Central Bank of Nigeria Crypto Policy Evolution: From Ban to Regulation

Back in 2017, if you tried to use Bitcoin to pay for something in Nigeria, your bank could shut down your account. Not because you broke the law, but because the Central Bank of Nigeria told banks to avoid cryptocurrency entirely. That wasn’t a ban on crypto itself-it was a ban on banks touching it. And that made all the difference.

2017: The First Warning

The CBN’s first move came in January 2017 with a circular to all banks and financial institutions. It didn’t outlaw Bitcoin or Ethereum. Instead, it told banks: don’t process transactions for crypto exchanges. Don’t hold accounts for them. Don’t even let your customers use your systems to buy or sell digital assets. The reasoning? Anti-money laundering and counter-terrorism financing. The effect? Nigeria’s crypto scene went underground overnight.

People didn’t stop using crypto. They just stopped using banks. Peer-to-peer trading exploded. Nigerians started buying Bitcoin directly from sellers via mobile money apps, cash deposits, and WhatsApp groups. The market didn’t die-it adapted. And it grew. By 2020, Nigeria was one of the top five countries in the world for peer-to-peer crypto trading, according to Chainalysis.

2021: The Crackdown

Then came February 5, 2021. The CBN doubled down. In a new letter to banks, it ordered them to identify and close any accounts linked to cryptocurrency exchanges. If you ran a crypto business, your bank account was gone. If you were a trader who used your personal account to buy Bitcoin, your bank might freeze it without warning.

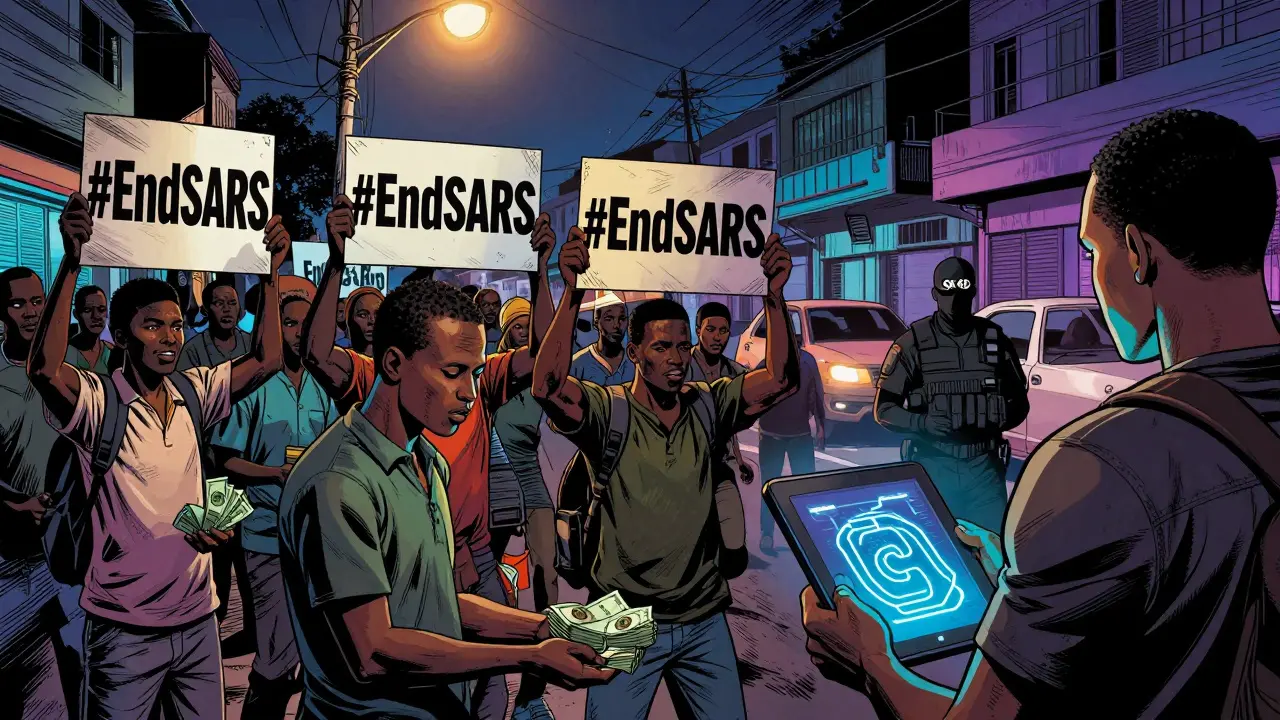

This wasn’t just inconvenient-it was devastating for small businesses. Crypto startups couldn’t pay employees. Exchanges couldn’t process withdrawals. Even ordinary Nigerians who used crypto to send money home to relatives saw their accounts frozen during protests in 2020, when the government blocked traditional payment channels. Crypto became the only way to raise funds for the #EndSARS movement. The more the government tried to shut it down, the more people relied on it.

