AFIN price: What you need to know about this obscure crypto token

When you see AFIN, a little-known crypto token with no public team, no whitepaper, and zero trading volume on major exchanges. Also known as AFIN token, it’s one of hundreds of tokens that appear overnight, flash a price on a small DEX, then vanish. Most people who chase AFIN price are chasing a ghost. There’s no company behind it. No roadmap. No community. Just a smart contract on a blockchain, and a few bots pretending to trade it.

AFIN isn’t unique. It’s part of a bigger pattern you’ll see across Solana, BNB Chain, and other low-fee networks: tokens with names that sound like they should mean something — AFIN, POCAT, M3M3, NPTX — but actually mean nothing. These aren’t investments. They’re digital lottery tickets with near-zero odds. The price you see? It’s not set by demand. It’s set by whoever controls the liquidity pool, and they can pull it all out in seconds. You’ll find this exact setup in over a dozen posts here — tokens with fake volume, zero adoption, and no reason to exist beyond a quick pump.

What makes AFIN different from Bitcoin or Ethereum? Everything. Bitcoin has a decade of history, a global network of nodes, and institutional backing. AFIN has a Twitter account with 23 followers and a contract address that hasn’t changed since it was deployed. If you’re looking for real value, you won’t find it here. But if you’re trying to avoid losing money on tokens that look like opportunities but are actually traps, then this collection is for you. Below, you’ll find real breakdowns of similar tokens — the ones that trick people into thinking they’re getting in early. You’ll learn how to spot the red flags before you click "approve" and send your crypto into the void.

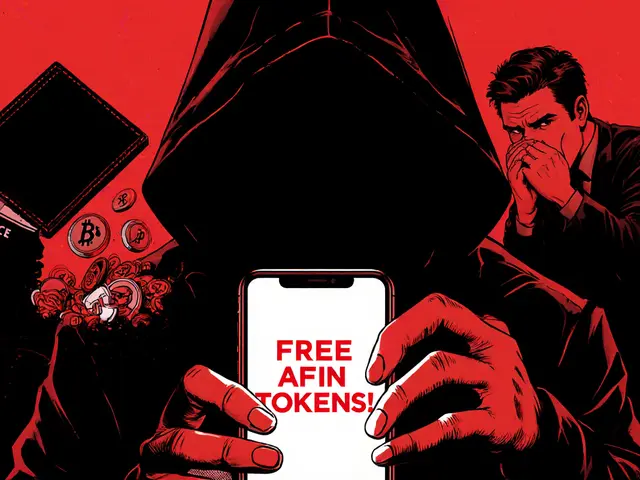

Asian Fintech (AFIN) airdrop claims are scams. No official airdrop exists in 2025. Learn why AFIN has $0 trading volume, how scammers trick users, and what real eco-friendly crypto projects to consider instead.

READ MORE