CryptoBulls Exchange Review: Fees, Security, and How It Stacks Up

CryptoBulls Fee Calculator

Fee Calculator

Estimate your trading costs on CryptoBulls based on your trade size and asset type.

Fee Breakdown

Trade Amount:

Asset Type:

Fee Rate: 0.20%

Trading Fee:

Important Note

For Bitcoin withdrawals, CryptoBulls does not disclose withdrawal fees. Please contact support for current rates.

Compare this with other exchanges like Coinbase (0-3.99%), Kraken (0-0.26%), or Binance US (0.10-0.20%).

Comparison with Other Exchanges

CryptoBulls: Flat 0.20% fee for both makers and takers

Kraken: Tiered fees from 0% to 0.26% based on volume

Coinbase: 0% to 3.99% depending on transaction type

Binance US: 0.10% to 0.20% for most trades

Note: CryptoBulls' flat fee is competitive for small trades but may not offer savings for high-volume traders.

When you hear the name CryptoBulls is a Dubai‑based cryptocurrency exchange that promises a flat 0.20% fee for all trades. It’s a modest player in a market dominated by giants like Coinbase, Kraken and Binance US. If you’re trying to decide whether to park your crypto there, you’ll want to know how its fees, security, asset selection and support actually work.

Quick Take

- Flat 0.20% maker & taker fee - lower than the industry average.

- Limited crypto selection; many popular assets are missing.

- Transparency gaps - Bitcoin withdrawal fees aren’t disclosed.

- Regulatory posture unclear; based in Dubai but not listed on major compliance registers.

- Customer support and educational resources are sparse compared with top exchanges.

What Is CryptoBulls?

Founded sometime in the early 2020s, CryptoBulls markets itself as a simple, flat‑fee platform for buying, selling and swapping digital assets. The exchange accepts wire transfers and credit‑card deposits, but it does not publish detailed deposit‑fee tables. Its home base in Dubai gives it a slightly different regulatory vibe compared to U.S.‑oriented venues.

Fee Structure in Detail

The headline promise is a 0.20% flat fee for both makers and takers. That beats the average 0.25%‑0.30% you see on most midsized exchanges. For a $10,000 trade, you’d pay $20 in fees - simple enough to calculate.

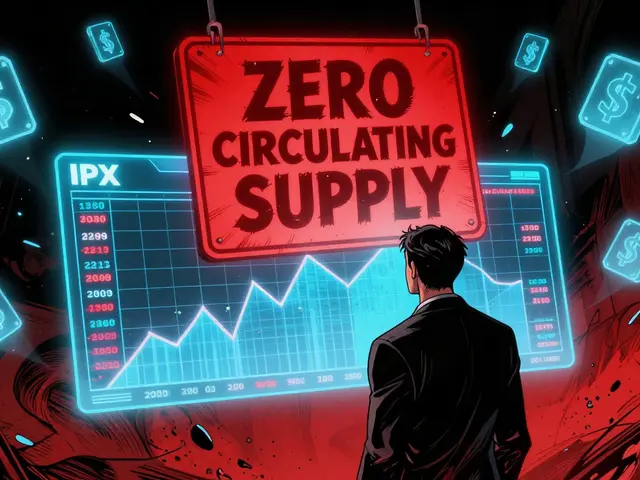

Where the fee model gets murkier is withdrawals. CryptoBulls lists fees for many altcoins, yet it omits Bitcoin (BTC) withdrawal costs entirely. Bitcoin is the most traded crypto, so that omission raises a red flag for anyone moving large sums.

Contrast this with Kraken, which offers a tiered fee schedule that can drop to 0% for high‑volume makers, and with Coinbase where fees range from 0% to 3.99% depending on the transaction type. CryptoBulls’ flat rate is transparent, but the missing withdrawal data hurts overall clarity.

Asset Coverage and Liquidity

CryptoBulls lists roughly 70 trading pairs - a fraction of the 350+ you’ll find on Binance US or the 466 supported assets on Kraken. Major coins like Ethereum (ETH), Ripple (XRP) and Litecoin (LTC) are present, but niche tokens and many DeFi projects are absent.

Liquidity depth is also hard to gauge because CryptoBulls does not publish order‑book depth or average daily volume. For traders who need tight spreads, the lack of transparent depth data means you could experience slippage on larger orders.

Security and Regulatory Compliance

Security details are thin on the ground. The exchange claims to use cold storage for the bulk of user funds, but no third‑party audit reports are linked on the site. In contrast, Kraken publishes annual SOC 2 Type II compliance and regular penetration test results.

