What Are Cross-Chain Bridges in Crypto? A Simple Breakdown

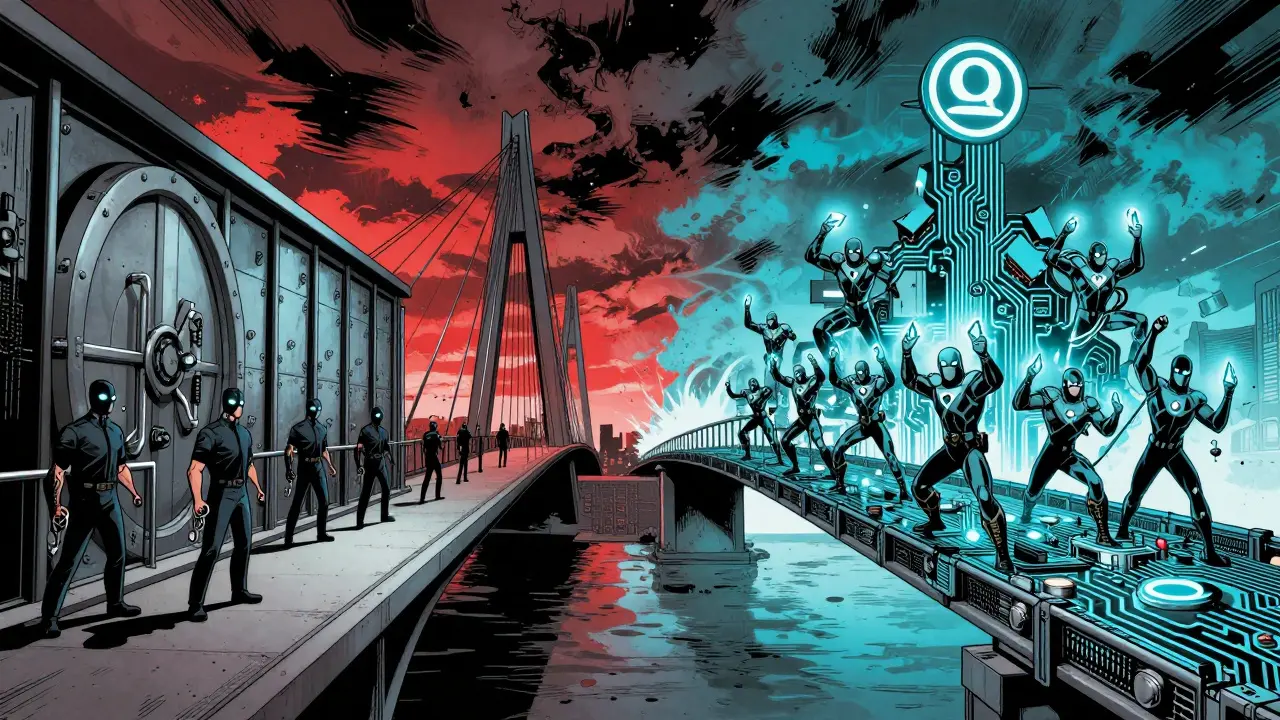

Imagine you have Bitcoin on the Bitcoin network, but you want to use it to earn interest on a DeFi app running on Ethereum. You can’t just send it directly - Bitcoin and Ethereum speak different languages. That’s where cross-chain bridges come in. They’re the invisible connectors that let your crypto move between blockchains without needing a centralized exchange. Think of them like international border crossings for digital money - same value, different country.

Why Do We Need Cross-Chain Bridges?

Not all blockchains were built to talk to each other. Bitcoin uses Proof of Work. Ethereum uses Proof of Stake. Solana has its own consensus engine. Each has its own rules, speed, fees, and security model. This creates fragmentation. Your assets get stuck. You can’t use your Ethereum-based NFT on Avalanche. You can’t lend your Solana tokens on a Curve pool built for Ethereum. Cross-chain bridges fix that.Before bridges, moving crypto between chains meant selling on one exchange, then buying again on another. That’s slow, expensive, and risky. You’re trusting a middleman. Bridges cut out the middleman. They let you lock your asset on one chain and get an equivalent version on another - all in minutes, not days.

How Do Cross-Chain Bridges Work?

At their core, bridges use smart contracts to lock and mint tokens. Here’s how it works step by step:- You send 1 BTC to a bridge’s smart contract on the Bitcoin network.

- The bridge locks that BTC and confirms the transaction across multiple nodes.

