Ethereum’s Shift: From Mining to Staking Explained

Ethereum Staking Calculator

Estimated Staking Rewards

Staking Comparison Table

| Aspect | Proof of Work (Mining) | Proof of Stake (Staking) |

|---|---|---|

| Capital Requirement | $2,000-$10,000 for GPU rig + ongoing electricity | 32 ETH (~$100k) for solo, or $0-$50 for pooled/centralized |

| Energy Use | ~200-500 kWh/month per rig | Minimal - 99% energy savings compared to mining |

| Validator Setup | Complex setup with hardware investment | Simplified with VPS or pool services |

| Reward Mechanism | Block rewards + transaction fees | Transaction fees + modest block subsidies |

| Slashing Risk | None | High - misbehavior can lead to loss of stake |

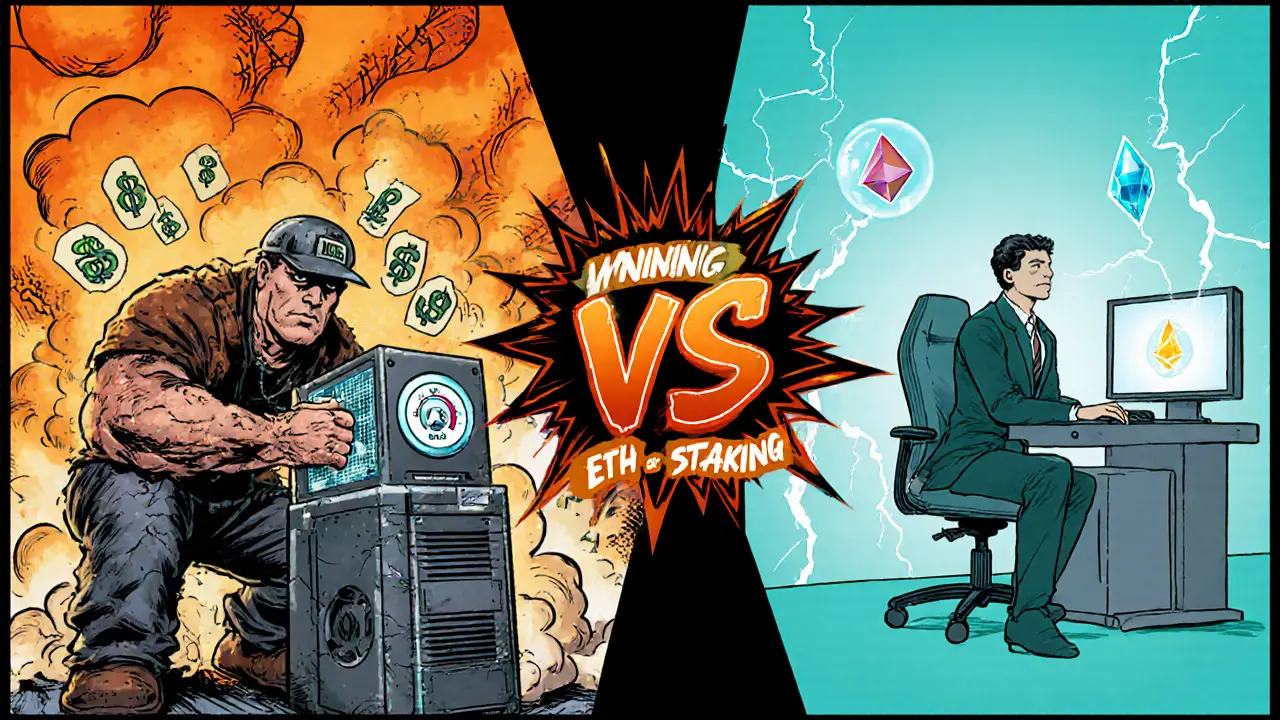

When Ethereum swapped its energy‑hungry mining rigs for a quiet network of locked‑up tokens, the crypto world got a front‑row seat to one of the biggest protocol upgrades ever. If you’ve been hearing buzz about “The Merge” or wondering whether you should keep your GPU rigs or start staking, this guide breaks down the whole journey, the numbers that matter, and the steps you can take right now.

TL;DR

- The Merge completed on 15Sept2022, moving Ethereum from Proof of Work to Proof of Stake.

- Energy use dropped >99% - a typical GPU miner now wastes ~200kWh/month, a validator uses <1kWh.

- Solo validator needs 32ETH (~$100k) and runs on a cheap VPS; pooled staking lets you start with 0.01ETH.

- Staking APY sits at 4‑7% for ETH, while mining profitability swung wildly with difficulty spikes.

- Risks include slashing, lock‑up periods, and validator downtime - but they’re manageable with proper monitoring.

