Pakistan Crypto Regulation Transformation: 2025 Pivot to Legalization

Pakistan’s crypto ban is officially over - but what does legalization really mean?

In 2018, the State Bank of Pakistan shut the door on cryptocurrency. Banks were told not to touch Bitcoin, Ethereum, or any digital asset. For years, Pakistanis who held crypto did so in the shadows - using peer-to-peer platforms, foreign exchanges, and informal networks. The market grew anyway. By 2025, an estimated $21 billion in crypto was circulating in Pakistan, mostly through remittances and informal trading. No one was taxed. No one was regulated. And no one was safe from fraud or seizure.

Then, on September 3, 2025, everything changed.

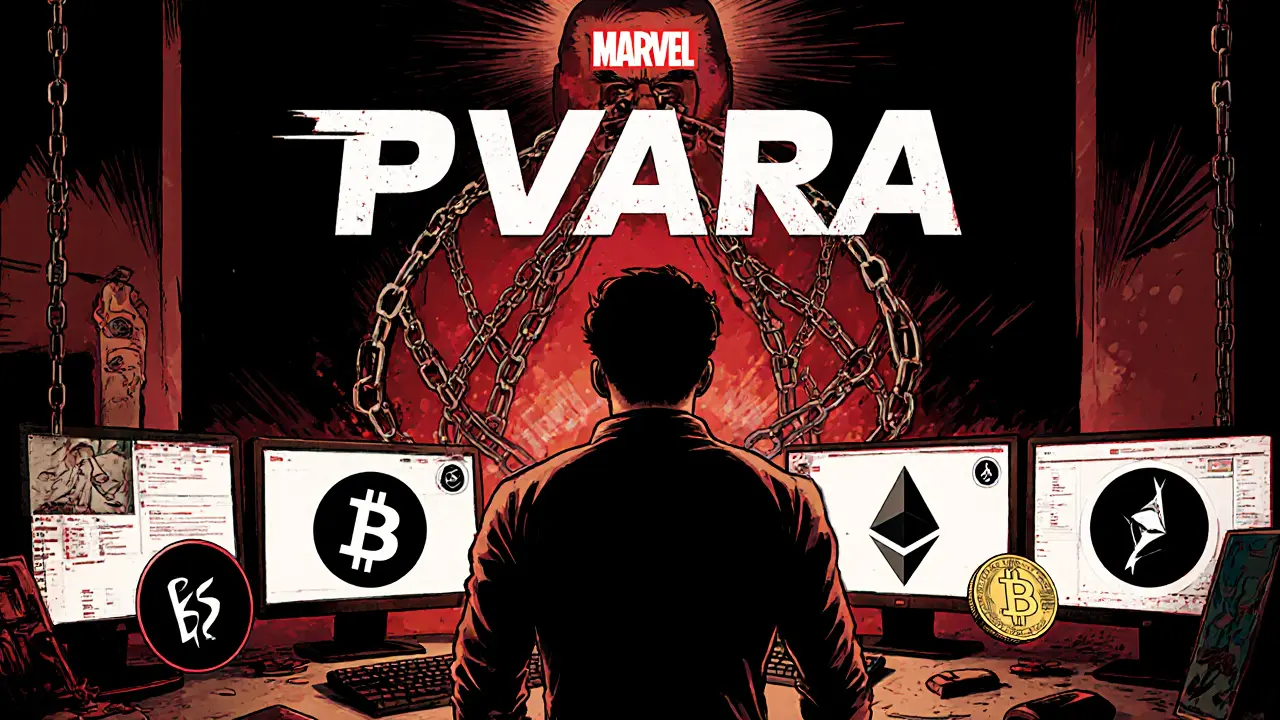

The government didn’t just lift the ban. It rewrote the rules. The Virtual Assets Bill 2025 is now law, signed by President Asif Ali Zardari. It created the Pakistan Virtual Asset Regulatory Authority (PVARA) - a new agency with full power to license, monitor, and punish crypto businesses. For the first time, holding and transferring crypto is legal. But here’s the catch: you still can’t use it to buy groceries, pay rent, or trade altcoins on open exchanges.

