How to Audit Smart Contracts for Security in 2026

Every year, millions of dollars vanish from blockchain projects-not because of hacking by shadowy outsiders, but because of simple mistakes buried in the code. In 2024 alone, over $2.2 billion was stolen from smart contracts that were supposed to be secure. The worst part? Many of these contracts had already been audited. If you're building or investing in a decentralized app, skipping a proper audit isn’t just risky-it’s reckless.

What a Smart Contract Audit Actually Does

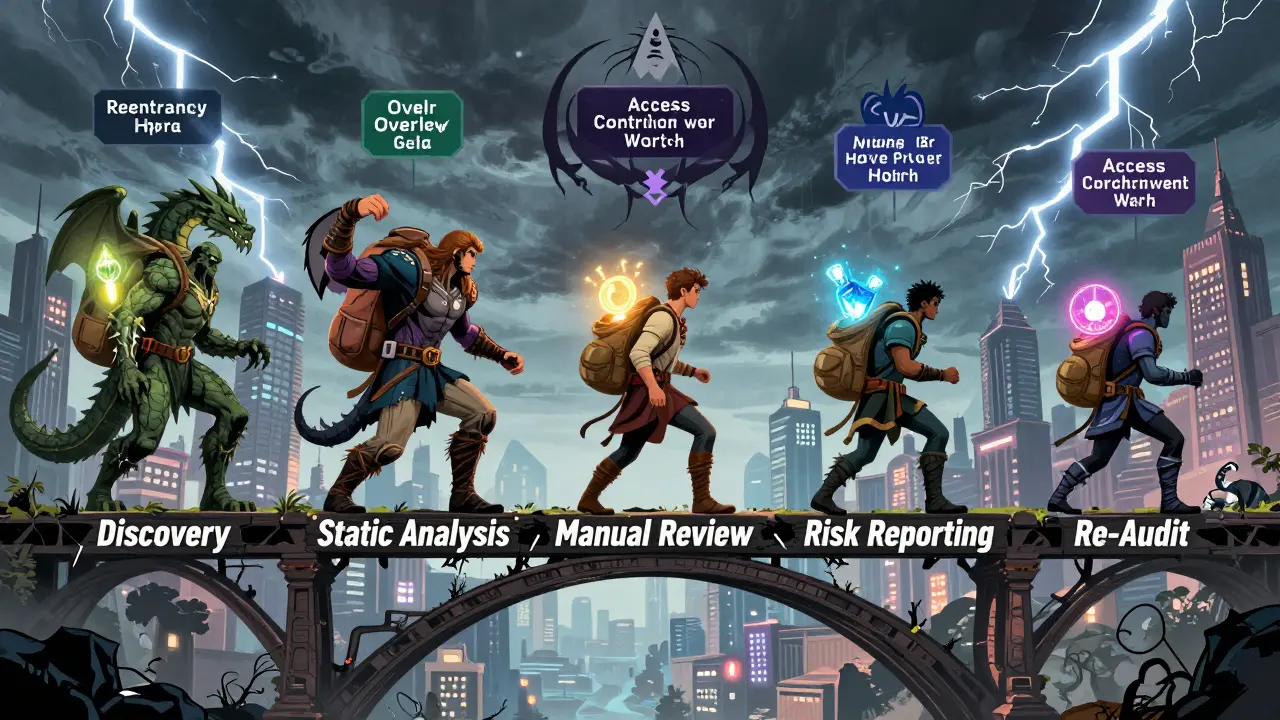

A smart contract audit isn’t just a code review. It’s a full security inspection that finds hidden flaws before they get exploited. Think of it like a structural engineer checking a bridge before cars drive over it. You’re not just looking for broken bolts-you’re testing how the whole system holds up under pressure. Smart contracts run on blockchains like Ethereum, Solana, Sui, and Aptos. They handle money, voting, token sales, loans-anything that needs trust without a middleman. But code doesn’t care about intent. If there’s a logic error, a missing check, or an unchecked call, attackers will find it. Audits catch these before they’re live. The goal? Make sure the contract does exactly what it’s supposed to-and nothing more. That means checking for reentrancy attacks, overflow bugs, access control flaws, and logic traps that even experienced devs miss.The Five-Stage Audit Process

A real audit isn’t a quick scan. It’s a structured process with five clear stages.- Discovery and Scope: Auditors start by reading the project’s whitepaper, architecture diagrams, and code comments. They ask: What’s the business logic? What tokens are involved? What happens if a user withdraws all funds at once? This stage defines what’s in scope and what’s not.

