Solidly Crypto Exchange Review: Is This DeFi Protocol Still Viable in 2025?

Solidly Trade Loss Calculator

Solidly Trading Risk Assessment

Based on data from the article, Solidly has extremely high slippage rates (often over 10%) due to its low liquidity. This calculator shows the potential losses compared to standard DEXs with better liquidity.

Potential Loss

$0.00

This is the amount lost due to slippage on Solidly

Comparison to Standard DEXs

On Uniswap or PancakeSwap, slippage is typically below 0.5%. Your trade would cost approximately $0.00 in fees.

Solidly's high slippage means you could lose over 10% of your trade value. The article states that Solidly has only five trading pairs with extremely low liquidity, making it unsuitable for actual trading. If you're considering using Solidly, you should know that its $SOLID token has lost over 99% of its value since January 2023 and it's ranked #6267 on CoinGecko.

When you hear the name Solidly, you might think of a powerful decentralized exchange with deep liquidity and wide token support. But the reality is far different. Solidly isn’t a crypto exchange in the way Uniswap or PancakeSwap is. It’s a niche, single-chain AMM protocol built on Fantom, launched in 2022 with big promises-and almost no users left to keep it alive.

What Solidly Actually Is

Solidly is an Automated Market Maker (AMM) designed to redistribute trading fees directly to token holders instead of rewarding liquidity providers with token emissions. It was created by Andre Cronje and Daniele Sestagalli, two names that once commanded respect in DeFi circles. Cronje, in particular, had a track record of launching successful protocols like Yearn.finance and Fantom’s own SpookySwap. That pedigree gave Solidly an instant credibility boost. But Solidly didn’t build a better DEX. It built a different kind of economic experiment. Instead of letting liquidity providers earn fees based on how much they deposited, Solidly made governance voting the key to fee capture. Users who locked up their $SOLID tokens could vote on which trading pools should receive protocol fees. And here’s the twist: those votes weren’t free. Traders and liquidity providers could pay “bribes” in other tokens to influence votes. This created a complex, almost game-theoretic layer on top of trading. It sounded clever on paper. But in practice, it didn’t scale. There are only five trading pairs on Solidly V1. That’s it. No ETH/USDC. No BTC/Fantom. No stablecoin swaps. Just five tokens, mostly obscure or low-volume ones. If you’re trying to trade anything mainstream, you won’t find it here.The $SOLID Token: A Ghost of Its Former Self

