Crypto Exchange Document Forgery: Legal Risks & Penalties

Crypto Forgery Penalty Estimator

Calculate Potential Penalties

Enter your scenario to estimate maximum potential prison time and fines for crypto document forgery offenses.

Estimated Penalties

Note: These are maximum penalties for a single count of the most common charges. Actual sentences may be lower based on judicial discretion.

Total sentences can be significantly higher for multiple charges and conspiracy.

Prison Time

Financial Penalties

This calculator estimates maximum penalties based on U.S. federal sentencing guidelines.

Actual sentences vary based on jurisdiction, specific facts, and defense strategies.

When we talk about Document forgery for cryptocurrency exchange access the illegal creation or alteration of identification documents to bypass KYC and AML checks on digital‑asset platforms, the stakes are high.

Key Takeaways

- Document forgery targeting crypto exchanges is prosecuted as federal securities, wire‑fraud and money‑laundering crimes, each carrying up to 20 years in prison.

- Regulators such as the Securities and Exchange Commission (SEC) U.S. agency that enforces securities laws, including crypto‑related securities fraud and Financial Crimes Enforcement Network (FinCEN) Bureau of the Treasury that oversees AML and KYC compliance actively coordinate investigations.

- Exchanges can face civil fines, loss of license, or criminal liability if they fail to implement robust multi‑factor verification and monitoring.

- Advanced forgery now uses AI‑generated IDs and deep‑fake video; detection tools look for lighting inconsistencies, synthetic artifacts, and mismatched data points.

- Defendants must prove intentional deception; defenses often focus on challenging the technical evidence of document manipulation.

What Exactly Is Document Forgery in the Crypto World?

At its core, document forgery means creating a fake driver’s license, passport, utility bill, or any ID that a crypto exchange will accept during its Know Your Customer (KYC) process that verifies a user’s identity to prevent fraud and comply with regulations checks. Fraudsters now buy full identity packages on dark‑web markets for as little as $15 up to $500. These kits often include:

- AI‑generated government‑issued IDs that mimic holograms and watermarks.

- Synthetic utility bills that match the forged ID’s address.

- Deep‑fake video clips that respond to live‑verification prompts.

Because many exchanges still rely on single‑point photo verification, a well‑crafted package can slide through untouched.

Regulatory Landscape: Who Polices the Crime?

Multiple U.S. agencies consider this conduct a serious breach:

- Department of Justice (DOJ) Federal body that prosecutes criminal violations, including fraud and money‑laundering brings criminal charges.

- The SEC Regulates securities markets and has expanded its jurisdiction to include many crypto tokens can pursue securities‑fraud allegations when forged access leads to unregistered offerings.

- FinCEN Enforces AML rules and can levy civil penalties for KYC failures focuses on the anti‑money‑laundering angle.

These agencies often coordinate, sharing intelligence and aligning enforcement priorities. The result is a dense web of possible charges for a single forgery scheme.

Criminal Charges and Their Maximum Penalties

The most common statutes invoked include:

- Wire fraud A federal offense for using electronic communications to defraud - up to 20 years per count.

- Securities fraud Deception involving the purchase or sale of securities, now applied to many crypto assets - up to 20 years.

- Money laundering Concealing the origins of illegally obtained money, often through crypto transfers - up to 20 years.

- Conspiracy to commit any of the above - additive sentences can push total imprisonment well beyond 30 years.

Federal sentencing guidelines also consider loss amount, number of victims, and the use of sophisticated technology when determining the actual term.

| Charge | Maximum Prison Term | Typical Fine |

|---|---|---|

| Wire fraud | 20 years | Up to $250,000 per count |

| Securities fraud | 20 years | Up to $5 million (civil) plus criminal fines |

| Money laundering | 20 years | Up to $500,000 per offense |

| Conspiracy | 10 years per additional count | Varies |

Exchange Liability: When Platforms Get Blamed

Even if a platform didn’t directly create the forged documents, it can still be on the hook if it:

- Fails to implement multi‑layered KYC/AML checks.

- Keeps accounts that facilitate large, suspicious transactions.

- Negligently markets its verification as “secure” while using outdated tools.

Regulators have shown willingness to levy hefty civil penalties. The 2022 OFAC settlement with Kraken, for example, resulted in a $30 million fine for sanction‑evasion lapses tied to inadequate identity checks.

Beyond fines, exchanges risk losing their license, facing injunctions, or being sued by victims who lost funds after a forged account siphoned their assets.

