AML CTF Crypto Australia: What You Need to Know About Anti-Money Laundering and Crypto Compliance

When you trade or hold crypto in Australia, you’re not just dealing with price charts—you’re navigating AML CTF crypto Australia, Australia’s legal framework to stop criminals from using digital assets to hide or move illegal money. Also known as anti-money laundering and counter-terrorism financing, it’s the rulebook that forces exchanges, wallets, and even individuals to prove who they are and where their crypto came from. This isn’t optional. If you’re using an Australian-based exchange like CoinSpot or Independent Reserve, they’ve already asked for your ID. That’s not just for security—it’s the law.

The Australian Transaction Reports and Analysis Centre (AUSTRAC), Australia’s financial intelligence unit that enforces crypto compliance rules. Also known as AUSTRAC, it treats crypto businesses like banks. That means they must report suspicious activity, keep records for seven years, and verify every customer. Even if you’re using a non-Australian exchange but live in Australia, you’re still bound by these rules. The government doesn’t care if you think crypto is "decentralized"—if you’re in Australia, you play by Australia’s rules.

And it’s not just about exchanges. If you’re running a crypto business—like a DeFi service, a wallet provider, or even a peer-to-peer trading platform—you need to register with AUSTRAC. Skip this step? You could face fines up to $1.1 million. Worse, if your platform gets used for money laundering, you could be held criminally responsible. This is why so many crypto projects avoid Australia entirely. The compliance cost is high, and the penalties are real.

What about regular users? If you’re just buying Bitcoin for long-term holding, you’re not likely to be targeted. But if you’re moving large amounts frequently, using privacy coins, or trading through unregulated platforms, you’re raising red flags. AUSTRAC monitors blockchain activity. They don’t need to know your name to spot patterns—just transaction flows. A sudden $50,000 transfer from an overseas wallet to your Australian wallet? That triggers a report. You might not get in trouble, but you’ll get asked questions.

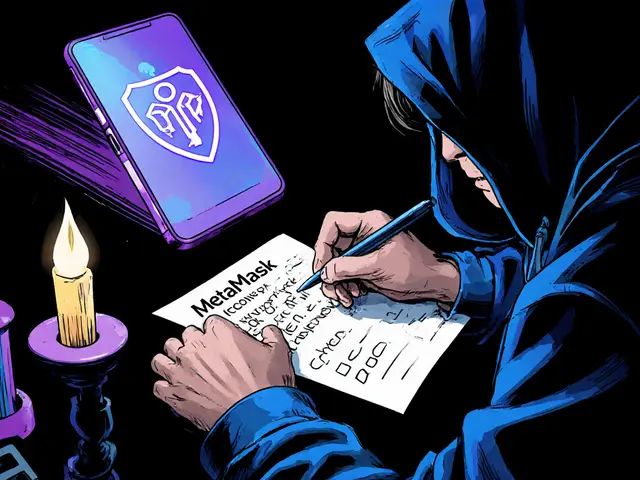

The rules keep changing. In 2024, Australia started requiring all crypto transfers to include sender and receiver info—just like bank wires. That’s called the Travel Rule, and it’s now enforced here. It means even small DeFi swaps might need identity checks. And if you’re using a non-custodial wallet like MetaMask? You’re still not exempt. If you later deposit that crypto into an Australian exchange, they’ll ask where it came from. No proof? No deposit.

There’s no gray area here. Australia doesn’t want to ban crypto. It wants to control it. That’s why you see so many posts in this collection about crypto regulation, tax reporting, and exchange shutdowns. Projects like Let’sBit and NeptuneX failed not just because they were scams—but because they couldn’t meet compliance standards. Even legitimate tokens like Pawthereum or MoMo KEY got ignored not because they were fake, but because they didn’t have the infrastructure to prove they weren’t.

What you’ll find below isn’t just a list of articles. It’s a map of what happens when crypto meets real-world law. You’ll see how people legally reduce crypto taxes using residency changes, how non-custodial wallets work in restricted countries, and why some airdrops are just traps. Every post ties back to one thing: in Australia, crypto isn’t lawless. It’s regulated—and if you don’t understand the rules, you’re already at risk.

AUSTRAC registration is mandatory for all crypto exchanges trading fiat and crypto in Australia. Learn the 2025 requirements, upcoming 2026 changes, and how to avoid fines or criminal charges.

READ MORE