What’s actually allowed now?

The law doesn’t say "crypto is legal" - it says "crypto is controlled." Here’s what you can and can’t do under the new rules:

- You can hold Bitcoin, Ethereum, or any other cryptocurrency in your wallet. No more fear of bank account freezes.

- You can transfer crypto between personal wallets or to approved VASPs (Virtual Asset Service Providers). Remittances from overseas workers are now a legal use case.

- You cannot use crypto for payments at stores, restaurants, or online retailers. No one can accept Bitcoin as payment - not even if both parties agree.

- You cannot trade altcoins on open platforms. Only licensed VASPs can offer trading, and only for a short list of approved tokens (mostly Bitcoin and Ethereum).

- You cannot mine crypto at scale. Small-scale personal mining isn’t banned, but no commercial mining farms are allowed without PVARA approval - and none have been granted yet.

The only crypto you can use freely as money is the Digital Pakistani Rupee (Digital PKR) - a state-controlled CBDC launched alongside the new law. This isn’t Bitcoin. It’s not decentralized. It’s digital cash issued by the State Bank of Pakistan, tracked by the government, and designed to replace cash, not compete with crypto.

Why did Pakistan change its mind?

The 2018 ban didn’t stop crypto. It just made it riskier. Millions of Pakistanis kept using it - especially for remittances. In 2024 alone, Pakistan received over $30 billion in remittances. A significant portion of that money moved through crypto channels because it was faster and cheaper than traditional wire services like Western Union or MoneyGram.

By 2025, the government realized two things:

- They were losing tax revenue. No one was reporting crypto gains or transfers.

- They were losing control. Underground crypto networks were growing faster than regulators could track.

The solution? Bring it into the light - but keep it on a leash. The new framework isn’t about freedom. It’s about oversight. PVARA now requires every crypto exchange, wallet provider, or payment processor to register, verify users, report transactions over $1,000, and follow strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) rules. Failure means fines, license revocation, or jail.

Experts call this model "state-controlled crypto." It’s not like El Salvador, where Bitcoin is legal tender. It’s not like the U.S., where you can buy crypto on Coinbase and trade Dogecoin on Robinhood. It’s closer to China’s approach: allow holding, ban trading, and push your own digital currency.

How does this compare to other countries?

Pakistan’s path is unique in South Asia:

| Country | Legal to Hold? | Legal to Trade? | Legal to Pay With? | State CBDC? |

|---|---|---|---|---|

| Pakistan | Yes | Restricted (only licensed VASPs) | No | Yes (Digital PKR) |

| India | Yes | Yes (30% tax on gains) | No | Under development |

| UAE | Yes | Yes (free zones) | Yes (in some cases) | Not yet |

| India | Yes | Yes (30% tax on gains) | No | Under development |

| El Salvador | Yes | Yes | Yes (Bitcoin legal tender) | No |

Pakistan chose a middle path - not as open as the UAE, not as restrictive as China. But it’s also not as flexible as India, where crypto trading is taxed but allowed. The goal isn’t innovation. It’s control. The government wants to know who owns what, where money flows, and how much tax it can collect.

Who benefits? Who loses?

Some groups are celebrating. Crypto holders who were scared to cash out now feel safe. Remittance companies are rushing to partner with licensed VASPs to cut costs and speed up transfers. Foreign investors are watching closely - regulatory clarity is rare in emerging markets.

But many are frustrated.

Young tech entrepreneurs wanted to build crypto apps, DeFi platforms, and NFT marketplaces. Now they’re stuck. No open trading means no liquidity. No payments mean no real-world use. Without those, innovation dies.

"We were told this was a breakthrough," said Ali Raza, a Lahore-based blockchain developer. "But if I can’t build an app that lets someone pay for a ride with Bitcoin, what’s the point? This isn’t adoption. It’s containment."