Regulatory standing is another gray area. Being based in Dubai places CryptoBulls under the jurisdiction of the UAE’s Virtual Asset Regulatory Authority, yet the platform is not listed on any major compliance registries that U.S. or European users typically rely on. If you need a platform that adheres to stringent AML/KYC standards, you’ll have to verify CryptoBulls’ procedures directly with their support team.

User Experience, Support & Education

The UI is clean but minimalistic. Newcomers will find a basic dashboard, but there are few tutorial videos, knowledge‑base articles, or community forums. This contrasts sharply with the extensive learning centers offered by Coinbase and Crypto.com.

Customer support operates via email and an online ticket system, with response times that can stretch beyond 48hours during peak periods. There is no 24/7 live chat, and phone support is unavailable. For traders who value immediate assistance, this could be a deal‑breaker.

Pros & Cons at a Glance

- Pros

- Simple flat‑fee model (0.20%) that’s easy to calculate.

- Basic UI works for straightforward buy‑sell actions.

- Located in Dubai, offering a non‑U.S. regulatory environment that may appeal to some global users.

- Cons

- Limited asset list and unclear liquidity.

- No publicly disclosed Bitcoin withdrawal fees.

- Sparse security documentation and unclear compliance status.

- Thin support resources; no live chat or phone line.

- Little community presence, making peer‑help difficult.

How It Stacks Up - Comparison Table

| Feature | CryptoBulls | Kraken | Coinbase | Binance US |

|---|---|---|---|---|

| Base trading fee | 0.20% flat | 0.00‑0.26% (tiered) | 0‑3.99% (varies) | 0.10%‑0.20% |

| Supported assets | ~70 pairs | 466+ | 235 | ~350 |

| BTC withdrawal fee | Undisclosed | Variable (network fee) | Network fee + $0.15 | Network fee |

| Regulatory jurisdiction | Dubai, UAE | U.S./EU (multiple licenses) | U.S. (NYDFS, FinCEN) | U.S. (registered broker‑dealer) |

| Customer support | Email/ticket, >48h response | 24/7 chat & phone | Phone, chat, email | Live chat, email |

| Security transparency | Basic claims, no audits | Regular audits, cold storage | Insurance, SOC‑2 reports | SAFU fund, cold storage |

Where to Get More Insight

The only dedicated review site that covers CryptoBulls in any depth is Cryptowisser. Their analysis flags the missing Bitcoin withdrawal fee and advises users to double‑check any hidden costs before depositing. Beyond that, mainstream outlets like NerdWallet or Finder do not list CryptoBulls at all, which signals limited market traction.

Bottom Line

If you’re a seasoned trader who only needs a low‑fee spot for a handful of major coins, CryptoBulls could serve as a secondary account-provided you’re comfortable with limited support and the opacity around BTC withdrawals. For most users, especially newcomers or anyone who values strong security attestations and a vibrant community, the established exchanges-Kraken, Coinbase, Binance US-offer a safer, more transparent experience.

Frequently Asked Questions

Is CryptoBulls regulated?

CryptoBulls operates out of Dubai under the UAE’s Virtual Asset Regulatory Authority, but it does not list specific licenses or compliance certificates on its website. Users should request proof of AML/KYC and any relevant licensing before committing large funds.

What are the exact fees for withdrawing Bitcoin?

CryptoBulls does not publish a Bitcoin withdrawal fee. The platform only shows fees for a subset of altcoins, leaving BTC fees undisclosed. You’ll need to contact support directly to obtain the current rate.

How does the 0.20% flat fee compare to other exchanges?

At 0.20% for both makers and takers, CryptoBulls is cheaper than Coinbase’s typical 0.50%‑3.99% range and marginally lower than Binance US’s 0.10%‑0.20% for most trades. However, major exchanges like Kraken can drop to 0% for high‑volume makers, making them cheaper for large traders.

Is there a mobile app for CryptoBulls?

CryptoBulls offers a basic mobile‑responsive web interface but does not have dedicated iOS or Android apps. This limits on‑the‑go trading functionality compared with competitors that provide native apps.

Can I trade on margin with CryptoBulls?

No. CryptoBulls currently only supports spot trading. If you need leveraged positions, platforms like Kraken (up to 5×) or Binance US (up to 3×) are the alternatives.

