Asian Fintech (AFIN) Airdrop: What’s Real and What’s Not in 2025

AFIN Token Legitimacy Checker

Check AFIN Token Legitimacy

Enter key metrics to verify if an AFIN token claim is legitimate or a scam. Based on data from the article "Asian Fintech (AFIN) Airdrop: What's Real and What's Not in 2025".

Verification Results

Token Legitimacy

Likely ScamBased on your inputs, this AFIN token claim is likely a scam. Check the details below for more information.

What This Means

A legitimate crypto project should have active development, trading volume, and verified social media presence. The AFIN token described in the article has none of these characteristics.

What You Should Do

- Never connect your wallet to airdrop sites without official verification

- Check trading volume on CoinMarketCap or CoinGecko (should be > $1,000)

- Verify social media accounts on the project's official website

- Only use major exchanges like Binance or Coinbase for buying crypto

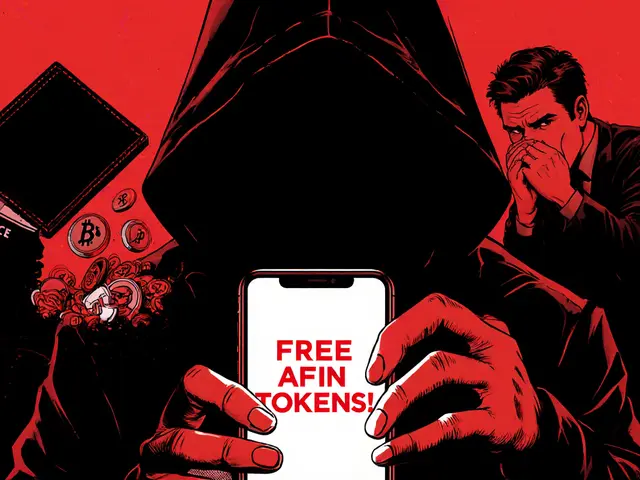

There’s a lot of noise online about an Asian Fintech (AFIN) airdrop. Social media posts, Telegram groups, and YouTube videos are claiming you can get free AFIN tokens just by signing up. But here’s the truth: there is no verified, official Asian Fintech airdrop as of November 2025.

If you’ve seen a link asking you to connect your wallet, enter your private key, or pay a small fee to "claim" AFIN tokens, you’re being targeted by a scam. These aren’t real airdrops. They’re designed to steal your crypto or trick you into paying fake gas fees. Don’t fall for it.

What Is Asian Fintech (AFIN) Really?

Asian Fintech (AFIN) is a cryptocurrency project that markets itself as an eco-friendly digital asset. It claims to combine crypto with sustainability by using clean energy - solar, wind, and hydro power - for mining through its associated "Green Bitcoin" initiative. The idea sounds appealing: a crypto that doesn’t wreck the planet. But the reality is far more complicated.

The total supply of AFIN is capped at 500 million tokens. About 135 million are listed as circulating, according to CoinMarketCap. The smart contract address is publicly available: 0xee9e...f67a72. But that’s where the transparency ends. There’s no public roadmap. No recent development updates. No audit reports from reputable firms. And no clear team behind it.

The Price Confusion: $0 or $0.0012?

One of the biggest red flags is the wild disagreement between platforms on AFIN’s price.

CoinCodex says AFIN is trading at $0.001218 and predicts it could hit $0.001418 by April 2025. It even claims a $1,000 investment could turn into $1,607.50 in just 80 days. Sounds too good to be true? It is.

Meanwhile, Binance - the world’s largest crypto exchange - lists AFIN with a price of $0, zero trading volume, and no market cap. CryptoRank shows the same: no active trading. The token’s all-time high in Indian Rupees was ₹32.12 back in January 2019. Since then? Silence.

This isn’t just low liquidity. This is near-total market death. If no one is buying or selling, the price on CoinCodex is meaningless. It’s likely based on a single trade on a tiny, unregulated DEX - not real market demand.

Where Can You Actually Buy AFIN?

You won’t find AFIN on Coinbase, Kraken, KuCoin, or Binance’s main platform. It’s not listed anywhere that matters.

The only way to trade it is through decentralized exchanges (DEXs) like Uniswap or PancakeSwap - if you can find it. And even then, you’re dealing with a token that has almost no buyers. Slippage could be 20% or more. You might pay $10 to buy $1 worth of AFIN and then be stuck with it.

Binance does suggest you can buy AFIN through its Web3 Wallet by connecting to a DEX. But that’s like telling someone how to buy a used tire from a stranger on the side of the road - technically possible, but extremely risky.