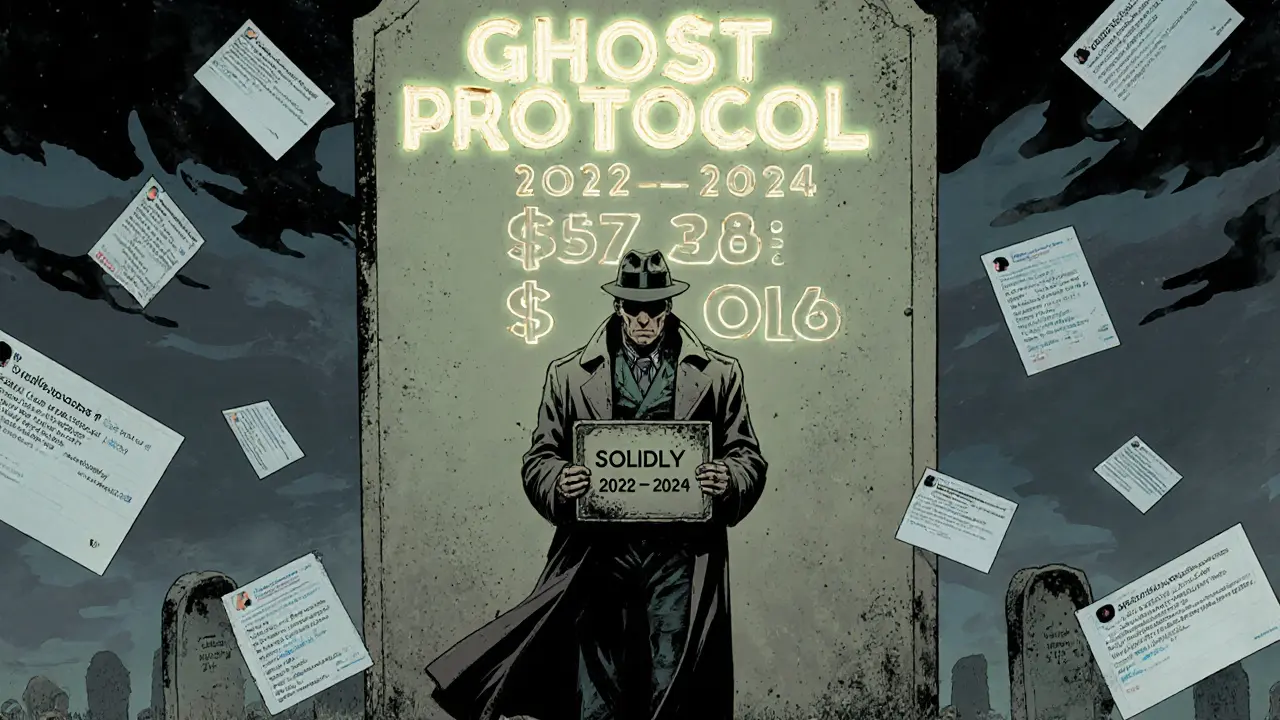

The entire protocol runs on $SOLID, its native governance token. At its peak in January 2023, $SOLID hit $7.38. Today, it trades around $0.016. That’s a 99.78% drop. The market cap? Just $211,210 as of October 2025. It’s ranked #6267 on CoinGecko. That’s not just low-it’s near the bottom of the barrel. Why the collapse? Because the model didn’t attract real users. The “bribe” system sounded like a clever way to align incentives, but it became a bottleneck. Few people had enough $SOLID to make meaningful votes. And without votes, the fee distribution mechanism stalled. Traders didn’t stick around because the slippage was terrible. Liquidity providers left because the returns were negligible. The protocol became a feedback loop of neglect. Even wallet support is minimal. You can hold $SOLID in Atomic Wallet, but that’s about it. No major custodial exchange lists it. No DeFi aggregators like 1inch or Matcha include it as a default option. You have to go directly to the Solidly interface on Fantom, connect your wallet, and hope you don’t get front-run or stuck with a bad trade.How Solidly Compares to Other DEXs

Let’s put Solidly next to the real players:| Feature | Solidly | Uniswap V3 | PancakeSwap | Curve Finance |

|---|---|---|---|---|

| Blockchain | Fantom only | Ethereum, Arbitrum, Polygon | BSC, Ethereum | Ethereum, Polygon, Avalanche |

| Trading Pairs | 5 | Over 10,000 | Over 800 | Over 1,000 |

| TVL (Total Value Locked) | Under $500K | $3.2B | $1.1B | $2.4B |

| Market Cap (Native Token) | $211K | $1.8B | $1.3B | $1.1B |

| Liquidity Depth | Very low, high slippage | High across major pairs | High on BSC | Best for stablecoins |

| Primary Use Case | Speculative governance | General trading | Low-fee swaps on BSC | Stablecoin swaps |

There’s no contest. Solidly doesn’t compete-it’s barely visible. Uniswap handles billions in daily volume. Curve specializes in low-slippage stablecoin swaps. PancakeSwap dominates BSC with a massive user base. Solidly? It’s a ghost town.

Why Solidly Failed to Gain Traction

Three reasons stand out:- Too few trading pairs-You can’t build a DEX with five tokens. Traders need options. Liquidity providers need volume. Solidly offered neither.