- Static and Formal Analysis: Tools like Slither, MythX, and Move Prover automatically scan the code for known patterns of vulnerability. Slither, for example, caught 92% of common bugs in 2023 tests. Formal verification goes further-it uses math to prove the code behaves correctly under all conditions. This is critical for high-value contracts like Ethereum’s deposit system.

- Manual Review: No tool catches everything. Human auditors read every line of code, tracing how data flows between functions. They look for privilege escalation: can a regular user call a function meant for the owner? Can they drain funds by manipulating inputs? This stage takes weeks for complex DeFi protocols.

- Risk Reporting: Auditors don’t just say “there’s a bug.” They rank each finding by severity: Critical, High, Medium, Low. Each report includes a clear explanation, code examples, and how to fix it. A Critical finding means money can be stolen right now. A Low might be a code style issue.

- Remediation and Re-audit: The team fixes the issues. Then, the auditors come back. A second pass checks if the fixes worked-and didn’t break anything else. This step alone has prevented $100 million in losses in 2023.

Most projects freeze their code before this process starts. No new features. No last-minute changes. If you’re still coding while the audit is happening, you’re inviting disaster.

Tools of the Trade

You can’t audit smart contracts with Notepad. You need the right tools.- Slither: Open-source static analyzer for Solidity. Fast, free, and great for catching common issues like unchecked external calls.

- MythX: Cloud-based platform that combines static and dynamic analysis. Used by enterprises for deep vulnerability hunting.

- Move Prover: For Aptos and Sui. It’s the only tool that can formally verify Move code-essential if you’re building on those chains.

- Hardhat & Truffle: Development frameworks with built-in testing tools. They help simulate transactions and edge cases before the audit even starts.

- Diligence Fuzzing: Automatically generates thousands of random inputs to crash or trick the contract. Finds bugs no human would think to test.

But here’s the catch: tools only work if you know how to use them. Many teams install Slither, run it once, and think they’re done. That’s like installing antivirus software and never updating it. You need experts who understand what the results mean-and what they don’t.

Who Should You Hire?

Not all audit firms are equal. Some specialize in Ethereum. Others in Move. Pick the wrong one, and you’re wasting money.- OpenZeppelin: The gold standard for Ethereum and ERC standards. If you’re building a token or DeFi protocol on Ethereum, they’re your go-to.

- Trail of Bits: For complex systems. They’ve audited critical infrastructure like the Ethereum 2.0 deposit contract. Their strength is formal verification and advanced attack modeling.

- Sigma Prime: Focused on consensus layers and validator clients. If your project touches Ethereum’s core, they’re the only choice.

- Move-specific auditors: If you’re on Sui or Aptos, make sure your auditor has proven experience with Move Prover and MoveFuzz. Most general Web3 firms don’t have this skill.

Ask for case studies. Check their GitHub. Did they audit a project similar to yours? Look at the public reports they’ve published. A good firm doesn’t hide their findings-they share them to help the whole ecosystem.

Why Even Audited Contracts Get Hacked

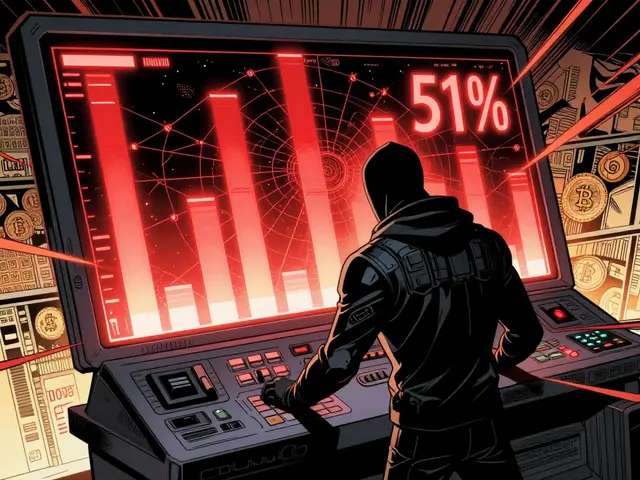

This is the uncomfortable truth: most major hacks in 2024 happened on contracts that had been audited. Why?- Multi-protocol complexity: A contract might be safe on its own, but when it interacts with another DeFi protocol, unexpected behaviors emerge. Audits rarely test cross-protocol flows.