When one contemplates the labyrinthine architecture of exchange fee structures, the mind inevitably drifts toward entropy; yet CryptoBulls offers a paradoxically simple 0.20% flat rate, a rarity in a market saturated with tiered complexities. This simplicity, however, is not without hidden corners-withdrawal fees for Bitcoin remain shrouded in opacity, demanding a direct inquiry to support. Moreover, the absence of a native mobile app hints at a strategic emphasis on web-centric trade execution, which may alienate on‑the‑go users. In juxtaposing CryptoBulls with Kraken’s volume‑based discounts, one discerns a trade‑off between predictability and potential cost savings. Ultimately, the exchange occupies a niche: low‑fee, low‑feature, suitable perhaps for the occasional spot trader.

It’s suspicious how CryptoBulls hides Bitcoin withdrawal fees-probably a front for data siphoning.

Let me take you on a winding tour through the economics of CryptoBulls, where every transaction feels like stepping onto a polished marble floor that gleams under a dim chandelier of uncertainty.

First, the flat 0.20% fee beckons with the charm of a uniform tariff, promising no surprise surcharges for the casual trader who merely wishes to swap BTC for ETH.

Yet, as you delve deeper, you discover that the exchange’s withdrawal policy resembles a well‑guarded vault, refusing to disclose the exact cost of moving Bitcoin off‑chain, a fact that can gnaw at the confidence of any diligent investor.

This opacity is compounded by the modest support infrastructure-24/7 chat exists, but the quality of assistance often feels like a scripted monologue rather than a personalized solution.

The platform’s regulatory posture, anchored in the UAE’s Virtual Asset Regulatory Authority, offers a veneer of legitimacy, but the lack of publicly displayed licenses raises eyebrows among compliance‑savvy participants.

Comparing this to Kraken, where tiered fees can dip toward zero for high‑volume makers, CryptoBulls appears to cater primarily to the low‑volume, cost‑sensitive segment.

The absence of a native mobile application further narrows its appeal, confining users to a responsive web interface that, while functional, lacks the seamless UX of dedicated iOS and Android apps.

Security, a cornerstone of any exchange’s reputation, is presented with only basic claims and no publicly available audit reports, leaving a shadow over the safety of stored assets.

For seasoned traders accustomed to cold‑storage strategies and insurance funds like those offered by more established platforms, CryptoBulls may feel like a modest roadside stop.

Nevertheless, its straightforward fee model can be a breath of fresh air for newcomers overwhelmed by the labyrinth of variable maker‑taker schedules endemic to other venues.

The educational resources on the site are sparse, making it imperative for users to conduct external research before committing significant capital.

In practice, the exchange’s order book depth can be thin during periods of market volatility, potentially leading to slippage that erodes the modest fee advantage.

Community engagement is limited; there is no vibrant forum or social media hub where traders congregate to share insights or troubleshoot issues collectively.

On the bright side, the platform does support a respectable range of major cryptos, ensuring that users can access the core market without hopping across multiple services.

In summary, CryptoBulls offers an uncomplicated fee landscape, but it is a double‑edged sword that juxtaposes simplicity with a palpable lack of transparency and ancillary features, making it a fitting auxiliary account rather than a primary trading sanctuary.

CryptoBulls certainly nails the low‑fee promise, but you’re paying for a stripped‑down experience-no mobile app, vague Bitcoin withdrawal costs, and limited support. If you value transparency and robust security, other exchanges outshine it.

Honestly, the whole “low‑fee” hype is overrated; most of us don’t even trade enough to notice a 0.10% difference, and the lack of a mobile app is a blessing-you won’t be tempted to check prices every five minutes.

Do you think CryptoBulls’ lack of disclosed BTC withdrawal fees could affect long‑term trust for users?

Oh sure, because nothing screams “trustworthy” like a secret withdrawal fee-maybe they’ll throw in a complimentary mystery box with your next trade.

Stop sugar‑coating it; CryptoBulls is a mid‑tier platform that sticks to basics and leaves serious traders in the dust.

For newcomers, starting with a platform that has a flat fee can simplify budgeting; just remember to verify KYC procedures and keep only a small amount on the exchange, moving the rest to a hardware wallet.

The allure of a flat fee beckons like a siren’s song, yet one must navigate the hidden reefs of undisclosed costs-proceed with caution.

Another “review” trying to sound smart-what a yawn. CryptoBulls is just another cash‑grabber in a sea of mediocrity.

I get why some people like the simple fee, but it’s also important to think about safety and how easy it is to move your crypto off the platform.

Totally feeling you! 😅 Just make sure you check the withdrawal stuff before you dump too much in there. 👍