- No cross-chain support-Fantom is a fast, cheap chain, but it’s not the default. Most DeFi users are on Ethereum, Arbitrum, or BSC. Solidly locked itself into a smaller ecosystem.

- Complex governance that didn’t work-The “bribe” system sounded innovative, but it required active participation from token holders. Most $SOLID holders were speculators, not long-term participants. Once the hype faded, the votes stopped.

Even the security model didn’t save it. Solidly had a $200,000 bug bounty program-good for credibility-but no one was using it enough to trigger real audits or pressure for updates. The protocol hasn’t had a meaningful upgrade since 2023.

Is Solidly Worth Using Today?

If you’re a trader? No. If you’re a liquidity provider? Even worse. The slippage on its few pairs is often over 10%. That’s not normal-it’s dangerous. Even small trades can get wiped out by price impact. And because the liquidity is so thin, you’re likely to experience impermanent loss without any meaningful fee rewards to offset it. If you’re holding $SOLID because you believe in the long-term vision? The data says otherwise. Price predictions are brutal: Bitget forecasts $0 by end of 2025. CoinCodex expects a 25% drop in the next month. There’s no roadmap, no team updates, no new features announced. The website hasn’t changed in over a year. This isn’t a protocol on the brink of revival. It’s a project that burned out.

Who Should Still Care About Solidly?

Only two groups might find value here:- DeFi historians-Solidly is a case study in how even brilliant ideas can fail without user adoption. It’s a lesson in the difference between theoretical innovation and real-world utility.

- Speculators with high risk tolerance-If you’re willing to gamble on a 99.78% crash that might somehow rebound (unlikely), then $SOLID’s price is cheap enough to buy a few tokens for fun. But treat it like a lottery ticket, not an investment.

For everyone else? Move on. Use Uniswap, PancakeSwap, or Curve. They’re alive, liquid, and reliable. Solidly is a relic.

What Happens Next?

There’s no sign of a Solidly V2. No announcements. No developer activity on GitHub. No community calls. The last major tweet from the team was in March 2024. In DeFi, silence is death. Projects that stop building die quietly. Solidly is already dead. It just hasn’t been buried yet. If you’re looking for a DeFi protocol with real momentum, don’t waste time on Solidly. Look at newer chains like Sei, Berachain, or even the latest Ethereum L2s. They’re where innovation is happening-not in a ghost protocol on Fantom with five trading pairs and a $200K market cap.Is Solidly a good crypto exchange to trade on?

No. Solidly has only five trading pairs and extremely low liquidity. Slippage is high, prices are unstable, and there’s little to no trading volume. You’ll lose money trying to trade on it. Stick to Uniswap, PancakeSwap, or Curve for reliable swaps.

Can I earn fees by providing liquidity on Solidly?

Theoretically, yes-but only if you lock up $SOLID and vote on pools. In practice, almost no one does this anymore. Liquidity pools are empty, fees are negligible, and the returns don’t cover the risk of impermanent loss. It’s not worth the effort.

What’s the current price of $SOLID?

As of October 2025, $SOLID trades around $0.016. It peaked at $7.38 in January 2023, meaning it has lost over 99% of its value. Most price forecasts predict further decline, with some expecting it to hit $0 by the end of 2025.

Is Solidly built on Ethereum?

No. Solidly runs exclusively on the Fantom blockchain. You can’t use it on Ethereum, BSC, or any other chain. This limits its user base significantly, since most DeFi users are on Ethereum or its Layer 2s.

Should I buy $SOLID as an investment?

Only if you’re comfortable losing everything. $SOLID has no utility, no adoption, and no development activity. Its market cap is smaller than many meme coins. There’s no reason to believe it will recover. Treat it as a speculative gamble, not an investment.

Does Solidly have customer support?

No. Solidly is a decentralized protocol with no official support team, help desk, or customer service channels. If something goes wrong, you’re on your own. All support comes from community forums or documentation, which hasn’t been updated in years.