Small traders who used crypto to hedge against inflation are also disappointed. The Digital PKR doesn’t protect against currency devaluation - it’s pegged to the Pakistani rupee. If the rupee falls, so does the digital version.

What’s next? The road to 2026

PVARA is still hiring. The agency needs experts in blockchain, cybersecurity, and financial compliance - but there’s a shortage in Pakistan. Training programs are being rolled out with help from the IMF and World Bank.

The Digital PKR pilot is set to launch in late 2025, starting with government employees and remittance recipients. If it works, it could replace cash in urban areas by 2027.

Will Pakistan ever allow open crypto trading? Probably not soon. The State Bank fears losing control over monetary policy. The Finance Ministry worries about capital flight. And the military - which has deep influence over economic policy - doesn’t trust decentralized systems.

But the door is cracked open. In five years, if the Digital PKR succeeds and PVARA proves it can manage risk, the rules might loosen. For now, Pakistan’s crypto future is not about freedom. It’s about function. And it’s being shaped by bureaucrats, not developers.

What does this mean for you?

If you’re a Pakistani crypto holder:

- You’re no longer breaking the law. Keep your coins. No need to panic-sell.

- Use licensed VASPs only. Unregulated exchanges are still risky.

- Don’t expect to pay with crypto anywhere. It’s still not money.

- Watch the Digital PKR. It’s the real story - not Bitcoin.

If you’re an investor or tech builder:

- Don’t come to Pakistan looking for a crypto hub. It’s not happening yet.

- Look at remittance tech. That’s where the opportunity is.

- Build tools that work with PVARA’s rules, not against them.

The transformation is real. But it’s not the revolution some hoped for. It’s a quiet, controlled shift - one that puts the state in charge, not the market.

Is it legal to hold Bitcoin in Pakistan now?

Yes. As of September 2025, holding Bitcoin, Ethereum, and other cryptocurrencies is legal under the Virtual Assets Bill 2025. You can store them in personal wallets without fear of legal action or bank account freezes. However, you cannot use them for payments or trade them on unlicensed platforms.

Can I use crypto to pay for goods or services in Pakistan?

No. The law explicitly bans using cryptocurrencies like Bitcoin or Ethereum for retail payments, even if both parties agree. This includes online stores, restaurants, and service providers. The only digital currency you can use as payment is the state-controlled Digital Pakistani Rupee.

What is PVARA and why does it matter?

PVARA stands for Pakistan Virtual Asset Regulatory Authority. It’s the new government agency created in 2025 to license, monitor, and enforce rules for all crypto-related businesses - exchanges, wallets, and service providers. All crypto businesses must apply for a PVARA license or face fines and shutdowns. It’s the central enforcer of the new legal framework.

Is crypto mining allowed in Pakistan?

Small-scale personal mining isn’t banned, but commercial mining operations are effectively prohibited. No mining farms have been granted licenses by PVARA, and the government has not approved any large-scale energy use for crypto mining. The focus remains on controlling digital assets, not enabling energy-intensive mining.

Will Pakistan ever allow open crypto trading like the U.S. or UAE?

Unlikely in the near future. The State Bank of Pakistan and Finance Ministry prioritize control over innovation. Open trading could lead to capital flight, market volatility, and loss of monetary control - all risks the government is unwilling to take. Any expansion of crypto access will be slow, limited, and tightly monitored.

How does the Digital Pakistani Rupee differ from Bitcoin?

The Digital Pakistani Rupee (Digital PKR) is a Central Bank Digital Currency (CBDC) issued and fully controlled by the State Bank of Pakistan. Unlike Bitcoin, which is decentralized and operates on a public blockchain, the Digital PKR is centralized, trackable by the government, and tied to the value of the Pakistani rupee. It’s designed to replace cash, not compete with crypto.

Can I send crypto to family overseas now?