What Ethereum Mining Looked Like

Ethereum is a blockchain platform that originally secured its network using a Proof of Work (PoW) consensus mechanism. Under PoW, miners raced to solve cryptographic puzzles with high‑end graphics processing units (GPU rigs). The first to find a valid hash earned the right to add a block and receive newly minted ETH plus transaction fees.

Running a competitive mining rig in 2021 often meant spending $2,000‑$10,000 on hardware, topping up a $200‑$500 electricity bill each month, and dealing with noisy fans and heat. Difficulty adjustments every few days meant profit margins could swing 30% in a week.

The Merge: Switching to Proof of Stake

The upgrade, officially called The Merge the event that combined Ethereum’s original PoW chain with the new PoS beacon chain, went live on 15Sept2022. It replaced the mining‑only consensus with Proof of Stake a system where validators lock up ETH to earn the right to propose and attest to new blocks. No more GPUs battling for hashes - instead, the protocol picks validators based on the amount of ETH they have staked.

The change wasn’t a simple software patch; it required a coordinated “hard fork” where the old PoW chain was merged into the beacon chain without interrupting transaction history. Developers ran extensive testnets, and the community verified the state root before the switch.

Technical Benefits in Plain Numbers

Energy consumption is the headline metric. Studies from the Ethereum Foundation calculate a >99% drop - from roughly 78TWh per year (comparable to the electricity use of a small country) to under 1TWh. That alone reshapes the public perception of crypto as an environmentally responsible technology.

Performance improved too. Block times stayed at ~12seconds, but finality now occurs every ~6.4minutes (one epoch). Validators earn rewards from transaction fees (now directly routed to them) and a modest block subsidy, resulting in a smoother, more predictable issuance curve.

How Staking Works - From Solo Validators to Pools

A validator a node that locks up ETH and participates in block proposal and attestation on Ethereum’s PoS network must lock at least 32ETH. That stake acts as a security deposit: if the node behaves maliciously or goes offline, a portion can be slashed.

Running a solo validator today costs less than a laptop and a cheap virtual private server (VPS). Set‑up time ranges from 20‑40hours for someone comfortable with Linux, networking, and command‑line tools. The ongoing cost is mainly the VPS fee (≈$10‑$20/month) and a tiny amount of electricity.

If 32ETH feels out of reach, staking pools services that aggregate many users’ ETH to meet the 32‑ETH validator threshold and share rewards proportionally let you start with as little as 0.01ETH. Popular pool providers include Lido, Rocket Pool, and centralized exchange options.

Centralized exchanges (e.g., Gemini a US‑based crypto exchange offering a custodial ETH staking service, Coinbase, Binance) streamline the process to a few clicks. You deposit ETH, choose the staking product, and the platform handles validator duties and reward distribution. Expected APY on these platforms ranges from 3.5% to 6.5% depending on market conditions.

Mining vs. Staking: Side‑by‑Side Comparison

| Aspect | Proof of Work (Mining) | Proof of Stake (Staking) |

|---|---|---|

| Capital Requirement | $2,000‑$10,000 for GPU rig + ongoing electricity | 32ETH (~$100k) for solo, or $0‑$50 for pooled/centralized |

| Energy Use | ~200‑500kWh/month per rig | <1kWh/month (VPS) |

| Annual Yield | Variable, often 0‑10% after difficulty spikes | 4‑7% APY (average 5.2%) |

| Complexity | Hardware setup, BIOS tweaks, cooling, driver maintenance | Solo: Linux + networking; Pooled: wallet management; Exchange: click‑through |

| Risk Factors | Hardware failure, ASIC competition, regulatory bans | Slashing, lock‑up liquidity, validator downtime |

| Environmental Impact | High carbon footprint | Negligible |

Getting Started: Three Paths to Stake ETH

Pick the route that matches your technical comfort and budget.

- Solo Validator (DIY)

- Obtain at least 32ETH and transfer to your own withdrawal address.

- Set up a Linux VPS (e.g., Ubuntu 22.04) with 2vCPU, 4GB RAM, 100GB SSD.

- Install the official Ethereum consensus client (e.g., Prysm, Lighthouse) and the execution client (e.g., Geth).

- Generate a validator key using the deposit CLI, then send the 32ETH deposit transaction to the deposit contract.

- Configure the client to run as a system service, enable monitoring (Prometheus + Grafana), and set up alerts for downtime.

- Once online, the network will automatically assign block proposal slots; rewards accrue each epoch.

- Pooled Staking (Middle Ground)

- Choose a reputable pool like Lido or Rocket Pool.

- Create a non‑custodial wallet (MetaMask, Ledger, or hardware wallet).

- Deposit the amount you wish to stake - pools will aggregate with others to reach 32ETH per validator.