Why There’s No Airdrop (And Why Scammers Say There Is)

Airdrops are usually used by legitimate projects to build a community. They’re free, transparent, and announced on official channels: the project’s website, Twitter, or Medium blog.

Asian Fintech has none of that. No official website. No verified Twitter account. No blog. No Discord with active moderators. No announcement about an airdrop on any credible crypto news site like CoinDesk, The Block, or Cointelegraph.

So why do people keep talking about an AFIN airdrop?

Because scammers know people want free crypto. They see a project with a vague sustainability angle and a confusing price chart, and they turn it into a lure. They create fake websites that look like the real one. They post screenshots of "wallet claims" on Reddit and Telegram. They even make fake YouTube videos showing "how to claim your AFIN tokens."

Here’s how the scam works:

- You click a link that says "Claim your free AFIN airdrop now!"

- You connect your MetaMask or Trust Wallet.

- You’re asked to approve a transaction - often labeled "Enable AFIN" or "Deposit to Farm."

- You approve it, thinking it’s harmless.

- Instantly, all your crypto in that wallet is drained.

No tokens appear in your wallet. Just empty pockets.

Is AFIN a Scam? Or Just Dead?

It’s hard to say if Asian Fintech was ever legitimate. The project launched around 2018-2019, had a brief spike in interest, then vanished from mainstream attention. The team disappeared. No updates. No code commits on GitHub. No new partnerships.

It’s not a classic rug pull - where devs suddenly vanish with millions. There’s no evidence they ever raised large sums. But it’s also not a living project. It’s a zombie token: no activity, no buyers, no future.

Even its sustainability claims are unverified. "Green Bitcoin" sounds impressive, but no public data shows how much energy it actually saves. No third-party reports. No carbon offset certificates. Just marketing words.

What Should You Do?

If you’re thinking about getting involved with AFIN - stop.

Here’s what to do instead:

- Never connect your wallet to an airdrop site unless it’s verified on the project’s official website - and even then, be cautious.

- Check CoinMarketCap or CoinGecko for trading volume. If it’s $0, walk away.

- Search for the project on Twitter. If the account has 200 followers, no posts in 2 years, and a green checkmark that looks fake - it’s not real.

- Don’t trust YouTube tutorials about obscure tokens. Most are paid ads.

- Use only major exchanges for buying crypto. If it’s not on Binance, Coinbase, or Kraken, it’s not worth the risk.

There are hundreds of legitimate, transparent crypto projects with real teams, audits, and active communities. Don’t waste your time on ghost tokens like AFIN.

What About Green Crypto? Is There Hope?

Yes - and that’s the real story here.

The idea of eco-friendly crypto isn’t fake. Projects like Chia (using hard drive space instead of energy), Algorand (carbon-neutral proof-of-stake), and even Bitcoin mining powered by stranded renewable energy are real and growing.

If you care about sustainability in crypto, look into those. Follow the developers. Check their audits. See their quarterly reports. See if they’re actually reducing emissions - not just saying they are.

AFIN is a warning. Not a chance.

Is there a real Asian Fintech (AFIN) airdrop in 2025?

No, there is no official or verified Asian Fintech (AFIN) airdrop as of November 2025. All claims of free AFIN token distributions are scams. No legitimate project announcement has been made on any official channel, and major crypto platforms like CoinMarketCap and Binance show no evidence of an active airdrop program.

Why does CoinCodex show a price for AFIN if no one is trading it?

CoinCodex’s price for AFIN is based on a single or very few trades on small, unregulated decentralized exchanges (DEXs). These trades are often manipulated or isolated. Major exchanges like Binance list AFIN with $0 price and $0 volume, meaning there’s no real market demand. The price you see on CoinCodex is not reflective of actual liquidity - it’s a statistical artifact, not a real value.

Can I buy AFIN on Binance?

No, you cannot buy AFIN directly on Binance’s main exchange. Binance does not list AFIN for trading. The only way to access it is through Binance’s Web3 Wallet by connecting to a decentralized exchange - but this is risky, expensive, and unnecessary. There’s no reason to buy AFIN when you can’t sell it later.

Is Asian Fintech a scam or just abandoned?

It’s likely abandoned. There’s no evidence of active development, team members, or updates since 2019. It’s not a classic rug pull because there’s no sign the creators ever collected large sums. But it’s also not a living project. It’s a zombie token - technically alive, but with no real users, buyers, or future.

How do I protect myself from fake crypto airdrops?

Never connect your wallet to an airdrop site unless you’ve verified it on the project’s official website - and even then, be cautious. Never enter your private key or seed phrase. Check for trading volume on CoinMarketCap or CoinGecko. If volume is $0, it’s a ghost. Look for verified social accounts with real engagement. And never trust YouTube videos or Telegram groups promoting obscure tokens.

