What is ITO (Initial Token Offering) in Crypto? A Clear Guide to Utility Tokens and How They Work

When you hear "ITO" in crypto, it’s not a coin you buy to flip for quick profits. It’s a fundraising model-a way for blockchain projects to raise money by selling tokens that actually do something inside their ecosystem. Unlike the wild west of ICOs from 2017, where people bought tokens hoping they’d skyrocket, ITOs are built around utility. If the token doesn’t give you access, discounts, or control over the platform, it’s probably not an ITO.

What Exactly Is an ITO?

ITO stands for Initial Token Offering. It’s when a new blockchain project sells its native tokens to early supporters in exchange for Bitcoin, Ethereum, or sometimes fiat. But here’s the key difference: these tokens aren’t just investments. They’re keys. Keys to use the platform. To vote on upgrades. To pay for services. To earn rewards. For example, a decentralized exchange might give ITO buyers reduced trading fees. A gaming platform might let you buy virtual land or gear with its token.

The term "ITO" became popular around 2020 as projects tried to distance themselves from the scam-heavy ICO era. Investors got burned when tokens had no real use and teams vanished with the cash. ITOs were meant to fix that-by tying token value directly to platform usage. If no one uses the app, the token doesn’t matter. If millions use it, the token grows in value naturally.

How ITOs Are Built: Smart Contracts and Blockchains

Every ITO runs on smart contracts-self-executing code on a blockchain. Most use Ethereum (about 78% of cases), where tokens follow the ERC-20 standard. Others use Binance Smart Chain (BEP-20), Solana (SPL), or newer chains. These standards define how many tokens exist, how they’re transferred, and what data they carry.

When you participate in an ITO, you’re interacting with this code. You send ETH or BNB to a wallet address, and the contract automatically sends you the token. No middleman. No paperwork. But that also means no protection if something goes wrong.

Tokenomics: Where the Tokens Go

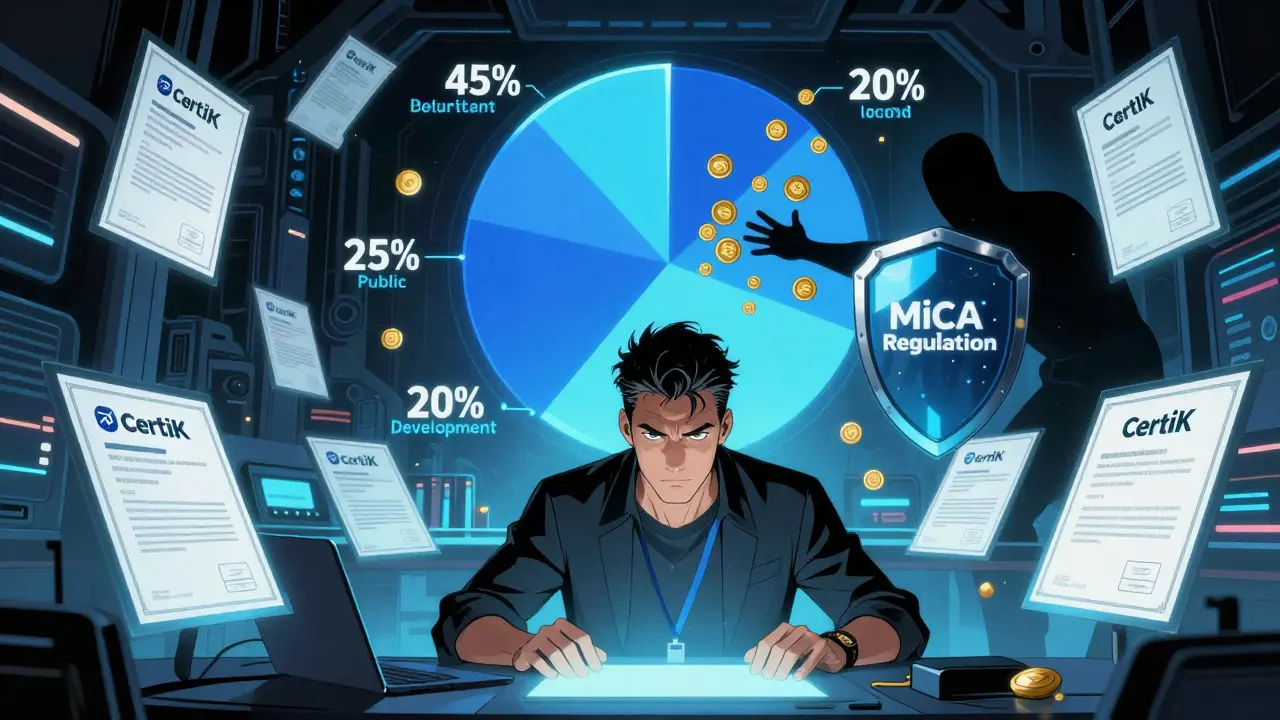

Smart projects don’t dump all their tokens on the market at once. A typical ITO token distribution looks like this:

- 45-60% for public sale (that’s you)

- 15-25% for the team and advisors (locked for 1-2 years)

- 10-20% for development and product growth

- 5-15% for marketing and partnerships

Team tokens being locked is critical. If founders can cash out immediately after launch, they have zero incentive to make the project succeed. Look for projects that lock at least 12 months. The hard cap-the total amount raised-varies. Early-stage projects might raise $500,000. Well-known teams can hit $50 million.