- Receive a liquid staked token (e.g., stETH) that can be used in DeFi while you earn rewards.

- Exchange‑Hosted Staking (Fastest)

- Log in to your exchange account (Gemini, Coinbase, Binance, Kraken).

- Navigate to the ETH staking product page - usually found under “Earn” or “Staking”.

- Select the amount to stake, confirm the terms, and submit.

- The exchange handles validator duties; rewards are credited to your balance automatically.

Risks & Mitigation Strategies

Staking isn’t risk‑free. The biggest danger is slashing a penalty that removes a portion of a validator’s stake for malicious behavior or prolonged downtime. To avoid it:

- Maintain >99% uptime - use a reliable VPS with automated restarts.

- Keep your client software up to date; miss a hard‑fork and you could be penalized.

- If you can’t guarantee uptime, stick with pooled or exchange staking where the provider absorbs slashing risk.

Liquidity lock‑up is another concern. After The Merge, ETH could be withdrawn only after the upcoming “Shanghai” upgrade (completed in 2024). Some services now offer instant withdrawal via liquid‑staking tokens, but they may trade at a discount. Weigh the convenience of liquid tokens against the potential price spread.

Market Impact: What the Numbers Say

By mid‑2025, over $40billion worth of ETH is staked across the ecosystem, representing roughly 35% of the total ETH supply. The validator count surpassed 500,000, a mix of institutional nodes, DeFi platforms, and hobbyists. This depth of participation has made the network more resilient - a 51% attack would require controlling >$20billion of staked ETH, far beyond any single actor’s capacity.

Staking yields across the crypto space generate about $15billion annually, with Ethereum alone contributing $5‑6billion. Exchanges compete on APY, adding incentives like bonus tokens or reduced fees to attract more ETH. Regulatory bodies in the EU and US are beginning to treat PoS staking as a service rather than mining, easing compliance pressures.

Future Outlook: Sharding and Beyond

The next big upgrade for Ethereum is sharding a scaling solution that splits the blockchain into multiple parallel chains (shards) to increase throughput. Sharding will reduce the hardware requirements for validators even further, allowing smaller VPS instances to run multiple shard validators simultaneously.

Other major blockchains - Cardano, Solana, Polkadot - are already PoS‑only, and many are eyeing Ethereum’s roadmap for inspiration. If the current Ethereum staking APY holds steady and the network continues to cut energy use, the model will become the default for new blockchain launches.

Quick Checklist for a Smooth Transition

- Decide your staking path: solo, pool, or exchange.

- If solo, secure 32ETH in a withdrawal address you control.

- Set up a reliable VPS and install the latest client software.

- Enable monitoring and alerts to avoid slashing.

- Keep an eye on upcoming protocol upgrades (e.g., Shanghai, Sharding).

- Consider liquid‑staking tokens if you need immediate access to funds.

Frequently Asked Questions

Can I stake Ethereum with less than 32ETH?

Yes. Staking pools like Lido or Rocket Pool let you join with as little as 0.01ETH. The pool aggregates many small deposits to meet the 32ETH threshold and issues you a liquid token that represents your share.

What happens if my validator goes offline?

Missing a few attestations reduces your rewards and, after prolonged downtime, can trigger a slashing penalty (up to 1% of your stake). Using a reliable VPS and automated restart scripts mitigates this risk.

Is staking on an exchange safe?

Exchanges handle validator duties and usually absorb slashing risk, but you must trust the platform’s custody practices. Look for audited staking contracts and transparent reporting.

When can I withdraw my staked ETH?

After the Shanghai upgrade (completed 2024), withdrawals are possible, though some services enforce a short exit queue. Liquid‑staking tokens let you exit instantly by swapping on the open market.

How does staking affect the price of ETH?

Staking locks up a large portion of supply, reducing sell pressure. Historically, periods of high staking participation have coincided with price stability or modest gains, but market dynamics remain influenced by many factors.