SEC Steps In

While the CBN blocked banks, another agency was watching from the sidelines. The Securities and Exchange Commission (SEC) didn’t see crypto as a threat to banking-it saw it as an asset class. In September 2020, the SEC released a statement saying digital assets that functioned like investments (like tokens sold to raise funds) would be regulated under the Investments and Securities Act.

This created a weird split: the CBN treated crypto like a dangerous currency. The SEC treated it like a stock. For years, there was no clarity. Was Bitcoin money? Was it a security? Was it both? The confusion let bad actors slip through the cracks. But it also showed that Nigeria’s regulators weren’t all on the same page.

2023: The Reversal

By late 2023, the CBN changed its tune. It released the Virtual Asset Service Provider (VASP) Guidelines. For the first time, banks were allowed to open accounts for crypto firms-if those firms were licensed by the SEC. It was a complete 180. No more blanket bans. No more account closures. Just rules.

The trigger? The Investments and Securities Act 2025. This law officially recognized digital assets as securities under SEC jurisdiction. It gave the SEC the power to license, audit, and punish crypto businesses. The CBN stepped back from trying to control crypto directly and focused on banking supervision. The SEC became the gatekeeper.

Now, if you want to run a crypto exchange in Nigeria, you need a license from the SEC. You need full KYC (know-your-customer) checks. You need anti-money laundering systems. You need to report suspicious activity. The rules are strict-but they’re clear.

Who Left? Who Stayed?

The crackdown hurt. In 2024, OKX pulled out of Nigeria entirely, telling customers to withdraw their funds. Binance stopped trading in naira. Two of its executives were detained over untraceable funds. The message was loud: the old days of wild west trading were over.

But not everyone left. Local exchanges like Yellow Card and Paxful adapted. They got licensed. They built compliance teams. They started working with banks again. Global players are watching. If Nigeria can get off the Financial Action Task Force’s Gray List-by proving it has real AML controls-it could become the most regulated crypto market in Africa.

Why Did the CBN Change?

Because it couldn’t stop crypto. No country can. The internet doesn’t care about borders. Nigerians kept trading. They kept sending remittances. They kept using crypto to protect their savings from inflation. The CBN realized: if you can’t beat them, join them-with rules.

The shift wasn’t about loving Bitcoin. It was about control. By bringing crypto into the regulated system, the government could track transactions, tax income, and stop criminals. It wasn’t a surrender. It was a strategy.

What’s the Situation Today?

As of early 2026, Nigeria’s crypto market is legal-but tightly controlled. You can buy Bitcoin. You can run an exchange. You can even get a bank account for your crypto business. But only if you play by the SEC’s rules.

People still use peer-to-peer trading, especially in rural areas where licensed exchanges don’t reach. But now, there’s a legal path. Businesses can hire employees. They can open offices. They can raise capital. Investors have confidence. The market is growing again.

The CBN still warns about volatility. It still says crypto isn’t legal tender. But it no longer tries to kill it. That’s the biggest change of all.

What Comes Next?

Nigeria’s next challenge? Enforcement. The SEC has the rules. But does it have the staff? The budget? The tech to monitor thousands of crypto transactions daily? That’s the real test.

Also, the government still blames crypto traders for foreign exchange instability. That tension won’t disappear overnight. But now, instead of shutting down accounts, regulators can trace them. And that’s progress.

Nigeria didn’t invent crypto. But it might have invented the most realistic path for emerging economies to handle it: don’t ban it. Regulate it. Control it. And let the market grow within the lines.

Is cryptocurrency legal in Nigeria in 2026?

Yes, cryptocurrency is legal in Nigeria-but only if operated through licensed Virtual Asset Service Providers (VASPs) approved by the Securities and Exchange Commission (SEC). The Central Bank of Nigeria no longer blocks banks from serving these licensed firms, but unlicensed trading still carries risk.

Can I open a bank account for my crypto business in Nigeria?

Yes, but only if your business holds a valid license from the SEC under the Digital Assets Rules. Banks are now permitted to serve licensed VASPs. Unlicensed crypto businesses still cannot access banking services, and attempting to do so may result in account closure.

Why did the CBN change its mind about crypto?