- New attack patterns: Attackers don’t use old tricks. They find new ways to exploit gas optimization, oracle manipulation, or governance vote timing.

- Fast-moving code: Projects update constantly. A patch might fix one bug but introduce another. Audits are snapshots, not live shields.

- Overreliance on tools: Teams assume automated scans catch everything. They don’t. Slither missed 8% of bugs in 2023-and that 8% was enough to steal $1.2 billion.

The solution? Don’t stop at one audit. Combine it with real-time monitoring and bug bounties.

Monitoring and Bug Bounties: The Missing Layers

An audit is a starting point, not an endpoint. Real-time monitoring tools now watch your contract 24/7. If someone tries to drain funds, the system alerts you instantly-and can even pause the contract automatically. Platforms like CertiK and PeckShield offer these services. In 2023, they prevented $100 million in losses. Bug bounty programs are equally powerful. Immunefi paid out $65 million to ethical hackers in 2023 for finding critical flaws. Offering a $50,000 reward for a bug is cheaper than losing $5 million. And it turns the community into your security team.How Much Does It Cost?

A basic audit for a simple token might cost $15,000. A full DeFi protocol with multiple integrations? $50,000 to $200,000. That sounds steep-but compare it to losing millions. The cheapest audits are the ones you skip. The most expensive are the ones you regret after the fact.What to Do Next

If you’re building a smart contract:- Don’t deploy without an audit.

- Choose an auditor with proven experience in your chain (Ethereum, Sui, etc.).

- Require a multi-stage audit with re-verification.

- Set up real-time monitoring from day one.

- Launch a bug bounty on Immunefi or similar.

If you’re investing in a DeFi project:

- Check if they’ve published a public audit report.

- Verify the auditor’s name and reputation.

- Look for signs of ongoing monitoring or a bounty program.

- Avoid projects that say “audited” but show no report.

Security isn’t a checkbox. It’s a habit. And in blockchain, habits save money.

What’s the most common mistake in smart contract audits?

The biggest mistake is treating an audit as a one-time event. Many teams get a report, fix the obvious bugs, and never look again. But code changes, integrations evolve, and new attacks emerge. Without ongoing monitoring or re-audits after updates, even a clean audit becomes outdated within weeks.

Can automated tools fully replace human auditors?

No. Tools like Slither and MythX are excellent at catching known patterns-like reentrancy or overflow bugs. But they can’t understand business logic. For example, if a contract is supposed to only allow withdrawals after 30 days, but the code lets anyone withdraw at any time, a tool might not flag that. Only a human can spot that kind of logic flaw.

Are audits worth it for small projects?

Yes-even more so. Small projects are often targeted because they’re seen as easier to exploit. A $20,000 audit might be all you can afford, but it’s far cheaper than losing $200,000. Start with a focused audit on your core functions, add monitoring, and launch a small bug bounty. You don’t need a Fortune 500-level audit to be secure.

What’s the difference between auditing Solidity and Move contracts?

Solidity (used on Ethereum) is flexible but error-prone. Move (used on Sui and Aptos) is designed to be safer-no reentrancy, strict resource ownership. But Move’s safety comes with complexity. Auditing Move requires tools like Move Prover and deep knowledge of its type system. Not all auditors can do it. Always confirm your auditor has proven Move experience.

How long does a smart contract audit take?

It depends on complexity. A simple token audit takes 1-2 weeks. A full DeFi protocol with lending, staking, and governance can take 4-8 weeks. Rushing an audit leads to missed flaws. The best projects plan for audit time before they even start coding.

What should I look for in an audit report?

A good report lists findings by severity (Critical, High, etc.), includes code snippets showing the bug, explains how to fix it, and gives a summary of what was tested. Avoid reports that just say “no critical issues found” without details. Transparency is a sign of a trustworthy auditor.

Can I audit my own smart contract?