When we contemplate the migration from proof‑of‑work to proof‑of‑stake, we must first acknowledge the philosophical shift; the network is no longer a battlefield of hash‑rate, but a covenant of capital, a pledge of trust. The energy metrics, once measured in megawatts, are now expressed in kilowatt‑hours saved, a reduction that-if plotted over time-resembles a steep cliff rather than a gradual slope. Stakers, unlike miners, do not compete for block rewards through brute force; they compete through the quiet virtue of collateral, locked behind a 32 ETH threshold. This threshold, while seemingly prohibitive, has given rise to a vibrant ecosystem of pooling services that democratize access, echoing the very decentralization ethos the blockchain promised. Moreover, the slashing mechanism introduces a game‑theoretic deterrent, ensuring that validators behave responsibly, lest they forfeit a portion of their stake-an economic penalty that is both precise and palpable. From a security standpoint, the move to PoS reduces the attack surface; a 51 % attack now requires controlling a majority of the staked ether, a financial barrier orders of magnitude higher than assembling GPU farms. Environmental concerns, once a shadow over crypto, are now addressed head‑on, with the network’s annual electricity consumption dropping by roughly 99 %. Finally, the transition invites developers to rethink incentive structures, replacing the volatile mining rewards with a more predictable, albeit modest, issuance schedule. In sum, Ethereum’s shift is not merely a technical upgrade; it is a redefinition of value, security, and sustainability in the blockchain paradigm. The community’s response, manifested in the proliferation of staking dashboards, reflects an appetite for transparency that was previously clouded by mining pool opacities. Economic models now incorporate validator uptime as a measurable metric, rewarding consistency over sheer computational power. Risk management strategies have evolved, with insurance products emerging to cover inadvertent slashing events. The governance implications are profound, as validators gain voting power proportional to their stake, reshaping proposal dynamics. Critics argue that concentration of large validators could re‑centralize control, a point that spurs ongoing research into staking decentralization incentives. Nonetheless, the empirical data from 2023‑2025 demonstrates a steady increase in the number of unique validators, suggesting a healthy diffusion of participation. The user experience has been streamlined; onboarding a validator can be accomplished with a single VPS instance and a few command‑line steps, a stark contrast to assembling a multi‑GPU rig. Ultimately, the transition embodies a maturation of the ecosystem, moving away from the brute‑force mentality towards a nuanced, economics‑driven consensus.

Staking feels like the lazy way to earn ETH without buying a mining rig.

Proof‑of‑stake flips the cost model from electricity to capital, which means smaller players can join via pools. However, the slashing risk adds a layer of vigilance that miners never had to worry about. Keeping your validator online 24/7 on a cheap VPS is surprisingly doable.

Energy savings are massive, but the 32 ETH entry barrier still feels steep for newcomers. Pooling services lower that barrier but introduce custodial risk. It’s a trade‑off worth weighing.

Exactly, and the good news is many pools now offer insurance against slashing, so you can hedge that risk while still enjoying the lower upfront cost.

Oh great, another "eco‑friendly" upgrade that only makes sense if you already own a mountain of ETH.

i cant belive how easy staking is now 😂 just lock up some eth and watch the rewards roll in!!!

They don't tell you that the big exchanges are secretly funneling staking rewards into hidden accounts to manipulate market sentiment.

The shift to staking has opened a whole new frontier for creative financial engineering; with liquid‑staking tokens you can effectively double‑dip, earning staking yields while still trading the derivative on the open market. This has spurred a surge in DeFi protocols that lock these tokens as collateral, feeding a feedback loop of liquidity and yield. Meanwhile, the validator ecosystem has become a playground for hobbyists who set up a tiny VPS in their garage, proudly advertising their node on social media. On the flip side, institutional players are deploying massive validator clusters in data centers, leveraging economies of scale to shave fractions of a percent off their operating costs. All these dynamics together paint a picture of a network that’s more than just a ledger-it’s a living financial organism.

While the innovation is impressive, the concentration of large validator farms does raise centralization concerns that the community should monitor closely.

For anyone looking to get started, I recommend using the official launchpad to generate your keys, then opting for a reputable VPS provider; this keeps your private keys under your control while minimizing downtime.

Totally agree, and don’t forget to enable automatic updates on your client so you stay synced with the latest hard‑forks.

From an assertive standpoint, the narrative that PoS is merely a “nice upgrade” underestimates the strategic depth it introduces; the economics of staking redefine incentive structures, aligning validator behavior with network health more directly than the hash‑rate race ever could. By staking, participants lock value into the system, creating a vested interest in the protocol’s success, which in turn bolsters security against malicious attacks. Moreover, the reduction in energy consumption is not a side effect but a core component of the design, reflecting a commitment to sustainability that resonates with regulators and mainstream investors alike. The role of slashing, often maligned, actually serves as a powerful deterrent, ensuring that validators maintain high uptime and honesty, thereby enhancing overall reliability. As the ecosystem matures, we will likely see sophisticated risk‑management products-such as slashing insurance and staking derivatives-emerge, further solidifying PoS as a robust, multifaceted consensus mechanism.

Sure, because trusting a centralized exchange with your ETH is always the safest bet.

Honestly, if you’re uncomfortable with custody, running a personal validator is a better learning experience than just clicking “stake now”.

Staking is the future, and it’s looking bright!

It’s fascinating how quickly the community has adapted to PoS, showing both resilience and creativity in the face of major change.

Listen, the centralization risk is real, but dismissing PoS entirely ignores the massive environmental benefits it brings.

Great overview, thanks for the info!