Why Pakistan Ranks 3rd-4th in Global Crypto Adoption

Pakistan isn't just using cryptocurrency - it's leading the world in how people actually use it. While headlines often focus on Bitcoin price swings or Wall Street ETFs, the real story is happening in cities like Lahore, Karachi, and Faisalabad, where millions of ordinary Pakistanis are turning to digital assets not for speculation, but for survival. According to Chainalysis’ 2025 Global Adoption Index, Pakistan jumped to 3rd place globally, behind only India and the United States. Other reports still place it at 4th or 9th, depending on how they measure it. But one thing is clear: Pakistan is among the top three countries on Earth where crypto isn't a niche experiment - it's a daily tool.

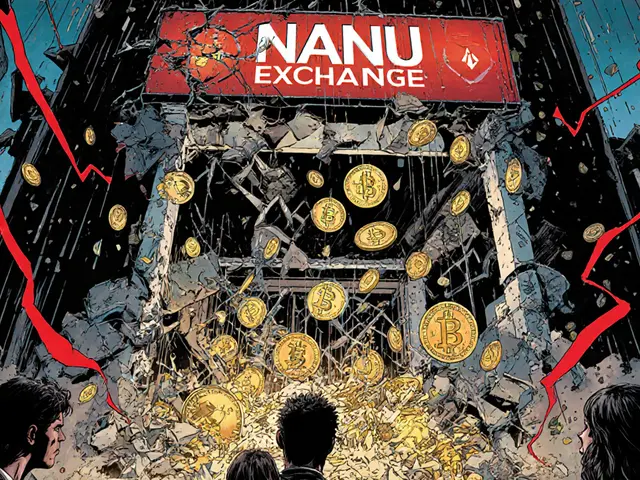

How Did Pakistan Get Here?

Just a few years ago, the State Bank of Pakistan banned banks from dealing with crypto exchanges. In 2018, it was illegal to even talk about Bitcoin. Fast forward to 2025, and the country created the Pakistan Virtual Assets Regulatory Authority a government body established in July 2025 to license, monitor, and regulate all virtual asset services in Pakistan. Alongside it came the Pakistan Crypto Council a public-private advisory body led by CEO Bin Saqib, formed in early 2025 to bridge government policy and industry needs. This wasn’t a last-minute pivot - it was a full institutional overhaul.The change didn’t come from Wall Street or Silicon Valley. It came from people. When inflation hit 35% in 2023 and the Pakistani rupee lost nearly half its value against the dollar in two years, families started looking for ways to protect their savings. Crypto wasn’t about getting rich overnight. It was about not losing everything.

What Are People Actually Buying?

Most of the crypto flowing into Pakistan isn’t Bitcoin. It’s stablecoins - especially USDT (Tether) and USDC. These digital coins are pegged 1:1 to the U.S. dollar, so they don’t swing up and down like Bitcoin. For a parent sending money to a child studying abroad, or a small business owner paying suppliers overseas, stablecoins are faster, cheaper, and more reliable than banks.Chainalysis data shows Pakistan’s crypto inflows surged 210% between July 2024 and June 2025. The majority of that came from peer-to-peer (P2P) trading, not exchanges. People are buying crypto directly from each other using local payment apps like JazzCash and EasyPaisa. A typical transaction? A worker in Dubai sends 500 USDT to his sister in Multan. She cashes it out in rupees within minutes - no bank fees, no 7-day delays. That’s not investment. That’s life.

Over 20 million Pakistanis now hold digital assets, with total holdings estimated between $20 billion and $25 billion. That’s roughly 9% of the country’s population. For context, the global average is just under 7%. In some urban areas, adoption rates hit 15% - higher than in Germany or Japan.

Why Other Countries Don’t Rank This High

Nigeria used to be #2 in crypto adoption. Now it’s slipped to #6. Why? Because Nigeria’s government cracked down on P2P trading in 2024, making it harder for people to buy crypto. Vietnam and India are also top performers, but they have different drivers. India’s growth comes from retail investors and institutional participation. Vietnam’s is fueled by young tech-savvy users and gaming tokens. Pakistan’s story is different: it’s about financial necessity.Kim Grauer, chief economist at Chainalysis, put it simply: "Crypto adoption is mostly accelerating in mature markets with clearer rules and in emerging markets where stablecoins are transforming how people manage money." Pakistan is the textbook example of the second.

The Role of Regulation - And the Risks

The creation of the Pakistan Virtual Assets Regulatory Authority was a game-changer. Before, crypto was a gray zone. Now, exchanges must be licensed, KYC rules apply, and anti-money laundering checks are mandatory. This sounds bureaucratic, but it’s actually what gave people confidence. Banks started relaxing restrictions. Payment processors began integrating crypto withdrawals. Even utility companies now accept USDT for electricity bills in pilot zones.But there’s a shadow side. In August 2025, the Pakistan Crypto Council signed a deal with World Liberty Financial a U.S.-based blockchain firm co-founded by Zach Witkoff, linked to the Trump family’s financial network. The goal? To build a national blockchain infrastructure. The catch? The firm is privately funded, with no public oversight. Critics worry this could turn Pakistan’s crypto strategy into a profit-driven project for foreign investors rather than a public service.