You can run automated tools and test your code, but self-auditing is risky. You’re too close to the project. You’ll miss blind spots. Even the best developers make mistakes. A fresh pair of expert eyes is worth the cost. Think of it like a surgeon not operating on themselves.

Is blockchain security getting better?

Yes, but not fast enough. Tools are smarter, formal verification is more accessible, and bug bounties are widespread. But the pace of innovation in DeFi still outstrips security development. Attackers adapt faster than most teams can audit. The key is layered defense: audit + monitoring + bounties + code freezes.

Smart contract audits are non-negotiable. Period. I've seen too many startups lose everything because they thought 'it works on my machine' was enough. Tools like Slither and MythX are great, but they're not magic. Human expertise is irreplaceable. Always go with auditors who have published reports - transparency builds trust. And please, for the love of blockchain, don't skip the re-audit.

Also, bug bounties? Absolutely essential. Immunefi has saved more projects than most people realize. A $50k reward is pocket change compared to a $5M hack.

Security isn't a one-time cost - it's an ongoing practice. Treat it like brushing your teeth.

Bro. I just launched my token and skipped the audit to save $20k. Big mistake. Lost $180k in 3 days. 😭

DO THE AUDIT. Even if you're small. Even if you're 'just testing.' You think no one will target you? Nah. They target the weak ones first. I'm now on a bug bounty and have a monitor running 24/7. Worth every penny.

Love this breakdown. Seriously. So many people think audits are just a checkbox, but it's like getting your car inspected before a cross-country road trip. You don’t just check the tires - you test the brakes, the alignment, the fluids. Same thing here.

Also, shoutout to Move Prover. If you're on Sui or Aptos and your auditor hasn't used it, run. Don’t walk. The safety model is fundamentally different from Solidity, and treating them the same is like using a hammer to screw in a lightbulb.

One thing nobody talks about: audit fatigue. Teams get a clean report, fix the high-sev bugs, then go back to coding like nothing happened. But the moment you add a new function, you’re back to square one. That’s why I insist on monthly regression checks for any active protocol. Even if it’s just a quick Slither scan and a sanity check with the auditor.

Also, if your audit report doesn’t include test cases or simulation results, it’s not an audit - it’s a glorified code review. Demand more.

Ohhh so now we’re paying $200k to ‘audit’ code that’s basically just a glorified if-statement? 🤡

Let’s be real - most of these audits are just PR exercises. The same 5 firms get paid to say ‘no critical issues’ while the real vulnerabilities - like oracle manipulation or front-running - get glossed over because they’re ‘too hard to test.’

And don’t even get me started on ‘re-audits.’ That’s just a way for auditors to make more money. The real solution? Open-source everything and let the community tear it apart. Not some $100k consultancy.

As someone who’s audited over 40 Move contracts, I can tell you - most teams don’t even know what resource typing means. Move’s safety model is brilliant, but it’s not foolproof. I’ve seen contracts with perfect resource ownership that still had reentrancy-like patterns through event triggers.

Also, Move Prover isn’t just a tool - it’s a mindset. You need to write code that’s provable, not just ‘works.’ That means avoiding dynamic dispatch, limiting external calls, and structuring logic around ownership. Most devs aren’t trained for this.

And yes, auditors who only know Solidity are useless here. Don’t waste your time.

Yo. If you're building on Ethereum and your auditor hasn't audited a Uniswap-like pool before, you're gambling. Same with Sui - if they haven't used MoveFuzz, they're guessing.

Don't just pick the biggest name. Look at their GitHub. Did they publish a report on a project that does what you're doing? If not, move on. I've seen teams hire Trail of Bits for a simple token swap and pay $150k for overkill.

Match the auditor to the use case. Simple = OpenZeppelin. Complex DeFi = Trail of Bits. Move = specialists. No exceptions.

Let me just say this - the whole idea that audits prevent hacks is a myth. The 2024 $2.2B loss? 87% of those contracts had been audited. The problem isn’t the lack of auditing - it’s the illusion of security. Audits are snapshots. They don’t account for future code changes, new oracle feeds, or unexpected interactions with other protocols. You can’t audit the future.

And yet, everyone treats it like a silver bullet. We need a paradigm shift: from ‘audit and deploy’ to ‘audit, monitor, and adapt.’ Real-time on-chain monitoring with automated kill switches is the only way forward. Audits are just the first step - not the finish line.