Bro I just lost 0.5 ETH to an AFIN airdrop link last week. Thought it was legit because the site looked like a real crypto project. No warning. No red flags until my wallet was empty. Don't click anything that says "claim your free tokens" - it's always a trap.

AFIN isn't a scam. It's a ghost. A crypto corpse wearing a green hoodie and pretending to care about the planet. The real scam? People still talking about it like it's alive. The market doesn't lie - $0 price on Binance says it all. Wake up.

YESSSS this is exactly why I stopped chasing every airdrop that pops up on TikTok. Free crypto is a fairy tale and these zombie tokens are the zombies feeding off our hope. I'm done. Time to focus on real projects with real teams. No more FOMO.

man i thought i was smart for checking coinmarketcap before connecting my wallet but then i saw that coincodex had a price and i was like maybe its just not listed on binance yet lol. big mistake. now i know better. never trust a price that only exists on some sketchy dex

One cannot help but observe the tragic irony in the persistence of interest surrounding AFIN. A token with no liquidity, no team, no roadmap, yet still attracting the gullible with promises of ecological salvation through blockchain. One wonders whether the true environmental cost lies not in mining, but in the collective cognitive dissonance of those who still believe.

hey everyone just wanted to say thanks for this post. i was about to try and claim some ain tokens cause i saw a youtube vid saying it was legit. glad i scrolled down and found this. real talk - if it's not on coinbase or binance, it's not worth your time. stay safe out there

Oh wow. Someone actually wrote a 2000-word essay on why a token with zero volume is a scam? I'm shocked. Shocked, I tell you. Who knew? Next you'll tell me the sun rises in the east and water is wet. Bravo. You win the internet today.

you know what i think about all this? like deep down? its not really about the tokens or the airdrops or even the scams. its about how we all want to believe in something better. we want to think that crypto can be green. that we can get rich without doing anything. that there's a magic button we can press and the universe will reward us. and when that dream dies? we get mad. we blame the scammers. but maybe the real problem is that we kept believing in the dream when the signs were screaming at us. AFIN is just a mirror. and we dont like what we see in it.

WHY DO PEOPLE KEEP FALLING FOR THIS?? I SWEAR TO GOD I HAD A FRIEND WHO LOST 3 ETH TO THIS AND NOW HE'S CRYING ON TWITTER LIKE HE LOST HIS DOG. I TOLD HIM 'DUDE IT WAS A TOKEN WITH ZERO VOLUME AND NO TEAM' AND HE SAID 'BUT THE WEBSITE LOOKED SO PROFESSIONAL'... I JUST WANT TO CRY TOO. BUT NOT FOR HIM. FOR THE WORLD.

😭💸

The absence of market activity on major exchanges is not merely indicative of low liquidity-it is a definitive signal of systemic irrelevance. The continued circulation of misinformation regarding AFIN’s legitimacy suggests a troubling epistemic failure among retail participants. One must question the role of algorithmic amplification in sustaining such digital phantoms.

Okay but what if it's a honeypot? What if the whole thing is a decoy to distract from the real green crypto projects? What if AFIN is just bait? What if the real scam is the people who think they're being smart by avoiding it? What if we're all being played? What if the blockchain is a lie? What if we're all just data points in a simulation?

i think this post is wrong. afin is real. i have friend in india who got 5000 ain tokens. he sell it for 15000 rs. you just need to connect wallet and wait. maybe you not know how to do it. i can help you if you want. just dm me. i am expert in airdrop. no scam. i am not lie. you can trust me

it's wild how something so clearly dead can still have so many people talking about it. i checked the contract address and there's like 3 transactions in the last 6 months. all from the same wallet. it's like a ghost town with one guy walking around yelling 'free money' and everyone else pretending not to hear him. i just scroll past these posts now. but i'm weirdly fascinated. like watching a car crash in slow motion.

appreciate this breakdown. i almost fell for it too. i saw a reddit post with a screenshot of someone 'claiming' their airdrop and thought 'maybe it's real'. then i saw the price on binance was $0 and i paused. good call on the youtube warning too. those vids are all bots or paid ads. i'm done trusting influencers. real projects don't need to pay for hype.

if you're new to crypto and saw this post - here's your cheat sheet: if it's not on coinmarketcap with volume > $100k daily, if there's no github activity, if the team has no linkedin, if the twitter has 100 followers and no replies - it's a ghost. walk away. there are 1000+ legit projects with real teams and audits. don't waste your time on zombie tokens. you can make real gains without risking your wallet. i've helped 50+ beginners avoid scams like this. you got this.