ITO vs ICO vs STO: What’s the Difference?

People mix these up all the time. Here’s the breakdown:

| Feature | ITO | ICO | STO |

|---|---|---|---|

| Primary Purpose | Utility within ecosystem | Speculative investment | Security-like asset |

| Regulation | Largely unregulated | Unregulated (mostly illegal now) | Heavily regulated |

| Legal Protections | Minimal | None | High (SEC-compliant) |

| Cost to Launch | $100K-$200K | $50K-$150K | $2M+ |

| Investor Minimum | $100-$500 | $50-$1,000 | $10K-$100K+ |

| Example | Decentraland (MANA), The Sandbox (SAND) | BitConnect, Tezos (early) | tZERO, Polymath |

ICO was the original model-no utility, just hope. STO is the corporate version: legal, expensive, and for accredited investors. ITO sits in the middle: accessible, utility-driven, and risky-but with better intentions.

Real-World Examples: ITOs That Worked (and Those That Didn’t)

Some ITOs delivered on their promises. Decentraland’s MANA token, launched in 2017, gave users the ability to buy, sell, and build on virtual land. By 2021, it had grown 1,200% from its ITO price because people actually used the platform.

Another success: The Sandbox raised $93 million in 2021 for its metaverse game. Their token lets players buy assets, vote on governance, and earn rewards-real utility.

Now look at the failures. EOSDice, a gambling platform, raised $12 million in 2019. Within 18 months, its token lost 99.8% of its value. Why? The game was poorly built, the team vanished, and the token had no real use outside betting. No one used it. No one wanted it.

Even worse: Vulcan Forged’s ITO in 2022. The team sold 87% of their own tokens within 72 hours of listing. Price crashed from $1.23 to $0.042. That’s not a failure of the market-it’s a failure of trust.

How to Participate in an ITO (Step by Step)

If you want to join an ITO, here’s how to do it safely:

- Read the whitepaper. Spend at least 5-8 hours on it. Look for technical details, not hype. Does it explain how the token is used? Is the roadmap realistic?

- Check the team. Are they doxxed? Do they have a track record? Projects with public team members are 63% more likely to survive.

- Verify the smart contract. Has it been audited by a reputable firm like CertiK or PeckShield? Only 41% of ITOs are audited. Skip the ones that aren’t.

- Set up a wallet. Use MetaMask (73% of users) or Trust Wallet. Never send crypto from an exchange. You’ll lose it.

- Complete KYC. Most ITOs require identity verification. This takes 24-72 hours. Don’t rush it.

- Buy with ETH or BNB. Make sure you have enough for gas fees ($5-$150 depending on network traffic).

- Don’t sell immediately. If you buy and dump on day one, you’re part of the problem. Wait. See if the project delivers.

Why ITOs Are Still Risky-Even When They’re Legit

Just because a project uses the "ITO" label doesn’t mean it’s safe. The biggest risks:

- Phishing scams. Fake websites that look real. Always double-check URLs. Chainalysis found 37% of ITO losses come from this.

- Illiquid markets. Tokens might not trade on major exchanges. You can’t sell if no one’s buying.

- Team betrayal. Even with lockups, some teams find loopholes. Watch for sudden large token sales.

- Regulatory crackdowns. The SEC says most tokens are securities. If they come after an ITO, your tokens could be frozen.

According to Outlier Ventures, ITOs with mandatory token use (like paying fees or accessing features) have an 83% survival rate. Those that are just speculative? Only 29%. Utility matters.

The Future of ITOs: Regulation and Innovation

Europe’s MiCA regulation, which took effect in June 2024, is a game-changer. It’s the first clear legal framework for utility tokens. It forces projects to publish whitepapers, disclose team details, and prevent market manipulation. This will push out bad actors and bring in serious investors.

Technologically, ITOs are getting smarter. Zero-knowledge proofs now let users transact privately. Multi-chain deployments mean tokens work across Ethereum, Solana, and others. And 58% of 2023 ITOs now include staking-so you can earn rewards just by holding.

Big companies are watching. Gartner predicts 31% of Fortune 500 firms will explore tokenized assets by 2025. But they’re not doing public ITOs. They’re doing private, regulated offerings. That’s the future: utility tokens that work in the real world, not just on crypto forums.

Final Thought: ITOs Are Tools, Not Get-Rich Schemes

Don’t treat ITOs like lottery tickets. They’re not about flipping tokens for a quick profit. They’re about backing projects you believe in-projects that need tokens to function. If you think the platform will be used by thousands, then yes, your token might grow. But if you’re just chasing the next moonshot, you’ll lose money.

The best ITOs are quiet. No hype. No influencers. Just solid code, a real need, and a team that’s been around. Do your homework. Check the audits. Read the whitepaper. Wait. And if it feels too good to be true? It probably is.