Also, why do we still have gas optimization bugs? People are still writing code that relies on block.timestamp and assumes miners won’t manipulate it. That’s not a bug - that’s negligence.

Just want to say thank you for this post. I’m a solo dev working on a small NFT project and I was scared to even ask about audits because of the cost. But reading this made me realize - spending $15k now is better than losing everything later. I’m booking an audit this week and setting up a $10k bounty. Small steps, but I’m finally doing it right.

You’re not alone. We all start somewhere.

Let me tell you about the time I hired a ‘top-tier’ audit firm. They gave me a 120-page report with 3 Critical issues. I fixed them. Then they sent me a bill for $80k. Two weeks later, my contract got drained by a reentrancy bug they missed because it was in a library I didn’t think was part of the scope. Turns out, they didn’t even check the imported dependencies.

So now I do my own static analysis, run fuzzing on every commit, and pay a bounty. And I never trust an auditor who doesn’t show me their test scripts. You think you’re buying security - you’re buying a receipt.

Every single ‘audit’ is a confidence trick. The firms have a vested interest in saying ‘no critical issues’ so they get paid again next time. They don’t want to scare clients away. The reports are written in corporate-speak so no one actually understands what’s wrong.

And the worst part? They’ll tell you ‘we tested everything’ - but they didn’t test what happens when the admin key gets compromised. Or when a governor votes with 0.0001 ETH. Or when the oracle feeds go offline.

Stop pretending audits are security. They’re insurance policies for the auditors. Not the devs. Not the users.

Just want to add - when evaluating auditors, look at their public GitHub activity. Do they contribute to Slither? Do they write blog posts explaining their findings? Do they respond to issues on audit reports? That’s the real signal.

One firm I worked with had zero public code, no blog, and a report that just said ‘no critical issues.’ Turns out, they used a script to auto-generate reports. I found their template online. Same wording as three other projects from last month.

Don’t just check their website. Dig deeper.

USA is the only country that takes blockchain security seriously. Everyone else is just playing around. India? They think ‘code review’ means asking a friend to glance at it. China? They don’t even publish audits. Europe? Too busy regulating to actually secure anything.

Meanwhile, here in the States, we’ve got OpenZeppelin, Trail of Bits, CertiK - real pros. If you’re not using an American auditor, you’re asking for trouble. This isn’t about nationalism - it’s about competence. And we’ve got it.

I cried when I saw how much an audit costs. Then I remembered my friend lost $300k because they skipped it. Now I’m saving every penny I can. I’m not rich, but I’m smart. I’d rather eat ramen for a month than lose everything.

This post gave me hope. Like, maybe I can do this. Maybe I don’t have to be a hacker to stay safe. Maybe I just need to be careful. Thank you. Really.

Okay, so let me get this straight - we’re spending hundreds of thousands of dollars to audit code that’s written by people who don’t even know what a nonce is? And we’re surprised when it gets hacked? This isn’t security - it’s performance art.

Why aren’t we teaching secure coding in bootcamps? Why are we letting people deploy contracts after a 2-week ‘course’? Why are we rewarding speed over safety?

And don’t even get me started on the ‘we’re just a small project’ excuse. The biggest hacks came from ‘small’ projects. Because they were easy. Because no one thought they mattered.

WE’RE ALL IN THIS TOGETHER. AND WE’RE FAILING.

Agreed on the layered defense - audit + monitoring + bounty. But let’s be real: most teams can’t afford all three. So prioritize. If you’re doing a token launch? Audit + bounty. If you’re doing a lending protocol? Audit + monitoring + bounty. If you’re doing both? You better have VC funding.

Also, don’t ignore the dev team’s skill level. If your lead dev doesn’t know what a reentrancy guard is, no audit will save you. Invest in training. Hire a security engineer. Even part-time.

Security isn’t a vendor. It’s a culture.

Just want to say - if you're reading this and you're about to deploy without an audit, STOP. Take a breath. Go make coffee. Think about your users. Think about your reputation. Think about your sleep.

This isn't just code. It's money. Real people's money. You wouldn't sell a car with a broken brake line. Don't deploy a contract with a broken logic gate.

Do the audit. You'll thank yourself later.