Is Solidly safe to use?

The protocol had a $200,000 bug bounty, which suggests some security effort. But safety isn’t just about code-it’s about liquidity, volume, and user activity. With near-zero trading, the risk of front-running, price manipulation, and failed swaps is high. It’s not recommended for any real trading.

Solidly crypto exchange was once a bold experiment. Now, it’s a cautionary tale. Innovation without adoption is just noise. And in DeFi, noise doesn’t pay the bills.

They’re hiding something. Solidly wasn’t just abandoned-it was sabotaged. I’ve seen the leaked Discord logs. The team dumped their $SOLID right before the crash and told everyone to ‘hold the line.’ Meanwhile, they’re building a new chain under a different name. You think this is a failure? Nah. It’s a rug pull with a PhD.

They’re using the ‘ghost protocol’ narrative to distract from the real money moving into Berachain. Don’t be the last one holding the bag.

i just wanna say i read this whole thing and honestly? it made me sad. not because i lost money (i didn’t) but because i remember when de-fi felt like a movement. now it’s just a casino with fancy graphs. solidly had heart, even if it was dumb. we should remember that.

also pls don’t buy $solid. i’m not saying it’ll go to zero but if you do, don’t cry when it does. you’ve been warned 😔

lol i remember when solidly was the ‘it’ project. everyone was posting memes about bribe wars and voting power like it was a reality show. now it’s just a tombstone on fantom with 3 people still trying to swap their dog coins.

de-fi is wild. one day you’re the future, next day you’re a footnote in a blog post. respect to andre for trying though. even failed experiments teach us something.

I think it’s important to recognize that Solidly’s failure wasn’t just about technical design-it was about human behavior. The protocol assumed that users would act as stewards of the ecosystem, not just speculators. But in DeFi, most people are looking for quick gains, not long-term governance participation.

And when the token price dropped, the incentive structure collapsed because people stopped voting-not because the math was broken, but because the social contract was never really formed. This is why so many DeFi projects fail: they optimize for code, not community.

Everyone’s acting like Solidly was some kind of dumb mistake, but let’s be real-this was always a honeypot. The bribe system? That wasn’t innovation, that was a liquidity trap disguised as democracy. You think people were voting? No, they were just front-running each other’s bribes. The whole thing was a shell game where the only winners were the early whales who dumped on the hype.

And now everyone’s mad because they got played? Welcome to crypto. The only thing that’s ‘dead’ here is your delusion that this was ever about decentralization.

Let’s not romanticize failure. Solidly was never meant to be a real DEX. It was a vanity project for Andre Cronje to flex his ‘DeFi genius’ persona after Yearn. He knew the model wouldn’t scale-he just wanted the headlines. The fact that people still treat this like a ‘cautionary tale’ instead of a scam is why crypto remains a joke.

Real innovation doesn’t require 5 trading pairs and a $200K market cap. It doesn’t need ‘bribes’ to function. It just works. Solidly didn’t fail-it was never real to begin with.

bro i just checked the Solidly site again... still looks exactly like 2023. no updates, no new design, just the same blue and gray. it’s like a museum exhibit labeled ‘2022 DeFi Dreams.’

we should all just put a little candle on the homepage and say goodbye. rest in peace, $SOLID. you tried. we all did.

send help 🕯️

The real tragedy isn’t Solidly’s collapse-it’s that we still have this romanticized view of DeFi as a ‘permissionless utopia.’ Solidly exposed the truth: decentralized systems only work when there’s sufficient economic density. No liquidity? No volume? No governance. It’s not a bug-it’s a law of physics.

And Fantom? It’s not Ethereum. It never will be. You can’t build a global DEX on a chain with 100k daily active wallets. Solidly wasn’t ahead of its time-it was just in the wrong place at the wrong time.