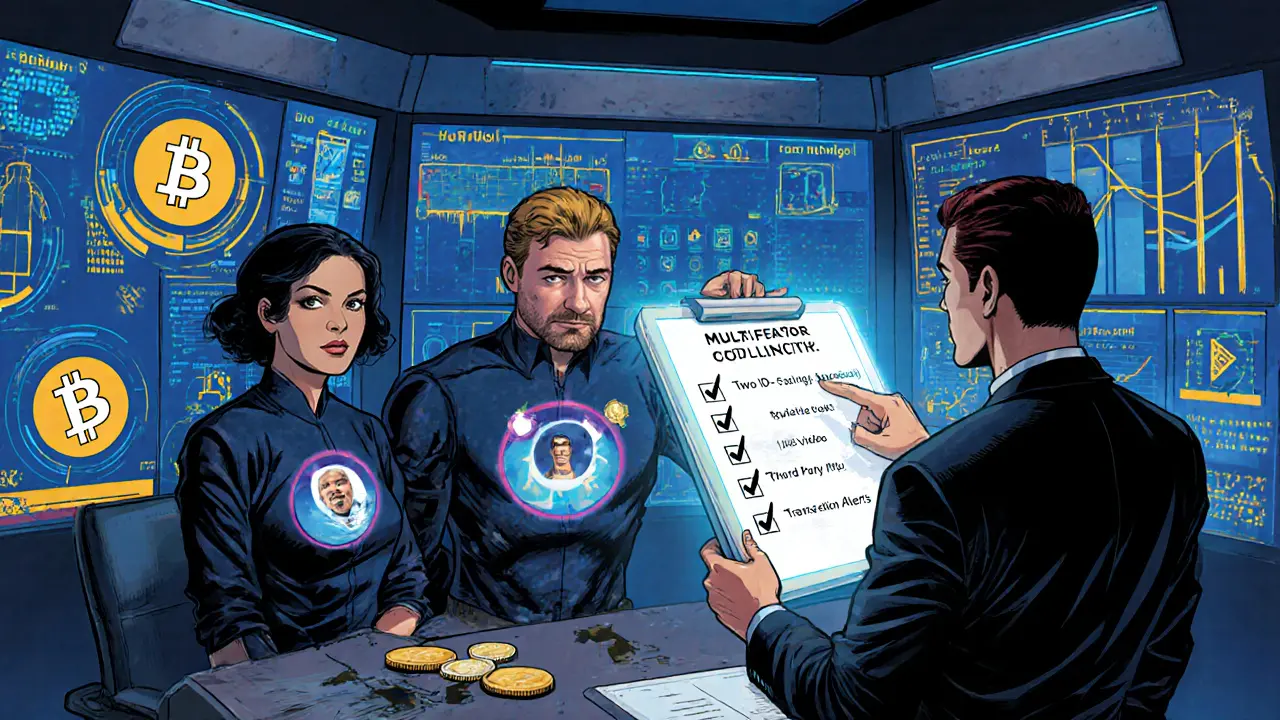

Detection & Prevention: How Exchanges Fight Back

Modern KYC suites now blend four core defenses:

- Document integrity analysis - AI scans for hologram distortion, font anomalies, and micro‑printing mismatches.

- Deep‑fake detection - Algorithms examine eye‑movement patterns, blinking rhythm, and lighting reflections in video verification.

- Database cross‑checking - Real‑time look‑ups against government and credit‑bureau records.

- Risk‑scoring engines - Combine device fingerprinting, IP reputation, and transaction patterns to flag high‑risk onboarding.

Exchanges that integrate all four layers can push the success rate for forged attempts below 1 %.

For smaller platforms, a pragmatic checklist helps:

- Require at least two independent ID documents (e.g., passport + utility bill).

- Implement live‑video capture with random prompts (e.g., “show your left hand”).

- Use a third‑party KYC provider that offers deep‑fake detection.

- Set automated transaction alerts for rapid fund movement from newly verified accounts.

- Conduct manual reviews on high‑value accounts before granting withdrawal limits.

Prosecutorial Strategies & Defense Tips

Prosecutors focus on two pillars: intent and loss. They’ll present forensic logs, blockchain transaction trails, and the forged ID package itself. To defend, attorneys often:

- Challenge the authenticity of the digital evidence (e.g., argue the deep‑fake detection tool produced false positives).

- Question whether the defendant understood the KYC requirements.

- Highlight any procedural missteps by the exchange, such as improper data retention, that could muddy the chain of custody.

Because the burden of proof is “beyond a reasonable doubt,” a well‑prepared technical expert can make a big difference.

Looking Ahead: How the Legal Landscape Is Evolving

Regulators are updating guidance at a rapid pace. In 2024, the SEC issued a notice urging all U.S.-serving exchanges to adopt multi‑factor biometric verification by 2026. FinCEN’s recent rulemaking proposes higher reporting thresholds for crypto‑related suspicious activity.

What does this mean for fraudsters? Higher barriers, but also higher rewards for those who crack them. Expect more sophisticated AI tools, but also stronger inter‑agency cooperation and stiffer penalties.

Frequently Asked Questions

What makes document forgery a federal crime in the U.S.?

Because it involves intentional deception to bypass federally mandated KYC/AML rules, it falls under statutes like wire fraud, securities fraud, and money‑laundering, all of which are federal offenses.

Can an exchange be criminally charged for allowing forged accounts?

Yes. If regulators determine the exchange knowingly facilitated fraud or was grossly negligent, the platform-or its executives-can face criminal charges alongside civil fines.

How long can I expect a prison sentence for a single count of wire fraud?

Up to 20 years, though actual sentences often depend on loss amount, victim count, and whether the offense involved sophisticated technology.

What are the most effective tools to detect AI‑generated IDs?