Then there’s the political angle. In April 2025, Zach Witkoff met directly with Pakistan’s army chief and prime minister. These aren’t random meetings. They’re strategic. Some analysts say this is Pakistan trying to build political leverage with a potential future U.S. administration. Others see it as a dangerous dependency - letting a private U.S. company shape the backbone of the country’s financial future.

What’s Next? The Real Test

Pakistan’s crypto adoption isn’t just about numbers. It’s about sustainability. Can this momentum last? Can the government avoid turning crypto into a political tool? Can it keep regulation focused on protecting users, not just attracting foreign capital?Right now, the answer looks promising. Unlike in Venezuela or Argentina, where crypto is used because the system collapsed, Pakistan’s adoption is growing alongside institutional reform. The country isn’t replacing its banking system - it’s patching the holes in it.

By 2030, experts predict over a billion people will own Bitcoin. Pakistan, with its young population, growing digital infrastructure, and clear utility-driven demand, is positioned to be one of the biggest beneficiaries. But only if it stays focused on what got it here: real people needing real solutions.

How Pakistan Compares to Top Crypto Nations

| Country | Chainalysis Rank | Primary Driver | Stablecoin Usage | Regulatory Status |

|---|---|---|---|---|

| India | 1 | Retail investment, exchange trading | Low | Clear tax rules, licensed exchanges |

| United States | 2 | Institutional ETFs, corporate adoption | Moderate | Fragmented state-level rules |

| Pakistan | 3 | Remittances, inflation hedge | Very High | Centralized regulatory authority |

| Indonesia | 4 | Gaming tokens, P2P trading | Medium | Restricted but tolerated |

| Vietnam | 5 | Young users, DeFi gaming | Low | Unclear, evolving |

The table shows Pakistan isn’t just riding the wave - it’s defining a new category: utility-first adoption. While others chase hype, Pakistan built infrastructure around real needs.

Why does Pakistan rank higher than Nigeria in crypto adoption despite Nigeria’s larger population?

Nigeria’s population is bigger, but its crypto adoption has slowed because of government crackdowns on P2P trading and bank restrictions. Pakistan, by contrast, embraced crypto as a solution to inflation and remittance bottlenecks. It didn’t ban users - it regulated platforms. That shift gave people confidence to use crypto daily, not just as a speculative gamble.

Is crypto legal in Pakistan now?

Yes. Since July 2025, crypto is fully legal under the Pakistan Virtual Assets Regulatory Authority. Exchanges must be licensed, users must pass KYC checks, and all transactions are monitored. But owning or trading crypto is not a crime - and banks can no longer block crypto-related payments.

Why are stablecoins so popular in Pakistan?

Because they’re stable. The Pakistani rupee has lost over 40% of its value since 2022. People use USDT and USDC to protect their savings, pay for imports, or receive money from abroad without waiting weeks or paying 10% in fees. Stablecoins act like digital dollars - and in Pakistan, that’s more reliable than local currency.

How many Pakistanis use crypto?

Approximately 20 million people - about 9% of the population. That’s significantly higher than the global average of 6.9%. In cities like Karachi and Lahore, adoption rates exceed 15%. Most users are under 35 and use crypto for remittances, savings, or small business payments.

Could Pakistan’s crypto growth be derailed?

Yes - if politics overrides utility. The partnership with World Liberty Financial and private U.S. interests raises concerns about foreign control over critical financial infrastructure. If regulation becomes more about pleasing foreign investors than serving citizens, trust could erode. But as long as people continue using crypto to survive inflation and send money home, the momentum will hold.

What This Means for the Rest of the World

Pakistan’s story isn’t just about crypto. It’s about what happens when a country listens to its people instead of its regulators. When banks fail, when inflation bites, when remittance fees eat your paycheck - people find a way. Pakistan didn’t invent crypto. But it showed the world how to use it right: not for gambling, not for hype, but for real, everyday survival.Other developing nations are watching. Bangladesh, Egypt, and Kenya are already drafting similar regulatory frameworks. If Pakistan can keep its focus on utility - not politics - it won’t just stay in the top 3. It could become the model for how the rest of the world should adopt digital money.

So I’ve been thinking about this whole Pakistan crypto thing for a while now, and honestly it’s kind of beautiful in a weird way. You know how in the U.S. everyone’s chasing Bitcoin like it’s the next gold rush? Like, ‘Oh I bought 0.002 BTC at $68k and now I’m rich!’ No. Not even close. In Pakistan, people aren’t trying to get rich. They’re trying to not starve. A mom sending money to her daughter studying abroad doesn’t care about Hodl or Lambo. She cares that the $200 she sends doesn’t take a week to get there and doesn’t get eaten up by fees. USDT is just… faster money. And that’s it. No hype. No memes. Just survival. And honestly? That’s the purest form of adoption I’ve ever seen. We overcomplicate everything here. They just use what works. Simple. Clean. Real.