The CBN realized that banning crypto didn’t stop it-it just drove it underground. Peer-to-peer trading grew massively, and Nigerians kept using crypto for remittances, savings, and business. With the 2025 Investments and Securities Act, the government chose regulation over prohibition to maintain control, track transactions, and combat illicit finance.

What role does the SEC play now?

The SEC is now the primary regulator for cryptocurrency in Nigeria. It licenses and supervises all Virtual Asset Service Providers (VASPs), enforces KYC and AML rules, and treats certain digital assets as securities under the Investments and Securities Act 2025. The CBN focuses on banking oversight, while the SEC handles crypto-specific compliance.

Did the crypto ban hurt Nigeria’s economy?

Yes. Between 2021 and 2023, at least three major crypto companies exited Nigeria. Remittances via crypto dropped temporarily, and innovation stalled. But the underground market kept growing. The real cost was lost tax revenue, missed job creation, and reduced foreign investment. The 2023 shift helped reverse those losses by bringing crypto into the formal economy.

Can I still trade crypto without a bank in Nigeria?

Yes. Peer-to-peer trading remains common, especially in areas without licensed exchanges. You can buy Bitcoin using mobile money, cash deposits, or local payment apps. But without a licensed platform, you have no legal protection, and your transactions are harder to trace-which increases risk.

So basically Nigeria figured out you can't stop people from using tech, so they just started charging for it. Classic. I mean, who even thought banning Bitcoin was a good idea? The internet doesn't care about central banks.

It's not just about regulation-it's about sovereignty. The CBN didn't 'lose' the battle against crypto; they realized that unregulated financial innovation posed a greater threat to monetary control than any peer-to-peer exchange. The SEC's介入 was inevitable because crypto isn't currency-it's a financial instrument. And in any mature economy, financial instruments are regulated by securities law, not banking policy. The fact that Nigeria had two agencies pulling in opposite directions for years is a testament to institutional fragmentation, not ideological conflict. This isn't a victory for decentralization-it's a victory for bureaucratic consolidation.

ok so like... the CBN was like 'NO CRYPTO' and then like... *poof*... people just kept trading anyway?? like??? i'm crying. also why does everyone think they're a financial genius now? i just wanna buy my btc with airtime and not get my account frozen 😭

As a Nigerian woman who lived through the 2021 bank freezes, I can tell you this: crypto didn't just survive-it became our lifeline. When the government blocked mobile money during EndSARS, we used Bitcoin to send food money to our families. When banks refused to pay our salaries, we got paid in USDT. This isn't about technology. It's about survival. The SEC licensing is good, but let's not pretend regulation equals justice. Many rural traders still can't afford KYC costs. We need more than rules-we need inclusion.

LMAO so Nigeria finally gave up and called it 'securities' so they could tax it? Classic. You can't regulate a borderless tech, you just tax it and call it progress. Meanwhile, the real winners? The guys who bought BTC at $3k and are now cashing out through Yellow Card. Congrats, SEC-you turned a revolution into a brokerage account.

Let me get this straight-Nigeria banned crypto, then turned around and made it a regulated asset class? So now we're supposed to be impressed? This isn't innovation. It's capitulation. The US doesn't let foreign governments dictate financial policy. Why are we patting Nigeria on the back for becoming a bureaucratic copycat? Crypto was supposed to be freedom. Now it's just another IRS form with a blockchain sticker.

So the CBN banned crypto... then Nigerians built a whole underground economy... then the government said 'oh hey we can tax that'... and now we're supposed to be like 'wow, what a smart pivot'?? like... congrats? you caught up to 2017? 🙃

Honestly, this is the most realistic approach any country has taken. You can't stop crypto. So you make it safe. People still trade P2P, but now there's a legal way too. That's not surrender-that's common sense.

It's interesting how the CBN shifted from fear to control. But I wonder-if they'd embraced this earlier, would more startups have stayed? The exodus of OKX and Binance hurt more than people admit. Sometimes, hesitation costs more than regulation.

This case study is textbook. Nigeria didn't defeat crypto-it adapted to it. The real lesson isn't about blockchain or banking-it's about governance. When institutions refuse to evolve, they create black markets. When they adapt, they retain power. The SEC becoming the gatekeeper? That's not surrender. That's strategic repositioning. The CBN didn't lose control-it delegated it to the agency best equipped to handle it. This is how emerging economies navigate disruption: not by resisting, but by redirecting. The world should pay attention. This isn't Nigeria's crypto story. It's the future of financial sovereignty in the Global South.