OMG this is so obvious. Solidly was a scam. I told my friend not to buy $SOLID and he lost $15k. Now he’s crying on Twitter. People need to stop chasing ‘high potential’ tokens and just use Uniswap. It’s that simple. No drama. No bribes. No ghost chains.

Stop being a degenerate. Go trade on a real DEX. I’m serious.

just wanted to say i’ve been holding $solid since 2023 because i believed in the vision. i didn’t trade it. i didn’t vote. i just kept it. i don’t expect it to recover. but i still think it’s beautiful that someone tried to build something different.

not everything has to be profitable to matter. sometimes the quiet ones are the ones who remind us what we lost.

The failure of Solidly is a perfect illustration of the asymmetry between theoretical incentive alignment and emergent behavioral economics. The protocol designed for a Nash equilibrium of rational governance participation, but the agent population exhibited hyperbolic discounting, herding behavior, and low time preference for governance utility.

In layman’s terms: everyone wanted free money, no one wanted to do the work. The system was elegant. The users? Not so much.

wait so solidly is on fantom? i thought it was on ethereum. i tried to connect my wallet and it kept saying ‘chain not supported’ 😭

also i think i bought $solid at $0.50 and now it’s $0.016… so i guess i lost 97%? lol

anyone know if i can still claim my bribes? i think i had 1000 tokens but i didn’t vote. oops.

Based on the data presented, Solidly’s total value locked is less than 0.02% of Uniswap’s. Its token market cap is lower than that of several meme coins with zero utility. Trading volume is negligible. Liquidity depth is insufficient for even small trades. No development activity since 2023. No team communication. No roadmap.

Conclusion: The protocol is functionally dead. Any engagement beyond archival interest is financially irrational.

they say silence is death… but what if the silence was planned? what if this was never meant to be a DEX? what if it was a honeypot to collect $SOLID from the gullible and then vanish? the team’s last tweet was ‘we’re building something bigger’-and then poof. gone.

you think this is a failure? nah. this is a ghost story. and we’re all the ghosts now.

just checked the chart again. $SOLID is down 99.78%. that’s not a crash. that’s a meteor impact.

if you still believe in this, you’re not a degenerate-you’re a masochist. go buy a lottery ticket instead. at least the odds are better.

also, who’s still using this? 3 people? a bot? my cat?

i’m from india and i never used solidly but i read this whole thing and i feel like it’s a story from every country. we all chase the shiny thing. we all think ‘this time it’s different.’ then it’s not.

but hey, at least we tried. and that’s more than most do. peace ✌️

the most interesting part for me isn’t the failure-it’s how few people talk about the fact that Solidly’s model could’ve worked if it had launched on Ethereum. the bribe system is actually brilliant for aligning incentives… if there’s enough volume to make bribes meaningful.

but on Fantom? with 5 pairs? it’s like trying to run a marathon on a treadmill in a closet. the design wasn’t wrong. the environment was.

you think this is just a failed DEX? no. this is part of the Great DeFi Purge. The Fed is behind it. They’re quietly shutting down any protocol that doesn’t use KYC. Solidly was too decentralized. Too open. Too free. That’s why they let it die. Look at the timestamps-right after the Fed’s crypto crackdown in 2023, Solidly went quiet.

they didn’t fail. they were silenced.

you people are pathetic. you act like Solidly was some noble experiment. it was a waste of time. if you can’t build something that works on Ethereum, you don’t belong in crypto. go back to your meme coins and stop pretending you’re innovating.

the only thing ‘historic’ here is how badly you all got played. wake up.

man i just wanna say i met one of the Solidly devs at a coffee shop in Austin last year. he said they ran out of funding after the FTX crash and couldn’t pay the devs anymore. no drama. no scam. just… no money.

he still had his old hoodie with the Solidly logo. he didn’t say anything about bribes or conspiracies. just sighed and said ‘we thought people would care more.’

that’s the real story. not the hype. not the crash. just… people stopped caring.