Is ITO the same as ICO?

No. ICOs (Initial Coin Offerings) were mostly speculative-people bought tokens hoping they’d rise in price, with no real use. ITOs (Initial Token Offerings) focus on utility. The token must do something inside the platform, like pay for services, vote on decisions, or unlock features. ITOs emerged after ICOs collapsed due to scams, aiming to rebuild trust.

Can I make money from an ITO?

You can, but it’s not guaranteed. Some early investors in projects like Decentraland and The Sandbox made large returns because the platforms succeeded and demand for their tokens grew. But many ITOs fail. The key is utility-if the token is essential to using the product, it has a better chance of holding or growing value. Treat it as a bet on the project’s success, not a shortcut to riches.

How much money do I need to join an ITO?

Minimum investments vary, but many ITOs allow participation with as little as $100-$500. You’ll need cryptocurrency like Ethereum (ETH) or Binance Coin (BNB) to send to the project’s wallet. Don’t forget gas fees-these can range from $5 to $150 depending on network congestion.

Are ITOs legal?

It depends on where you live and how the token is structured. In the U.S., the SEC considers most tokens sold in ITOs to be securities, meaning they should be registered. Many projects avoid this by operating offshore in places like Switzerland, Singapore, or the UAE. In Europe, the new MiCA regulation (2024) provides a legal path for utility tokens. Always check local laws before investing.

What’s the biggest risk in participating in an ITO?

The biggest risk is losing your entire investment. Many projects never deliver on their promises. Others are outright scams. Even legitimate ones can fail due to poor execution. Phishing scams, team sell-offs, and illiquid markets are common. Only invest what you can afford to lose, and always verify audits, team identities, and token utility before participating.

It's wild how people still treat ITOs like lottery tickets. I get it-you want to get rich quick. But if you don't care about the project’s actual use case, you’re just feeding the cycle that killed ICOs. Utility isn’t a buzzword, it’s the whole point.

Ohhhh MY GODDDDD-this post is like a breath of fresh air in a landfill of crypto scams!!! ITOs are the ONLY thing keeping this space from collapsing into pure, unadulterated chaos!!! People need to READ THE WHITEPAPER, not just copy-paste a Telegram link!!!

Love this breakdown! 🙌 I’m from a country where crypto’s still kinda shady, and this helps explain why ITOs matter beyond the hype. Real utility = real trust. No cap. 😊

Great summary! I’ve seen too many Indian investors jump into ITOs without checking audits. Just last month, a project called ‘CryptoBharat’ vanished after raising 200 ETH. Always check CertiK. Always. No exceptions.

wait so ito is just ico but with less scammy vibes? i mean like… is it really diffrent or just rebranded? i feel like the same people are just changin the name lol

You people are still confused? Look-I’ve been in this space since 2016. ICOs were a joke. ITOs are the bare minimum of responsibility. If you’re not doing your homework, you deserve to lose your money. Stop blaming the market-blame yourself.

YES! Utility over hype! 🚀 Let’s build, not gamble!

They’re lying. All of them. MiCA? Ha. The SEC is just waiting to crush you. They don’t want you to own anything. They want you to work for them. This is just the new financial slavery with a blockchain sticker on it.

Wow. A crypto post that doesn’t sound like it was written by a TikTok influencer. Who even are you? Did you go to college? Or did you just read a whitepaper and suddenly become a genius?

Let me tell you something, darling-90% of these ITOs are rug pulls wearing a suit. The team lockups? Useless. They use DAO voting loopholes. They sell through offshore wallets. They even bribe auditors. You think CertiK gives a damn? They get paid by the project. It’s all theater.

Actually, you’re all missing the deeper epistemological framework here. The very notion of ‘utility’ is a capitalist illusion. Tokens are not keys-they’re semiotic signifiers of alienated labor under blockchain feudalism. The ERC-20 standard is just a digital cage dressed in open-source aesthetics. The real utility is the psychological comfort of believing you’re participating in something ‘decentralized’ while still trusting a multisig wallet controlled by five VCs in Zug.

They’re all owned by the same 3 hedge funds. MiCA? Just a way to legalize the cartel. You think they want competition? Nah. They want you to think you’re free while your wallet’s on their spreadsheet. Check the founder’s Coinbase history. You’ll see the pattern.

They’re watching. Every transaction. Every wallet. Every ‘utility’ token is a data point for the surveillance state. MiCA isn’t protection-it’s a digital leash. You think you’re voting? You’re just feeding the algorithm.

I appreciate the nuance here. I’ve seen projects with great tech fail because the community was toxic. Maybe the real utility isn’t just in the token-but in the people who build and use it. Healthy communities last longer than smart contracts.

Bro. I bought a token from a guy named ‘CryptoPapa’ who said it was an ITO. Turned out he was 14 and lived in his mom’s basement. He spent the ETH on Fortnite skins. I cried. Not for the money. For the lost potential. The dream. The… the… UTILITY.

good post! i didnt know about the 45-60% public sale thing. that makes sense. i always thought they just dumped it all. thanks for the heads up! 🙏