- On the Ethereum network, the bridge mints 1 Wrapped Bitcoin (WBTC) - a token that represents your BTC on Ethereum.

- You now have WBTC. You can use it in DeFi apps, stake it, trade it - just like any other ERC-20 token.

- When you want your original BTC back, you burn the WBTC. The bridge unlocks your original BTC and sends it to your Bitcoin wallet.

This system keeps the total supply balanced. No extra BTC is created. No double-spending. The bridge just moves ownership from one chain to another using smart contracts as the middleman.

Trusted vs. Trustless Bridges

Not all bridges are created equal. There are two main types:- Trusted bridges rely on a small group of operators - often a company or consortium - to verify transactions. They’re faster and cheaper, but you’re trusting those operators not to steal or freeze your funds. Examples include the original WBTC bridge, which is managed by a group of custodians.

- Trustless bridges use decentralized verification, often through threshold signatures or zero-knowledge proofs. No single entity controls the funds. If one node fails, the system keeps running. Wormhole and LayerZero are examples of trustless bridges.

Trustless is safer, but often slower and more complex. Trusted is easier to use, but you’re taking on counterparty risk. For small transfers, trusted bridges are fine. For large amounts, trustless is the better choice.

Real-World Examples You Can Use Today

You don’t need to be a developer to use a bridge. Here are some real ones you’ve probably heard of:- Wormhole connects Ethereum, Solana, Polygon, Avalanche, and over 20 other chains. It’s used by DeFi apps like Jupiter and Radiant to move liquidity between networks.

- Polkadot isn’t just a bridge - it’s a whole ecosystem designed for interoperability. Its parachains can talk to each other natively, and it connects to external chains via bridges.

- Cosmos uses the Inter-Blockchain Communication (IBC) protocol to let chains like Osmosis and Terra (before its collapse) exchange assets securely.

- Arbitrum and Optimism aren’t bridges to other chains, but they’re rollups built on Ethereum. You still need a bridge to move assets from Ethereum to them - and back.

Even popular tokens like USDC use bridges. You can send USDC from Ethereum to Binance Smart Chain, Polygon, or Solana - all with a single click on platforms like MetaMask or Coinbase Wallet.

What Can You Transfer Through a Bridge?

You’re not limited to just tokens. Cross-chain bridges can move:- Stablecoins (USDC, DAI, USDT)

- Native tokens (ETH, SOL, AVAX)

- Wrapped assets (WBTC, wETH)

- NFTs (some bridges support NFT transfers, like across Ethereum and Polygon)

- Smart contract data (for cross-chain DeFi strategies)

This means you can take an NFT you bought on Ethereum and sell it on a marketplace on Solana. Or borrow against your ETH on Aave, then repay the loan using income earned on a DeFi yield farm on Arbitrum.

Why This Matters for You

Cross-chain bridges aren’t just techy buzzwords. They change how you interact with crypto:- You can chase the best yields - move your USDC to the chain with the highest APY.

- You can avoid high gas fees - send ETH to Polygon to swap tokens for pennies instead of dollars.

- You can access exclusive apps - some DeFi protocols only exist on Avalanche or Base, and bridges let you join.

- You can diversify risk - don’t keep all your assets on one chain. Spread them out.

Before bridges, you had to choose one ecosystem. Now, you can use the best parts of all of them.

Risks and Things to Watch Out For

Bridges aren’t risk-free. In 2022, the Ronin Bridge was hacked for $625 million. In 2024, a flaw in a popular bridge allowed attackers to mint unlimited tokens on a new chain. Here’s what you need to know:- Smart contract bugs - if the code has a flaw, your money can vanish.

- Centralized control - if a trusted bridge operator goes rogue or gets hacked, you’re out of luck.

- Delay risks - some bridges take hours to confirm, especially during high traffic.

- Reputation matters - stick to bridges with open-source code, audits from firms like CertiK or Trail of Bits, and large TVL (Total Value Locked).

Never bridge more than you’re willing to lose. Use bridges with a proven track record. Check the bridge’s website for audit reports. If they don’t publish them, walk away.

The Future of Cross-Chain Bridges

The next wave isn’t just about moving tokens. It’s about moving logic. Imagine a single DeFi strategy that borrows on Ethereum, trades on Solana, and stakes on Avalanche - all in one transaction. That’s the goal of cross-chain messaging protocols like LayerZero and Chainlink CCIP.Some projects are even building bridges that don’t need wrapped tokens. Instead, they verify asset ownership directly across chains using cryptographic proofs. This could make bridges faster, cheaper, and more secure.