Platforms combine document‑integrity scanners, deep‑fake video analysis, and cross‑database verification. Vendors like Onfido and Persona now offer bundled solutions that flag synthetic artifacts in seconds.

If I’m sued by a victim, can I be held personally liable?

Executives can be sued personally for breach of fiduciary duty or negligence, especially if they ignored known security gaps. Corporate indemnity may cover some costs, but personal exposure remains a risk.

Next Steps for Exchange Operators

Take action now:

- Audit your current KYC workflow for single‑point failures.

- Partner with a KYC provider that includes deep‑fake detection.

- Update your user agreements to reflect new verification requirements.

- Train compliance staff on emerging forgery tactics and evidence preservation.

- Run a tabletop legal scenario with your counsel to gauge exposure.

Staying ahead of the fraud curve not only protects your users-it shields you from the severe legal fallout that regulators are already handing out.

Sometimes I wonder if the regulators are just another layer of the invisible hand that decides who gets to play in the crypto arena. The idea that forged IDs can slip through feels like a hole in a ship that we all ignore until it capsizes. Maybe the truth is simpler: the system was never built to handle the speed of modern fraud.

It’s like watching a shadow puppet show where the strings are hidden from the audience, and we keep convincing ourselves the dance is harmless. The deeper the deception, the more the whole network trembles, even if we don’t feel it on the surface.

The recent surge in AI‑generated identification documents represents a pivotal moment for both regulators and exchange operators.

While the technology enables rapid creation of seemingly authentic IDs, it simultaneously forces a reevaluation of traditional KYC paradigms.

From a legal perspective, each forged document can be construed as an act of intentional deception, thereby satisfying the mens rea element required for federal offenses such as wire fraud.

Moreover, the involvement of synthetic media introduces novel evidentiary challenges, as courts must now assess the reliability of algorithmic forensic tools.

In practice, prosecutors have begun to lean on expert witnesses who can explain the minutiae of hologram distortion and pixel‑level anomalies to juries.

This trend underscores the importance of exchanges maintaining comprehensive logs that capture every step of the verification workflow.

Such logs not only serve as a defensive shield against regulatory scrutiny but also provide a clear audit trail should litigation arise.

Collaboration between compliance teams and technical auditors is therefore essential to bridge the gap between legal theory and operational reality.

Exchanges that adopt a multi‑factor approach-combining document integrity scanners, biometric verification, and real‑time database cross‑checks-reduce the probability of successful forgery to a fraction of a percent.

Nevertheless, no system is infallible, and the residual risk must be quantified and reported to senior management.

From an empathetic standpoint, we must also consider the legitimate users who may be unfairly delayed by overly aggressive false‑positive filters.

Striking a balance between security and user experience requires ongoing dialogue with both regulators and consumer advocacy groups.

As the legal landscape evolves, we can anticipate that statutes will be amended to explicitly address deep‑fake technologies, thereby providing clearer guidance for enforcement.

Until such legislative clarity is achieved, best practice remains a proactive posture: anticipate threats, invest in adaptable technology, and train staff to recognize emerging patterns.

Ultimately, the collective resilience of the crypto ecosystem will depend on our willingness to view these challenges not as isolated incidents, but as an interconnected web demanding coordinated action.

I need two forms of ID and a live video that asks you to show a random object

Honestly this whole thing feels like an endless cat‑and‑mouse game.

Ah, the noble art of pretending to be sophisticated while simply re‑packaging a $20‑dark‑web identity kit-truly a masterclass in regulatory futility.

Yo, the feds are gonna crush these jokers faster than a bad meme spreads, and anyone thinkin they can outsmart the system is just diggin their own grave.

🚨 Brace yourselves, folks! The courtroom drama about AI passports is about to hit peak absurdity, and we’ll be watching the fallout like a reality TV season finale! 🎬

When choosing a KYC provider, look for those that publish their detection rates and regularly update their models; this transparency helps you gauge whether the solution can keep up with the latest AI‑generated forgeries.

Implementing a layered verification framework not only mitigates risk but also demonstrates due diligence to regulators 😊. Consider integrating biometric checks, document authenticity scanners, and cross‑reference databases for a comprehensive defense.

Great points all around, and I’m confident that with these proactive steps the industry will stay ahead of fraudsters while keeping user trust intact.

It’s easy to feel overwhelmed by the technical jargon and the looming penalties, but remember that every security layer we add is a step toward protecting both the platform and its users. A robust KYC system starts with clear policies that are communicated openly to newcomers, reducing confusion and resistance. Training compliance staff on the nuances of deep‑fake detection empowers them to spot anomalies that automated tools might miss. Continuous monitoring of transaction patterns acts as a safety net, catching suspicious activity before funds disappear. Collaboration with law‑enforcement agencies ensures that evidence is preserved correctly for potential prosecutions. While the costs of implementation can be significant, the long‑term savings from avoided fines and reputational damage are immeasurable. Ultimately, a culture of vigilance and education creates an environment where fraud attempts are less likely to succeed.

Let’s view these challenges as opportunities to innovate, strengthen our compliance frameworks, and set a new industry standard that others will aspire to follow.