Unichain: What It Is, How It Works, and Where It Fits in Crypto

When you hear Unichain, a blockchain network designed to scale Ethereum with low fees and high speed. Also known as a Layer 2 solution, it lets users trade, stake, and build apps without the high gas fees that plague the main Ethereum chain. Unlike sidechains that operate in isolation, Unichain connects directly to Ethereum’s security while handling most of the transaction load off-chain. This makes it a practical tool for everyday crypto users who want fast swaps, cheap NFT minting, or smooth DeFi interactions.

Unichain doesn’t exist in a vacuum. It’s part of a bigger group of Layer 2 solutions, technologies built on top of Ethereum to improve speed and reduce costs like Arbitrum, Optimism, and Base. But Unichain stands out by focusing on simplicity and developer-friendly tools. It’s not trying to reinvent blockchain—it’s trying to make Ethereum work better for real people. That’s why you’ll find projects using it for DeFi apps, gaming tokens, and even small business payment systems. It’s also gaining traction in regions where high transaction fees make Ethereum nearly unusable.

Behind Unichain is a team focused on Ethereum scaling, the process of increasing how many transactions the network can handle without sacrificing security. They’re not chasing hype—they’re solving a real problem: Ethereum’s congestion. The network uses zk-rollup technology to bundle hundreds of transactions into one secure proof that gets posted to Ethereum. This keeps costs low and speeds high, while still letting users trust that their funds are as safe as if they were on Ethereum itself.

What does this mean for you? If you’ve ever waited 10 minutes for a swap to confirm, or paid $20 in gas to buy a $5 NFT, Unichain offers a way out. You can trade tokens, lend crypto, or play on-chain games without the stress of fee spikes. And if you’re a developer, it gives you a clean, low-cost environment to launch your app without needing a venture fund to cover transaction costs.

But Unichain isn’t perfect. It’s still new. Liquidity is thinner than on bigger chains. Some wallets don’t support it yet. And while it’s secure, you’re trusting a newer protocol—not the same battle-tested infrastructure as Ethereum mainnet. That’s why you’ll see mixed results in the posts below: some users love the speed, others hit roadblocks with token bridges or support.

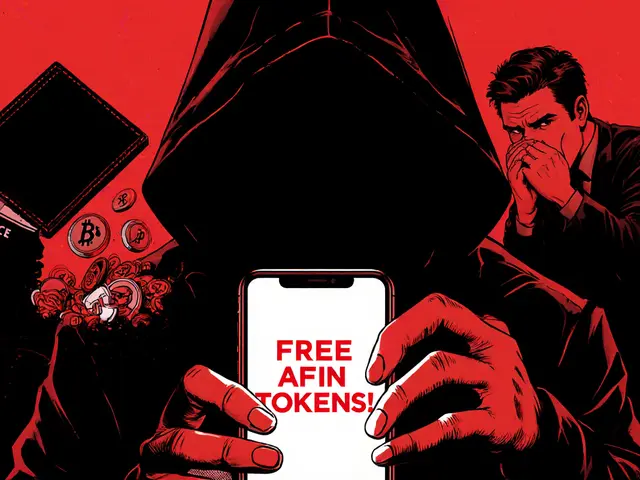

Below, you’ll find real reviews, breakdowns, and warnings about projects built on Unichain. Some are promising. Some are risky. All of them show how this network is being used—right now—in the wild. Whether you’re looking to trade, build, or just understand where the next wave of crypto is heading, these posts give you the unfiltered truth.

Uniswap v3 on Unichain delivers 95% lower fees and 1-second swaps, making it the fastest DeFi experience in 2025. See how it compares to other Layer 2s and why active traders are switching.

READ MORE