As more chains launch and more users join, bridges will become as essential as internet routers. You won’t think about them - you’ll just expect your crypto to work everywhere.

Final Thoughts

Cross-chain bridges are the unsung heroes of Web3. They turn a fragmented, isolated crypto world into one connected ecosystem. They give you freedom - to move, to earn, to choose. But they also demand caution. Know what you’re using. Check the audits. Start small. And remember: you’re not sending crypto from one chain to another. You’re moving ownership - and that’s powerful.Are cross-chain bridges safe?

Some are, some aren’t. Trusted bridges carry counterparty risk - if the operator is hacked or dishonest, your funds are at risk. Trustless bridges are safer because they’re decentralized, but they can still have smart contract bugs. Always check for audits, use well-known bridges like Wormhole or Polygon’s bridge, and never move more than you can afford to lose.

Do I need to pay fees to use a cross-chain bridge?

Yes. You pay gas fees on both the source and destination chains. Some bridges also charge a small service fee - usually under 0.1% to 0.5%. For example, sending ETH from Ethereum to Arbitrum might cost $3 in Ethereum gas and $0.10 in Arbitrum gas, plus a $0.25 bridge fee. It’s still far cheaper than selling and rebuying on an exchange.

What’s the difference between a bridge and a wrapped token?

A wrapped token (like WBTC) is the result of using a bridge. The bridge is the system that locks your original asset and issues the wrapped version. So WBTC is the token you get on Ethereum - the bridge is the process that created it. All wrapped tokens come from bridges, but not all bridges use wrapped tokens - some use native asset verification instead.

Can I send NFTs across chains with a bridge?

Yes, but not all bridges support it. NFT transfers are trickier because they’re unique. Bridges like Across and LayerZero now support NFTs between Ethereum, Polygon, and BSC. Always check if the bridge you’re using explicitly supports NFTs before attempting a transfer.

What happens if a bridge shuts down?

If a trusted bridge shuts down, you may lose access to your wrapped assets unless the team provides a withdrawal mechanism. Trustless bridges are more resilient - because they’re decentralized, they’re harder to shut down. Still, if the underlying smart contracts are abandoned, you might not be able to withdraw. Always prefer bridges with active development teams and community backing.

This is basic crypto 101. If you don't understand bridges, you shouldn't be touching DeFi. 🤦♂️

Bridges are the reason crypto feels like a wild west carnival where everyone's selling snake oil and you're the sucker holding the bag

I just lost $8k on a bridge last year 😭 I swear I read the docs... I swear I did...

This is all part of the fed crypto agenda to destroy national sovereignty and replace it with blockchain oligarchy

I just started learning about this and honestly it feels like magic. Like I'm handing my digital treasure to a wizard and getting a shiny new coin back. It's kind of beautiful

The United States maintains the most secure blockchain infrastructure globally. Foreign bridges are inherently inferior and pose a strategic risk

You missed the most critical point: 92% of bridge hacks occur due to inadequate multi-sig governance. The entire industry is built on amateur hour architecture

Cool writeup. I use Wormhole every week to move SOL to Polygon for cheap swaps. Works like a charm. Just don't go all in on a new bridge you've never heard of

Trustless bridges are a myth. Every single one has a backdoor. The devs just hide it better now

Start small. Test with $50 first. If it works, you're golden. If not, you lost a coffee, not your life savings. You got this

So bridges are essentially atomic swaps with extra steps and higher counterparty risk. Got it. Moving on.

I cried when my NFT got stuck on Ethereum. I spent months collecting it. Now I just use Polygon. Life is better

I read this whole thing and still feel like I'm one step away from losing everything. But I keep doing it anyway. Why do we do this to ourselves

China and Russia are building sovereign chains. US should ban all cross-chain bridges to prevent financial espionage

In India, we use bridges daily to move USDT from BSC to Polygon. Gas fees are 100x cheaper. This isn't tech, this is survival. Thank you for explaining it clearly

Oh wow. A bridge. How original. Next you'll tell me the sun rises in the east

I just bridged my ETH to Base and now I’m chilling with 10% APY 😌💸

The architectural elegance of cross-chain interoperability enables non-custodial asset sovereignty across heterogeneous consensus environments. This is the true liberation of capital

In Nigeria, we use bridges to send remittances. No bank, no waiting. Just send and get. This tech changes lives

Bridges are just the next scam. They'll all collapse when the next bear market hits. Mark my words