Yes - and this is one of the main reasons the law was passed. Sending crypto for remittances is now a legal and regulated activity. Licensed VASPs are working with international partners to offer faster, cheaper cross-border transfers than traditional services. This could save Pakistani families billions in fees annually.

Are there taxes on crypto in Pakistan now?

As of October 2025, there is no official tax law for crypto gains. However, PVARA requires all transactions over $1,000 to be reported, and the Federal Board of Revenue is expected to introduce a tax framework in early 2026. Crypto holders should prepare for potential capital gains tax, likely modeled after India’s 30% rate.

lol so now we can hold crypto but not use it? 🤡

This is actually a smart move. Pakistan was losing billions in remittances to shady P2P apps. Now they can track it, tax it, and make it safer. No more crypto scams wiping out grandma’s savings. 👊

As someone from India, this feels familiar. We have 30% tax on crypto gains but can trade freely. Pakistan’s approach is more like China - control the narrative, not the market. The real win is remittances. If they can cut Western Union fees by 70%, that’s a win for 20 million families. But no altcoin trading? That’s a death sentence for devs. 🤷♂️

I knew it. This is a CIA plot. PVARA is just a front for the NSA to track every Pakistani’s wallet. They’ll use this to freeze accounts during protests. Mark my words - next thing you know, your Bitcoin will be seized for "suspected terrorism financing". 😏

Control is the only true freedom. The market is a lie. The state knows better. This isn’t regulation - it’s wisdom.

So let me get this straight - you can hold Bitcoin but not trade it? You can send it overseas but not buy a chai with it? That’s not legalization, that’s psychological torture. If you’re going to ban use cases, just ban the whole thing. Half-measures are for cowards.

The regulatory framework appears to prioritize financial stability and anti-money laundering objectives over speculative market participation. This is consistent with emerging market CBDC adoption trajectories observed in Nigeria and Brazil. The exclusion of altcoins and retail payment use cases suggests a deliberate strategy to contain systemic risk. A nuanced, albeit restrictive, approach.

Honestly? This is the best possible outcome for most people. No more fear. No more black market. Just a slow, safe path forward. The Digital PKR might be boring, but it’s real. And real beats risky every time.

You people are delusional. This isn’t "progress." It’s authoritarianism disguised as regulation. The U.S. lets you buy Dogecoin on your phone. The UAE lets you pay for Lambos with ETH. But Pakistan? No. They want you to sit quietly while they print digital rupees and track your every move. This isn’t a country - it’s a surveillance state with WiFi. And you’re cheering?

As a Nigerian, I see parallels. Our CBDC, eNaira, was launched with similar promises - faster remittances, lower fees. But adoption stalled because people didn’t trust the government to manage it. The real test isn’t the law - it’s whether ordinary people believe PVARA won’t abuse its power. Trust, not technology, is the missing ingredient.

If you can’t use crypto to pay for food then its just digital glitter. The state wins again. No one wins

I’m so hyped for this! 🚀 Imagine sending crypto to your cousin in Karachi without paying $50 in fees. That’s life-changing. Yeah they’re limiting trading but who cares? Remittances are the real MVP. Let the devs figure out the rest later. 💪

I get why people are mad about the restrictions. But let’s be real - if they’d opened the floodgates, it would’ve been chaos. Scammers, pump-and-dumps, bank runs. This is like putting training wheels on a motorcycle. It’s not freedom, but it’s not a crash either. Maybe in 5 years, when PVARA learns how to breathe, they’ll loosen up. Patience.

Honestly, I’m shocked anyone thought this would be revolutionary. You’re telling me a country with 25% inflation is going to let people trade crypto freely? Please. This is a PR stunt to impress the IMF. The real innovation here is the Digital PKR - and even that’s just a rebranded rupee with blockchain glitter. The only people winning are the bureaucrats who got new titles and offices.

Pakistan is not America. We don’t need crypto. We need food, water, and electricity. This law is just another waste of time by elites who don’t understand real problems. If you want to hold Bitcoin, go to Dubai. Here, we have real struggles.