Crypto Long-Term Investment: What Works and What’s Just Noise

When you think about crypto long-term investment, a strategy focused on holding digital assets for years, not days, based on fundamentals rather than hype. Also known as buy and hold crypto, it’s the opposite of flipping memecoins or chasing fake airdrops. Most people hear "crypto" and think of quick wins—but the real wealth builders are the ones who stick with assets that actually solve problems.

True long-term crypto investing isn’t about what’s trending today. It’s about understanding what gives a coin staying power. Bitcoin, the first and most decentralized digital currency, with a fixed supply and global adoption is the foundation. It’s not flashy, but it’s the only crypto with a decade of trust, institutional backing, and real scarcity. Then there’s Ethereum, the blockchain that runs smart contracts, DeFi, and tokenized assets. Unlike meme coins with zero trading volume, Ethereum has developers building on it every day—and institutions using it to move trillions in value.

What makes a crypto worth holding for years? It needs real-world use, not just a cool name. That’s why real world asset tokenization, turning property, gold, or bonds into blockchain tokens that anyone can buy is a quiet revolution. It’s not a giveaway—it’s a shift in how ownership works. And if you live in a country where banks block crypto, like Cambodia or Pakistan, then non-custodial wallet, a wallet where only you control the keys, not a company or government isn’t optional—it’s your only way to keep your money safe.

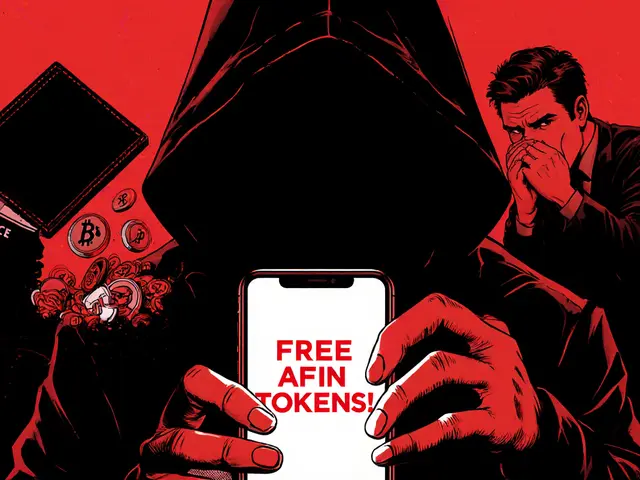

You won’t find any of these in the fake airdrops or abandoned exchanges. No one’s giving away free tokens from Let’sBit or CHIHUA because those projects don’t exist. Real long-term value doesn’t come from hype—it comes from infrastructure, regulation, and adoption. The posts below show you what’s real: the crypto that’s actually being used, the wallets that keep you safe, the laws that protect you, and the assets that are changing how money works. Skip the noise. Focus on what lasts.

Learn how to HODL crypto during bear markets with a practical, data-backed approach. Avoid panic selling, use dollar-cost averaging, and hold only proven assets like Bitcoin and Ethereum for long-term gains.

READ MORE