowerment’ fairy tale. Let me guess-you also think NFTs are the answer to climate change? You’re literally asking people to pay for a digital file while the planet burns. And you call that progress? The only thing being minted here is delusion.

Also, your ‘fans’? They’re just crypto bros looking for a tax write-off. Don’t flatter yourself.

Anyone who thinks this is a real solution hasn’t studied music history. Labels didn’t steal your money-you gave it away by signing away your rights. Now you’re handing your future to a decentralized ledger? Pathetic. You’re not empowered. You’re just more distracted.

I tried it. Sold one NFT for $40. Someone resold it for $120. I got $8. Felt good. Like, really good. Not because of the money-because someone believed in me enough to pay more. That’s all I needed.

The semantic precision of this argument is fundamentally flawed. Royalty enforcement is not a technological problem-it is a governance problem. The blockchain merely executes; it does not adjudicate. Until legal frameworks recognize on-chain royalties as binding contractual obligations under UCC Article 2, this remains a performative gesture masquerading as economic reform.

Just read @SeTSUnA Kevin’s comment and had to laugh. You’re right-it’s a governance issue. But here’s the thing: the artists are building the governance. They’re forming collectives. They’re pressuring platforms. They’re writing smart contracts that lock in fairness. The law lags behind. Always does.

But the people? The people are already there. And they’re not waiting for permission.